ZOPI Q1/2023: Online print prices settle at a high level

With the start of the new year, three new suppliers have also been added to the ZOPI: druckdiscount24, Primus-Print and Printkit. This gives the Zipcon Online Print Price Index an even broader data base and enables us to assess individual developments even better.

General economic conditions

The overall economic situation in Germany has not changed fundamentally compared with the last quarter of 2022: companies and private individuals alike are still struggling with the consequences of the Ukraine war, i.e., higher prices in almost all areas. Nevertheless, the first cautious signs of a gradual cushioning are visible.

After the overall inflation rate of +8.7% in January and February of the year was still almost at the record level of November 2022, it fell slightly in March 2023 to +7.4% year-on-year. This is still an above-average value, but the peak seems to have been passed for the time being.

According to the Statistisches Bundesamt (Federal Statistical Office), prices for energy products also weakened. In March, these were 3.5% higher than in the same month a year earlier – in January this figure was -19.1% and in February -23.1%. In March, however, a base effect due to the sharp rise in energy prices in the previous year took effect; in addition, the price brake for electricity, natural gas and district heating, which has applied retroactively since January 2023, is now also taking effect. However positive the slight decline may be, it should at best be seen as a "brief breather", as both the inflation rate and energy prices remain well above the levels of a year ago.

Business climate in the printing industry

Companies in the German printing and media industry also appear to have bottomed out: As the March economic telegram of the Bundesverband Druck und Medien (BVDM – German Printing and Media Industries Federation) showed, the business climate, business situation and business expectations were again assessed more positively overall in the first three months of the year than in the last two quarters of 2022. Even though the respective values varied in January, February and March and remained below the level of the first quarter of 2022, printing companies are again somewhat more positive about the future overall.

Paper prices fall slightly again

The fact that prices for graphic papers have been falling slightly for some time, as indicated by the Verband der Papierindustrie (German paper industry association) "Die Papierindustrie" and the Statistisches Bundesamt (German Federal Statistical Office), may also have contributed to this. However, and this is also part of the truth, production and sales of graphic papers have also fallen by a good 30% year-on-year. Perhaps because there are fewer print shops? Because according to the BVDM, the printing industry started the new year with just under 6,900 companies – a decline of 3.1% overall, driven primarily by fewer production companies in the newspaper market, but also among traditional print shops.

The online print market

Online print companies have coped better with the challenges of the last three years compared to many classic print service providers and have recovered more quickly. In particular, the top 5 – Cewe, Flyeralarm, Cimpress, Onlineprinters and Celebrate – were able to significantly increase their sales last year and, according to estimates by zipcon consulting, their combined sales are only just below the two-billion-euro mark. At the Online Print Symposium in Munich at the end of March, I also ventured a forecast on the development of print volumes generated online, which will increase in all regions of the world by 2025 – including Western Europe most strongly at over 40%.

How are prices developing in online printing?

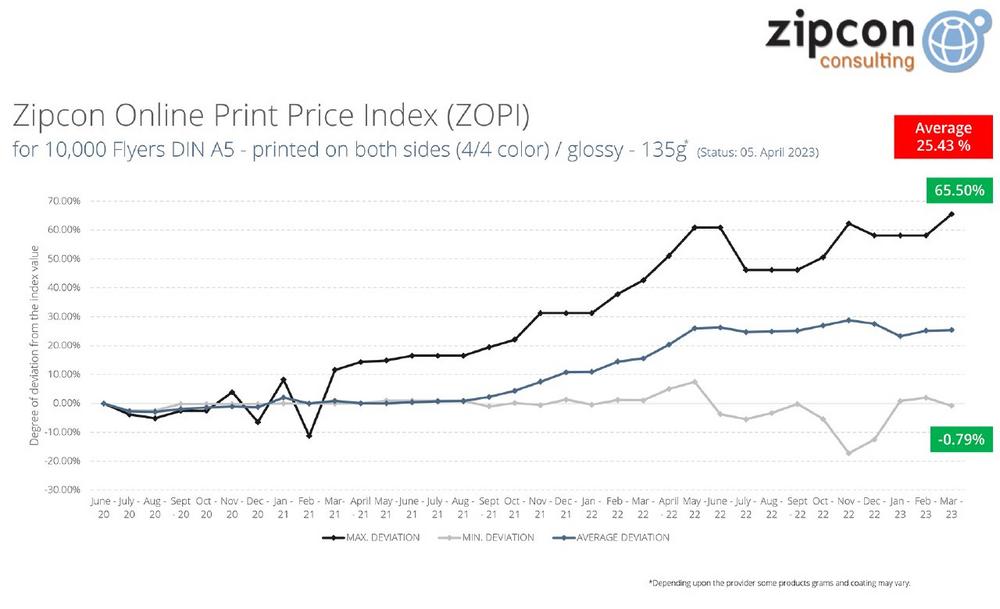

But back to the first quarter of 2023: The Zipcon Online Print Price Index, or ZOPI for short, is a trend barometer that takes a close look at price developments in the online print market, thus providing a more detailed overview of the market. It is important to note that the index does not focus on the sales figures of the groups, but rather on the prices charged by the most important online print providers for various product clusters.

