Plug-in hybrids as company cars: (Where) is the part-time electric car still paying off?

Taxation must not be complicated

In addition to tax benefits and grants on initial registrations, the Dataforce Car Taxation Guide provides an accurate but easy to understand overview of all applicable car taxes in 11 countries.

It also includes precise calculations of the cost advantages and disadvantages between petrol cars, plug-in hybrids and pure electric cars. The question "where is it worth switching to electric" is answered at a glance. In this analysis, Dataforce took a closer look at plug-ins.

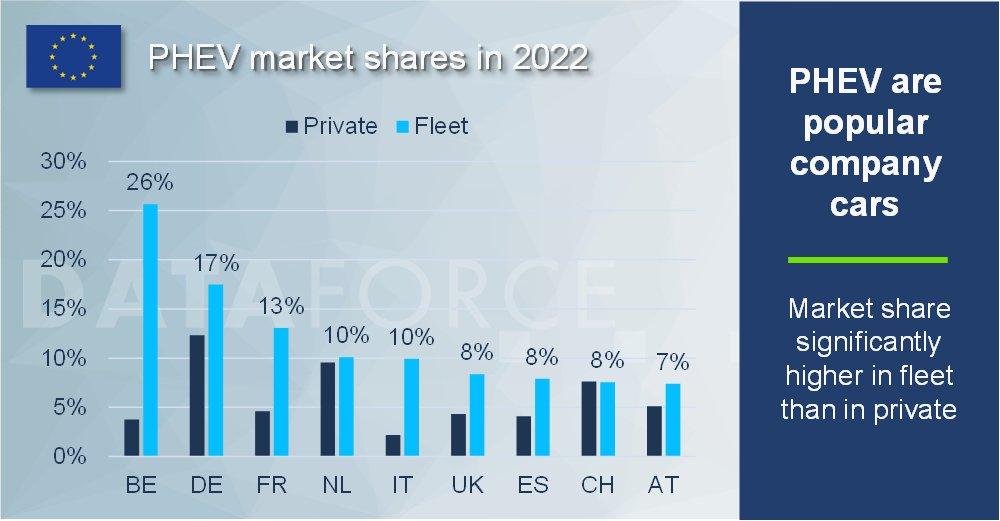

PHEVs in 2022 particularly popular as company cars

Looking at the market shares of PHEVs not only reveals major differences between countries. It is also noticeable that the shares in the fleet market are generally significantly higher than in the private market. There are several reasons for this. On the one hand, the typical company cars in the D and E segments are often equipped with hybrid systems by manufacturers in order to reduce the emissions of the large vehicles.

On the other hand, company car taxation plays an important role. In Germany, for example, the rule still applies that plug-ins as a benefit-in-kind only have to be taxed at a rate reduced by 50%.

2023 Analysis: In most countries you pay (significantly) more for the plug-in

Since many tax regulations regarding PHEVs have been revised in 2023, Dataforce has calculated in the Car Taxation Guide whether the part-time electric vehicles are still paying off. For this purpose, a compact SUV as internal combustion version has been compared with its plug-in-hybrid pendant. A mileage of 50,000 kilometres over 3 years was assumed.

In view of the popularity of plug-in hybrids so far, the results of the analysis are surprising: Companies pay significantly more for plug-in hybrids in almost all countries. This is mainly due to the significantly higher acquisition costs, but also to the reduced tax benefits in 2023, which can no longer compensate for the higher price. And it applies even if fuel costs are reduced due to a high electric driving share.

Only in the Netherlands is the plug-in still paying off, UK and Belgium just over the line

In the Dataforce press release published in February on the subject of "EU comparison of BEV subsidies", pure electric cars appeared to be particularly attractive from a tax point of view in the Netherlands. But PHEVs are also still profitable there. The Netherlands is the only country in the comparison were a PHEV, calculated over 3 years, is still saving money.

This is mainly due to the extremely expensive registration tax, which adds around 10,000 Euros to the costs of a pure combustion engine car. The plug-in saves these expenses and thus compensates for the higher purchase price. As a result, the lower running costs have a noticeable effect over the lifetime of the vehicle.

In the UK and Belgium, the PHEV is more expensive over the assumed usage period, but only just. Assuming, for example, a longer period of use of 5 to 7 years or a higher mileage, the lower running costs would turn the tables and make the plug-in more attractive in terms of costs – always assuming the car is mainly driven in electric mode. In France, Germany, Italy, Spain and Switzerland, however, this would not change anything.

Find out more about the Car Taxation Guide: https://www.dataforce.de/en/car-taxation-guide/

DATAFORCE – Wir zählen Autos.

As a leading market research company, we bring transparency to the European automotive market. Independent – with over 25 years of experience – we set standards and make markets comparable.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930382

E-Mail: julian.litzinger@dataforce.de

![]()