A better world is possible – nuclear energy in vogue

The age of clean energy is just dawning. The world has entered a race to meet CO2 targets.

In the latest IEA (International Energy Agency) report, there is optimism about achieving net zero emissions by 2050. This mainly concerns solar and nuclear energy, less so wind power. Governments are supporting wind and solar power, and increasingly now nuclear power. According to the IEA, wind power has become less important. For net-zero to become a reality by 2050, nuclear power generation would need to grow an estimated 152 TWh (terawatt-hours) per year between 2030 and 2040, it said. The United States and South Korea are particularly supportive of nuclear power. China and India also have policies that will ensure a rapid increase in nuclear power generation.

Nuclear power is in a new trend. Compared to a year ago, the predicted short-term growth of nuclear power has now increased by 60 percent. Reliable energy is important and energy demand is also growing. With an improved outlook for the global economy, the IEA projects a 3.3 percent increase in demand for electricity in 2024. The demand for nuclear power generation was set upward by six percent. Even in 2050, nuclear energy would be the third-largest source of energy after solar and wind power. In this country, the nuclear energy issue has not completely disappeared.

Radiant Energy Group believes a significant reduction in electricity and strengthening of the German economy would be possible if eight nuclear power plants were put back into operation. Even without nuclear power in Germany, the number of nuclear reactors worldwide is growing and companies with uranium projects should be able to look positively into the future. For example, Uranium Energy or Latitude Uranium.

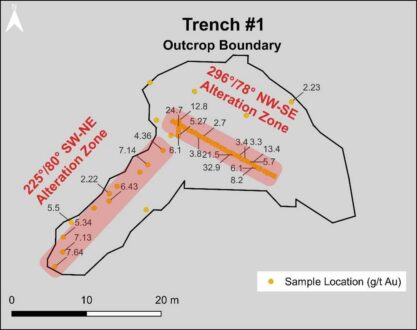

Latitude Uranium’s – https://www.commodity-tv.com/ondemand/companies/profil/latitude-uranium-inc/ – uranium projects are located in Labrador and Nunavut in Canada. The Angilak project is one of the highest-grade uranium deposits in the world.

Uranium Energy – https://www.commodity-tv.com/ondemand/companies/profil/uranium-energy-corp/ – can score points with projects in the USA and Canada, some of which are already operational. Uranium Energy is also well financed and has a stake in the only royalty company in the uranium sector.

Current corporate information and press releases from Uranium Energy (- https://www.resource-capital.ch/en/companies/uranium-energy-corp/ -) and Latitude Uranium (- https://www.resource-capital.ch/en/companies/latitude-uranium-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()