New suppliers in ZOPI

The newly considered companies (druckdiscount24, Primus-Print and Printkit) have an impact on the average values, which without the new providers would have reached a new high of +33.22% in March 2023, especially in the flyer product cluster, but even including the additional data are only a few percentage points lower at 25.43%. Here, the slightly lower paper and energy prices do not yet seem to have had a direct impact on the online print price. The situation is different for the shopping cart: here, the average price in both cases – without the new providers (+25.98%) and with the new providers (+23.46%) – is below the peak value from November 2022 (+34.97%). However, a look at the individual online printers is more exciting.

Detailed view of flyers

In the Zipcon Onlineprint Price Index, twelve providers were thus considered for the first time for the first quarter of 2023: In addition to the three already mentioned, these are: Vistaprint, Wir-machen-Druck, Unitedprint/print24, Onlineprinters, Flyeralarm, Saxoprint, Onlinedrucken, Redprintgroup and sourc-e. All of them were asked to print 10,000 flyers in DIN A5 format, printed in four colors on both sides and on 135 g glossy paper. The average price increase for this order had reached a provisional high of 28.77% in November 2022 – which would have climbed even higher in March, to +33.22% based on the previous nine suppliers. However, the addition of the three new companies pushes the average value down somewhat, as already described, to +25.43%.

Looking at the details, the picture is more mixed: While Unitedprint/print24 called up the largest recorded price increase to date for the 10,000 flyers in March with +65.50% compared to the index value from summer 2020 (December 2022: +58.12%), Vistaprint again marked the largest downward deviation from the index value with -5.43% (December 2022: -12.43%). Between these two extremes, the other providers sort themselves out in March 2023 in descending order as follows: sourc-e with +50.59% (December 2022: +29.20%), Onlineprinters with +36.99% (December 2022: +31.70%), Saxoprint with +35.33% (December 2022: +34.00%), Redprintgroup with +34.70% (December 2022: +21.13%), Wir-machen-Druck with +34.28% (December 2022: +39.10%), and Onlinedrucken with +27.84% (December 2022: +28.41%). The latter two have thus actually lowered their prices slightly compared with the end of last year.

Below the new average price in this product cluster were Flyeralarm with +19.20% (December 2022: +18.43%) and Vistaprint with -5.43% (December 2022: -12.43%). The three new providers were in the single digits – however, these values refer to a starting value from the summer of 2022. Accordingly, the changes in the prices for the 10,000 flyers were +5% for Primus-Print, +1.97% for druckdiscount24 as well as -0.79% for Printkit.

The biggest price jumps compared to December 2022 have occurred at sourc-e, Redprintgroup and Unitedprint/print24, while in the same period the prices at Wir-machen-Druck, Onlinedrucken and Printkit have slightly decreased.

Price development in the shopping cart shows a slight downward trend

The prices for the shopping cart have developed differently than the prices for the order for the 10,000 flyers. Here, the average change compared to the first survey of this product category in November 2020 was +23.46%. However, it must also be remembered here that the addition of three new suppliers has pushed the figure down slightly. However, even without the "newcomers," the average change in price in March 2023 would have been +25.98%, lower than the December figure (+33.46%).

In addition to the 10,000 flyers in DIN A5 format, the shopping basket also includes brochures (32 pages, DIN A4, stitched, printed on both sides) and business cards (4/4 color, without finishing). Ten suppliers have been considered for this product cluster since the new year: In addition to the three "newcomers", these are: Wir-machen-druck, Unitedprint/print24, Onlineprinters, Flyeralarm, Saxoprint, Onlinedrucken and the Redprintgroup.

