Alpha Lithium Significantly Increases Resource at Tolillar Salar, Argentina

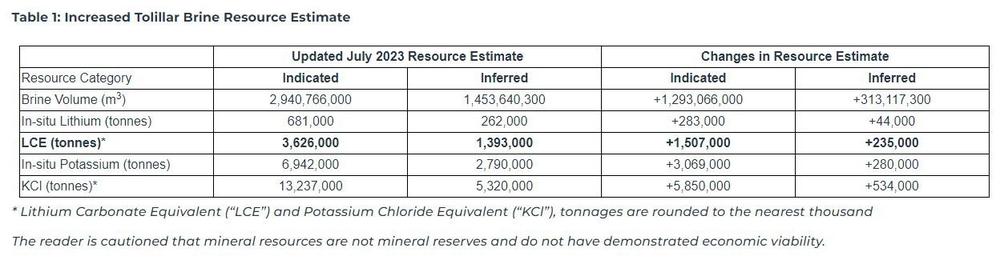

Alpha’s latest drilling campaign resulted in a 70% increase to the “indicated resource” category and a 20% increase to the “inferred resource” category.

Brad Nichol, President & CEO of Alpha, commented, “A 70% increase in the indicated resources of Tolillar clearly demonstrates the very high quality of this resource and represents a significant increase in the asset’s value for Alpha’s shareholders. In the context of our ongoing strategic review process, since October 2021, comparable assets in close proximity to Tolillar have been sold at an average of US$163 per tonne of measured and indicated resources. The majority of those transactions were completed by western companies and we are pleased to have seen significant interest from multinational parties in our strategic review process. I am very keen to deliver maximum value for Alpha’s shareholders and this updated resource estimate is a noteworthy development in that regard.”

The updated resource estimate is still considered preliminary, as it was prepared primarily to assist multiple parties that have entered into standard Non-Disclosure Agreements as part of the sale of the Company’s Tolillar asset (the “Sale Process”) and/or the Company’s consideration of a potential corporate-level transaction (collectively the “Strategic Review”).

In the interest of time and the dissemination of meaningful information, and resulting from an externally imposed timeline, Alpha has published this resource estimate while two drilling rigs are still active in Tolillar (others were moved to drill Alpha’s nearby Hombre Muerto assets) and only 37%, or 10,200 of the 27,500-hectare site, has been explored.

The resource estimate also includes 13,237,000 tonnes of potassium equivalent (“KCl”) in the indicated, and a further 5,320,000 tonnes of KCI in the inferred, category. The current values are subsequent to the Company’s maiden resource estimate, published in September 2022 (see August 23, 2022 news release).

Groundwater Insight, Inc. (“GWI”), provided the detailed technical oversight of the resource estimate. GWI has suggested that deeper exploration drilling should enable upward conversion of indicated and inferred resources. Additional drilling may also access additional resources across the property, which have not yet been identified, other than on geophysical surveys, which indicate brine basins may extend deeper than 500 meters. The maximum depth drilled, to date, was 400 metres. The deepest brine sample was obtained at a depth of 349 metres with a lithium concentration of 345 mg/L.

The resource estimate was prepared in accordance with the guidelines of National Instrument 43-101 and uses best practice methods specific to brine resources, including a reliance on sampling methods based on sustained pumping (pumping tests) and effective (drainable) porosity estimation. Independent qualified person, Dr. Mark King, PhD, FGC, PGeo, of GWI provided technical oversight of the resource estimate.

The resource is defined over a 102 km2 footprint using results from short-term pumping tests and from naturally flowing wells. The indicated and inferred resource was derived from wells drilled to depths up to 400 meters. Geophysical surveys were used to assist with location and anticipated depths for all holes, and also to identify potential for brine at-depth, freshwater values, and to extend the inferred resource, to be included in future drilling to even greater depths and potentially for increased resource estimates. Over most of the basin, the brine resource occurs to within one metre of surface and its thickness is defined by the extent of drilling.

The total contained lithium and potassium values are based on effective (drainable) porosity estimates for the lithologies in the resource zone. As the term implies, drainable porosity estimates the portion of the total porosity that can theoretically be drained.

Resource Estimation Methodology

GWI chose to estimate the resource using a drill-hole centered polygonal technique, similar to the previous (2022) estimate. A total of 4,635 metres of drilling from 17 holes were used to define the polygons used in the resource estimate calculation. An additional 5 boreholes in the resource domain were used for qualitative information. The total thickness of the basin, and the total thickness of saturated sediments, remains undefined in some resource areas.

