Indians love not only gold but also silver

Net investments in physical silver reached almost 333 million ounces in 2022. Silver prices were rather low, so Indians in particular went on silver buying sprees, namely with an increase of 188 percent compared to the previous year. Silver investments also went up in the USA, although not as extremely as in India. Australians increased their physical investments by around 15 percent. Overall, across all sectors, 2022 was a very successful silver year in terms of demand.

Looking at the supply side, it is noticeable that global mine production declined slightly in 2022. 2021 was also a very strong year after the pandemic disruptions were overcome. Production volumes from primary silver mines in 2022 were roughly unchanged from 2021, but production from lead and zinc mines, where silver is a by-product, declined. Silver production increased year-on-year in Mexico, and there were also increases in Argentina and Russia. Peru, on the other hand, struggled with social unrest that caused disruptions in mine operations. Grades also fell at various large mines. Silver recycling yields were three percent higher last year than in the previous year.

Recycling thus reached a ten-year high of more than 180 million ounces of silver, primarily from the industrial scrap sector. Given silver’s many uses, including in renewable energy technologies, electromobility and electrification, silver should shine in the years ahead. This is positive for companies with silver in their projects, such as Vizsla Silver or Discovery Silver.

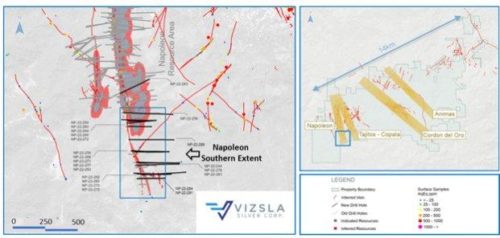

Vizsla Silver – https://www.commodity-tv.com/ondemand/companies/profil/vizsla-silver-corp/ – owns 100 percent of the high-grade Panuco silver-gold project in Mexico.

Discovery Silver – https://www.commodity-tv.com/play/discovery-silver-advancing-one-of-the-largest-undeveloped-silver-deposits-in-the-world/ – can be pleased with its Cordero silver project in Mexico, it is one of the largest silver deposits on earth.

Latest corporate information and press releases from Vizsla Silver (- https://www.resource-capital.ch/en/companies/vizsla-silver-corp/ -) and Discovery Silver (- https://www.resource-capital.ch/en/companies/discovery-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()