The following picture emerges from the detailed analysis: Unitedprint/print24 also marks the largest upward deviation in percentage terms in the shopping cart, with +59.92%, 3.46 percentage points more than in December 2022 (+56.46%). At just +2.27%, Flyeralarm was charging almost the same prices again in March 2023 as it did at the start of the shopping cart ZOPI in November 2020. Flyeralarm is also one of two suppliers in the shopping cart analysis to have reduced its prices compared with the end of last year – and significantly so, in this case from +21.37% to now +2.27%. This is probably also one reason why the average value was lower this time.

The remaining suppliers that ZOPI regularly monitors for the shopping cart developed as follows in the first quarter of 2023: At +37.11%, Wir-machen-Druck called up the second-largest change compared with the first survey in summer 2020. This value had still been +35.47% in December 2022. This was followed by Onlineprinters with +35.70% (December 2022: +33.60%), Onlineprinters with +35.03% (December 2022: +24.50%), and Saxoprint with +34.87% (December 2022: +34.67%). The change compared to the index value was comparatively low for Redprintgroup: +10.92% (December 2022: +28.17%). The online print brand of Druckhaus Mainfranken has significantly reduced its prices since February. This means that Redprintgroup, together with Flyeralarm, forms the duo that is charging lower prices than in December.

Outlook

After the feared recession in the German economy failed to materialize last year, the German Council of Economic Experts, in its economic forecast of March 2023, dares to take a still cautious but very cautiously positive view of the current year: it states that German GDP could rise by 0.2% in the current year, but by 1.3% in 2024. A stronger upswing is not to be expected, partly in view of the lower purchasing power due to inflation and the deterioration in financing conditions. However, inflation has peaked and energy supplies have stabilized for the time being.

Incidentally, in its spring projection just published, the German Federal Ministry of Economics and Climate Protection has raised its expected economic output slightly and is now forecasting growth of 0.4% for the current year and 1.6% for 2024.

Nevertheless, it is of course important to be prepared for all eventualities. The fact that the markets have become volatile is something we have to learn to deal with – that has been clear since the pandemic at the latest. The fact that online print shops in particular can act flexibly against this backdrop and respond quickly to developments in the market is something we have impressively demonstrated to ourselves in recent months. So there is no reason to panic – online print shops in particular can and should look to the future with confidence. Because, as I said at the Online Print Symposium 2023: online print is the evolutionary reactor of the printing industry. The only thing is, we have to keep at it and keep developing to make sure it stays that way! So, we better roll up our sleeves!

About the ZOPI – Zipcon Online Print Price Index

With the Zipcon Online Print Price Index, or ZOPI for short, the Essen-based consulting company zipcon consulting has developed a trend barometer that for the first time takes a close look at price developments in the online print market. Two clusters were formed for this purpose: One looks at a standard order for 10,000 flyers in DIN A5 format, printed in four colors on both sides, on 135-gram paper, glossy. Nine online print shops were selected for the job: Vistaprint, Wir-machen-Druck, Unitedprint/print24, Onlineprinters, Flyeralarm, Saxoprint, Onlinedrucken, Redprintgroup, Primus-Print, Printkit, druckdiscount24 and sourc-e. The second cluster focuses on a shopping cart that includes brochures and business cards in addition to flyers. This basket involves the following printing companies: Wir-machen-druck, Unitedprint/print24, Onlineprinters, Flyeralarm, Saxoprint, Onlinedrucken, Primus-Print, Printkit, druckdiscount24 and Redprintgroup.

The prices are recorded on a weekly basis. On this basis, zipcon calculates the average values for each month and presents the percentage change compared to the index value. The index value for the flyer cluster is from June 2020 (July 2022 for Primus-Print, Printkit and druckdiscount24), and the index value for the shopping basket is from November 2020. ZOPI thus reflects the changes in prices in online printing over the entire period up to the present day – and puts them in the context of developments on the market and in the economy as a whole in the subsequent evaluation. A detailed look at and interpretation of the figures is provided on a quarterly basis.

zipcon consulting GmbH is one of the leading consulting companies in the print and media industry in the German-speaking region. zipcon is an independent and holistic technology and strategy consultancy and is active around the globe. Bernd Zipper, founder and owner of zipcon consulting, and his team are driving market innovators in the areas of mass customisation, digital printing, web-to-print, e-business print, functional printing, colour management, quality assurance, management information systems (MIS), print, workflow and automation.

zipcon consulting GmbH

Am Buchenhain 4

45239 Essen

Telefon: +49 (201) 81175-0

Telefax: +49 (201) 81175-22

http://www.zipcon.de

Geschäftsführender Vorsitzender

Telefon: +49 (201) 8117-50

Fax: +49 (201) 8117-522

E-Mail: bernd.zipper@zipcon.de

![]()