Blockade of the combustion engine phase-out in 2035: Is the e-fuel discussion even necessary?

Pure combustion engines hardly play a role for manufacturers any more

For the Vehicle Lifecycle Calendar, Dataforce collects monthly data on all model events that are planned by manufacturers in the future. These can be entirely new models, new generations, and facelifts of existing models, as well as discontinuations of production. Based on the data, Dataforce has gained a systematic insight into the product plannings of all manufacturers in Europe.

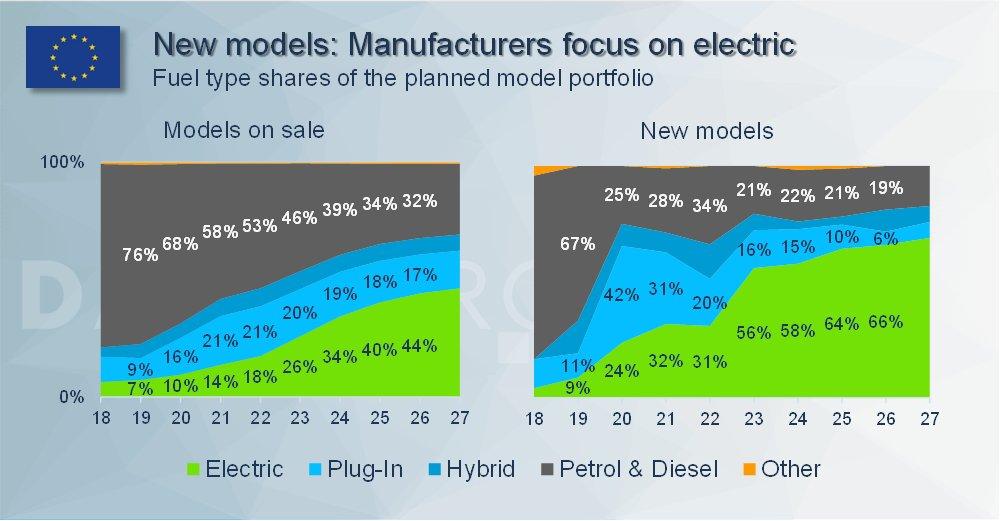

Looking at the plans, it is striking that from the manufacturer’s point of view, combustion engines no longer play as big a role as often assumed. In 2026, just three years from now, 44% of all models on sale will be all-electric, only 32% will be pure internal combustion cars. Thus, even 9 years before the end of the internal combustion engine, the product portfolio will be focused on electric vehicles.

In addition, there is an even more obvious trend: 66% of all new models that will be launched in 2026 will be electric, which corresponds to 35 new models that have been announced as of today. In contrast, with 10 new models and the equivalent of 19%, hardly any new internal combustion vehicles will come onto the market.

E-fuels will play an important role in the future. But the supply is scarce. Aircrafts, ships and trucks should be supplied first. If relevant quantities are then still available for passenger cars, e-fuels can be used much more effectively in the existing fleet, while new vehicles hit the road electrically. Dataforce expects that, based on the EU’s current planning, there will still be around 26 million old internal combustion cars on the road in Germany in 2035. BEVs will not make up the majority of existing vehicles until the end of the 2030s.

Only BEVs can guarantee mobility for all

Looking at the mass market, it is essential that all manufacturers focus on BEVs, otherwise automobility will soon become a luxury for fewer and fewer people. This is also due to the upcoming Euro 7 emissions standard. It makes it more and more difficult for manufacturers to build affordable small cars in the A and B segments. But these are exactly what is needed to ensure climate-neutral mobility for the vast majority of people. When the EU extends CO2 emission trading to petrol and diesel fuel, pump prices will raise to new heights. At what price points e-fuels will be sold is currently not foreseeable.

Consequently, it is important that technological advances in battery technology are accelerated and that manufacturers develop in the same direction in order to reduce unit costs. That this is possible can be seen in the presentation of the new VW ID.2all, which is expected to cost less than 25,000 euros in 2026. Even before that, competitors from China are entering the market, such as BYD with the Dolphin, which is due to arrive in Germany already in 2023.

Learn more about the Vehicle Lifecycle Calendar here: https://www.dataforce.de/en/vehicle-lifecycle-calendar/

DATAFORCE – Wir zählen Autos.

As a leading market research company, we bring transparency to the European automotive market. Independent – with over 25 years of experience – we set standards and make markets comparable.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930382

E-Mail: julian.litzinger@dataforce.de

![]()