Investors focus on precious metals

The summer months themselves are, looking at the development in the past decades, rather weaker months. Thus, July takes seventh place among the hit list of the best gold months. A year ago, by the way, an ounce of gold cost 1,744 euros. As in the case of gold, a firmer U.S. dollar and the prospect that interest rates will remain high for some time to come are also putting pressure on silver prices. China’s economic activity has also not yet recovered as hoped, so that this is also not so good for silver in terms of price. Platinum and palladium also seem to be affected by the weak summer months. After all, platinum has lost almost a quarter of its value since May. Some of the palladium producers in South Africa are having problems with the power supply. About 80 percent of palladium is consumed by the automotive industry. The fact that palladium will have a supply deficit in 2023 should actually counteract the price decline more strongly.

Low prices are entry prices. And in a few months, the gold price could already be much more expensive. The linchpin is the further interest rate development as well as the economic development. Here, the Bank of Montreal (BMO) assumes that gold will remain stable until the end of the year. However, the bank has increased the forecast silver price and now assumes an average silver price for 2023 of 22.70 U.S. dollars per troy ounce. Catching the best possible moment to enter the precious metals market is difficult, but currently – with some confidence in the future – good opportunities should arise.

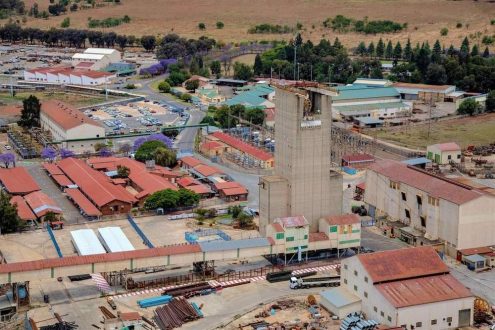

One company that produces gold, as well as platinum and palladium (South Africa, North and South America) is Sibanye-Stillwater – https://www.commodity-tv.com/ondemand/companies/profil/sibanye-stillwater-ltd/ . The company is also engaged in the field of battery metals.

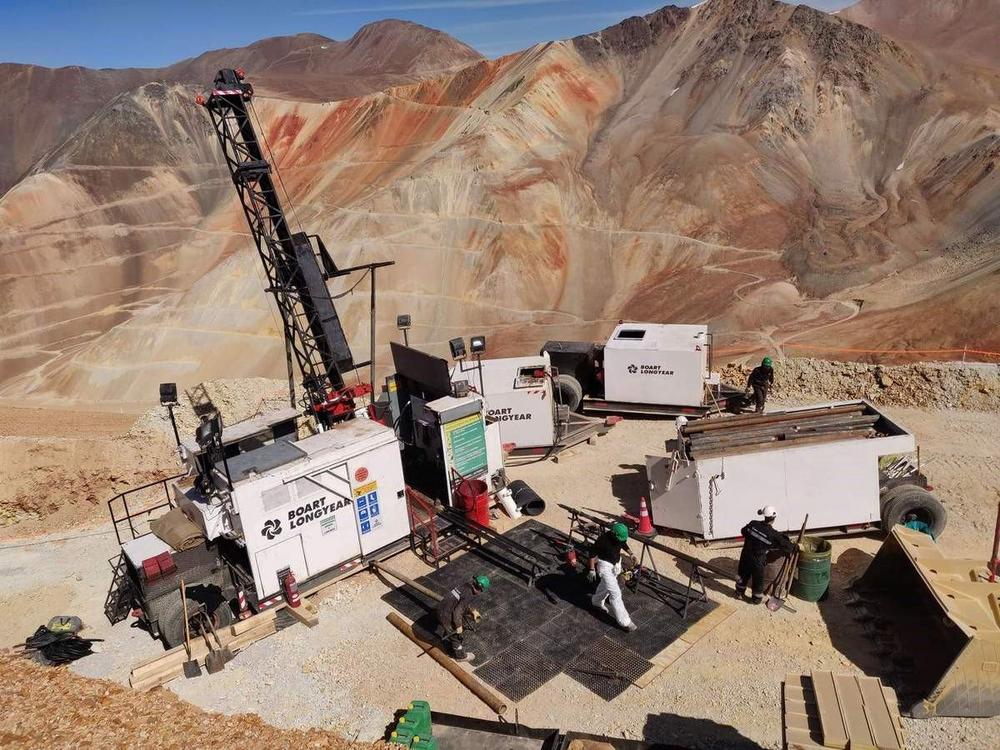

Vizsla Silver – https://www.commodity-tv.com/ondemand/companies/profil/vizsla-silver-corp/ – is working on its prospective Panuco silver-gold project in Mexico. This formerly producing property covers approximately 7,200 hectares.

Latest corporate information and press releases from Vizsla Silver (- https://www.resource-capital.ch/en/companies/vizsla-silver-corp/ -) and Sibanye-Stillwater (- https://www.resource-capital.ch/en/companies/sibanye-stillwater-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()