Money laundering and gold

A global body, including China, South Korea and Japan, stands to combat money laundering, terrorist financing linked to weapons of mass destruction. The United Arab Emirates has now suspended Emirates Gold over money laundering allegations, meaning the country has suspended the license of a major gold refiner. Then last Friday, the London Bullion Market Association suspended Emirates Gold’s membership. Because two owners of Emirates Gold are said to be related to businessmen from Zimbabwe. And these same businessmen were said to have been involved in money laundering. The international pressure on the United Arab Emirates is great, because strict measures are taken against money laundering.

Of course, the Emirates want to be removed from the list of the global supervisory authority. But the Gulf country must first convincingly demonstrate that it is fighting financial crime. For example, just earlier this year, the Emirates‘ central bank issued new guidelines to ultimately stem global criticism. Money laundering is a problem worldwide. In this country, a new anti-money laundering law has been in place since 2021. Banks must closely monitor suspicious transactions, and if they suspect money laundering, they are allowed to freeze customer accounts. Money laundering or not, investors who want to invest their honestly saved money in gold can buy physical gold or fall back on the stocks of gold companies such as Condor Gold or Chesapeake Gold.

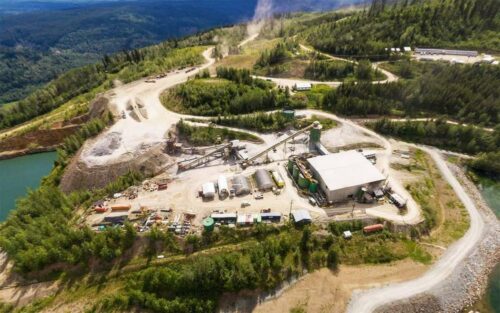

Condor Gold – https://www.commodity-tv.com/ondemand/companies/profil/condor-gold-plc/ – is focusing on three projects in Nicaragua. The La India project (100 percent) covers 588 square kilometers and covers 98 percent of the historic La India gold mining district.

Chesapeake Gold – https://www.commodity-tv.com/ondemand/companies/profil/chesapeake-gold-corp/ – is active in North and South America. The prospective flagship Metates project in Durango contains gold, silver and zinc.

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()