Pessimistic sentiment on the gold market as an opportunity

Market sentiment seems to be pessimistic, especially when the price of the precious metal is trading below $1,950 as it is now. This applies to both private investors and Wall Street analysts. It may be that the price of gold will trend even lower in the near future. But at the same time, this may be the best time to enter the gold market to guard against growing recessionary threats. At this time of year is often the best time to enter gold and also silver. The reason for the low gold price is the attitude of the central banks and probably also the dangers of further banking crises that have disappeared from view. Whereby the latter can also manifest themselves again, that is, the danger of new banking crises is not posed.

However, if gold and silver continue to fall in price, this will in turn attract new investors who will then jump in. According to a Kitco News Survey, 41 percent of nearly 1,000 analysts polled thought the price of gold would rise again this week, 42 percent foresaw gold prices falling further, and the rest were neutral. Of course, there are also analysts who are extremely positive and point to the long-term protective function of gold. This is more important than short-term opportunity costs.

From a chart perspective, a recovery of the gold price to around 1,940 U.S. dollars and then even in the direction of 2,000 U.S. dollars by the end of July is possible. Speculators and investors should therefore not be deterred right now, but take advantage of favorable entry prices. This also applies to the stocks of gold companies such as Fury Gold Mines or Revival Gold.

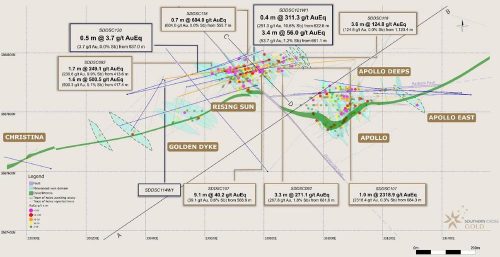

Fury Gold Mines – https://www.commodity-tv.com/ondemand/companies/profil/fury-gold-mines-ltd/ – owns excellent gold properties in Quebec and Nunavut, is well financed and is working to expand its gold resources.

In Idaho, Revival Gold – https://www.commodity-tv.com/ondemand/companies/profil/revival-gold-inc/ – is working on exploration and development of its Beartrack-Arnett gold property. There will be an updated mineral resource and preliminary feasibility study in a few weeks.

Latest corporate information and press releases from Fury Gold Mines (- https://www.resource-capital.ch/en/companies/fury-gold-mines-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()