Hydrostratigraphic units have variable thickness and were determined based on observed lithology and anticipated similar hydraulic properties. The values for drainable porosity were estimated from similar materials. Grade (lithium and potassium values) for each hydrostratigraphic unit were derived from direct sampling of the wells. The unit thicknesses combined with the areas yield a volume. The volumes combined with the drainable porosity values, represent the amount of fluid available from the formation, which is converted to brine tonnage. Applying the grade, represented as lithium carbonate and potassium chloride equivalents provides the estimated resource for each block, which are then summed.

The primary analytical laboratories for the data used in this resource are Alex Stewart in Mendoza, Argentina and SGS Laboratory in Buenos Aires, Argentina. Both laboratories are accredited to ISO 9001:2008 and ISO14001:2004 for their geochemical and environmental labs for the preparation and analysis of numerous sample types, including brines.

Qualified Person:

Dr. Mark King, PhD, FGC, PGeo, of Groundwater Insight, Inc., is a qualified person (QP) as defined by NI 43-101. Dr. King has extensive experience in salar environments and has been a QP on many lithium brine projects. Dr. King is independent from the Company and has reviewed and approved the technical information mentioned in this press release. A Technical Report prepared in accordance with NI 43-101 in support of the resource estimate will be filed on SEDAR (www.sedar.com) and on the Company’s website (www.alphalithium.com) within 45 days.

Take No Action

Further to the hostile bid announced by Tecpetrol, the Board and management of Alpha will not tender to the Tecpetrol bid and remind all parties that shareholders have no obligation to tender – or sell – their shares. For the reasons fully described in our Directors’ Circular (see June 23, 2023 news release), Alpha recommends that shareholders REJECT the undervalued and opportunistic Hostile Offer and today’s announcement reinforces the assertion of complete inadequacy of the Hostile Offer. To reject, shareholders simply need to do nothing. If you have already tendered your Common Shares and wish to withdraw, simply ask your broker or contact Kingsdale Advisors (by phone at 1-800-749-9197 (toll-free in North America) or 647-251-9740 (for collect calls outside North America) or by email at contactus@kingsdaleadvisors.com) to assist you with this process. For more information, please go to www.ProtectAlphaLithium.com.

All operations and assets of the Company are in Argentina and are fully managed by Alpha Lithium Argentina SA and Alpha Minerals SA, collectively (“Alpha SA”), utilizing local employees and consultants. Since initiating the first steps of an exploration program in 2020, Alpha SA has drilled more than 20 holes, constructed an in-house brine chemistry research laboratory, developed a proprietary Lithium Carbonate production process that successfully works in Tolillar, started construction of a pilot plant, and employed dozens of highly skilled Argentinian technologists, engineers, geologists, geophysicists and chemists, in addition to several students, accounting, managerial and HR professionals. The Company is grateful for, and reliant upon, the significantly large Argentinian team that has proven instrumental at generating value for shareholders.

ON BEHALF OF THE BOARD OF ALPHA LITHIUM CORPORATION

“Brad Nichol”

Brad Nichol

President, CEO and Director

For more information:

Alpha Lithium Investor Relations

Tel: +1 844 592 6337

relations@alphalithium.com

www.alphalithium.com

www.protectalphalithium.com

About Alpha Lithium (NEO: ALLI) (OTC: APHLF) (German WKN: A3CUW1)

Alpha Lithium is a team of industry professionals and experienced stakeholders focused on the development of the Tolillar and Hombre Muerto Salars. In Tolillar, we have assembled 100% ownership of what may be one of Argentina’s last undeveloped lithium salars, encompassing 27,500 hectares (67,954 acres), neighboring multi-billion-dollar lithium players in the heart of the renowned “Lithium Triangle”. In Hombre Muerto, we continue to expand our 5,000+ hectare (12,570 acres) foothold in one of the world’s highest quality, longest producing, lithium salars. Other companies in the area exploring for lithium brines or currently in production include Allkem Ltd., Livent Corporation, and POSCO in Salar del Hombre Muerto; Orocobre in Salar Olaroz; Eramine SudAmerica S.A. in Salar de Centenario; and Gangfeng and Lithium Americas in Salar de Cauchari.

Forward-Looking Statements

This news release contains forward-looking statements and other statements that are not historical facts, including statements concerning the potential size and value of the minerals contained in the Tolillar salar, the Hostile Offer, the Sale Process and the Strategic Review and the possible results thereof. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects” and similar expressions. All statements other than statements of historical fact, included in this news release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include the results of further brine process testing and exploration, the results of further discussions, if any, between the Company, Tecpetrol and other third parties, the ability of the Company to successfully complete the Sale Process or the Strategic Review or to do so on a timely basis, global economic conditions and other risks detailed from time to time in the filings made by the Company with securities regulators. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, include numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by applicable law.

No securities regulatory authority has reviewed nor accepts responsibility for the adequacy or accuracy of the content of this news release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()