Gold from the perspective of chartists

For chart technicians, chart patterns serve as a basis for future price developments.

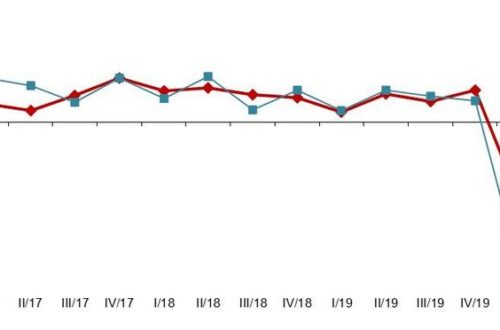

Experts often disagree right now, is it going down again with the gold price (because it rose too quickly, banking crisis over) or steeply further up. The well-known chart technician Mensur Pocini of Bank Julius Baer, for example, is very positive. If the gold price can establish itself above 2,000 U.S. dollars and then manages to jump above 2,070 U.S. dollars, then it will continue to go up, says Pocini. Chart technicians see in historical price trends what market sentiment is like. And patterns repeat themselves again and again, thereby the further development of the gold price can be concluded.

The Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is still a tool used by chart technicians. According to this theory, zigzag price movements occur in both upward and downward phases. There are eight waves in a bullish wave movement. And there is a major super cycle that can last for decades. This cycle consists of five waves. Gold may now be currently in a super cycle that started in 1973 or so. In 1980, a super cycle was completed with the abolition of the gold standard. The largest impulse wave began in 2000 (gold rose from 250 to 1,900 US dollars). This was followed by a correction. Accordingly, gold may now have started the last bullish impulse wave in a major super cycle, and it is not over yet. The occupation with chart-technical analyses is certainly an exciting thing, even if only roughly touched here. But the fact is that gold is part of the investment portfolio, and its value preservation function provides security. Gold companies are therefore not to be despised as an investment.

These include Golden Rim Resources – https://www.commodity-tv.com/ondemand/companies/profil/golden-rim-resources-ltd/ -, for example, in possession of four projects. The flagship project is the Kada Gold Project in Guinea, plus a second gold project in Burkina Faso and two projects in Chile (copper, silver, zinc and lead).

Torq Resources – https://www.commodity-tv.com/play/copper-special-copper-is-fundamentally-under-explored-to-secure-demand-in-the-future/ – is involved in excellent projects in Chile in the gold and copper sectors (Santa Cecilia, Andrea, Margarita).

Current corporate information and press releases from Torq Resources (- https://www.resource-capital.ch/en/companies/torq-resources-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()