Aztec Minerals Closes C$1.1M PP, Commences Drilling At Tombstone Project

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Aztec Minerals wasted no time, as it commenced drilling at its Tombstone project in Arizona on February 28, 2023, after closing a non-brokered C$1.1M financing on February 23, 2023. The financing was done at C$0.25 per share, for 4.378M shares, no warrants and no finders fees. As Aztec was trading at C$0.25-0.26 at the time, it was basically done at market prices without discount, so together with no warrants this shows strength. It was good to see Alamos Gold, a 15.86% (partially diluted) holder, putting in another C$100k in this round, and CEO Simon Dyakowski also bought a few shares to raise his total to 1.8M shares. This fresh cash enables Aztec Minerals to conduct the Tombstone drill program, and will cover preparation and part of the follow-up drill program at Cervantes later this year as well. Let’s have a quick recap of Tombstone before we delve into the current program.

The 434 hectare Tombstone project is located in the middle of a world class copper porphyry district, but also close to the massive Taylor/Hermosa CRD deposit in Arizona.

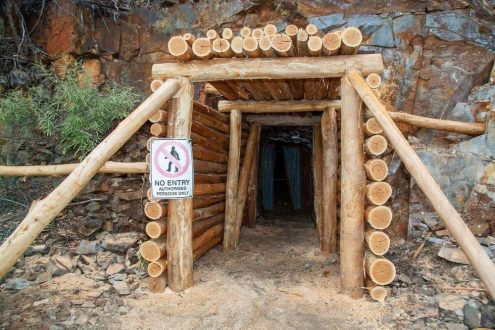

Aztec is the operator of a 75/25 JV with private Tombstone Partners. Tombstone hosts a historical mine from the old days, called the Contention Mine, producing 32Moz of silver and 240koz of gold, mostly from CRD deposits and oxide ores between 1878 and 1939. Historic mining was terminated because of lack of technology to counter the water table related inflows at the time.

RC drill programs completed in 2020 and 2021 at the Contention pit indicated substantial mineralization, as all but one of the 44 drill holes intercepted gold and silver. Intercepts were often long, and also predominantly longer than the thickness of overburden at each hole, indicating a potentially favourable stripping ratio which could bode extremely well for future economics. Highlights from 2020 are: TR20-002: 67m @ 1.07g/t Au (1.6g/t AuEq) from 19.8m, TR20-003: 93m @ 0.77g/t Au (1.07g/t AuEq) from 6.1m, TR20-009: 30.48m @ 3.31g/t Au (3.78g/t AuEq) from 32m, TR20-017: 140.21m @ 0.38g/t Au (0.62g/t AuEq) from 1.5m, and TR20-018: 32m @ 1.4g/t Au (2.09g/t AuEq) from 80.8m.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Aztec Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.aztecminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

For more information please see the attached file.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()