Gold investments are mandatory

Jerome Powell, Fed Chairman, has signaled that the rate hike cycle is all but over. In the past two months, large and small futures speculators have added about 311 tons of gold. Central banks also added heavily to gold in the first quarter of 2023. For example, Singapore added 17 tons of gold to its gold reserves. For China, it was 18 tons of gold. Gold thus continues to live up to its status as a hedging vehicle. The all-time high in the gold price of June 2020 has almost been reached. In addition to the signals from the Fed chief, bank worries and the looming U.S. debt ceiling are driving the price of the precious metal. In addition, there is the weakness of the U.S. dollar, which is good for rising gold prices. The recession risks in the U.S. are not yet off the table. March also brought net inflows into ETFs. Gold in the portfolio has improved returns in recent decades.

Of course, on the other hand, the currently high gold price is vulnerable if interest rate expectations change, or the U.S. dollar strengthens again. But there are no signs of that at the moment. The silver price is currently hovering around 25 US dollars per troy ounce. The gold-silver ratio is around 80. Inflation is still above the target level of two percent, but if the banks are now more cautious in granting loans, this could also lower inflation. At least that’s what Powell said recently. However, the future is likely to show that the inflation rate will remain above the target value for longer. So, if the interest rate peak is reached soon, and it can’t be much longer, then investors should be able to look forward to strong gold and silver prices. And gold companies like Calibre Mining or Condor Gold will also be happy.

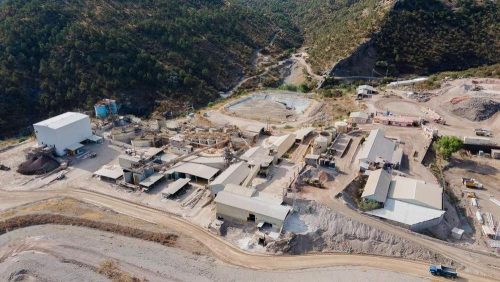

Active in North and South America, Calibre Mining – https://www.commodity-tv.com/ondemand/companies/profil/calibre-mining-corp/ – brought in a record 65,000 ounces of production in the first quarter of 2023.

Condor Gold – https://www.commodity-tv.com/ondemand/companies/profil/condor-gold-plc/ – owns the prospective La India gold project in Nicaragua.

Latest corporate information and press releases from Calibre Mining (- https://www.resource-capital.ch/en/companies/calibre-mining-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()