Gold is part of the investment mix

The main factor for the price development of gold is still the Fed’s monetary policy. There are analysts who see the US economy sliding into recession. True, the U.S. economic data was quite resilient in the first half of 2023. But there could still be downside, there are signs of that. Also, recessions usually happen with a lag. It is clear that consumer credit card debt went up sharply in the second quarter. For example, consumer debt is now more than $1 trillion. Consumers are incurring debt to finance their spending and are doing so now at higher interest rates. The days of low interest rates and government Corona bailouts are over; this is now driving consumer debt to record highs. And that is precisely not a sign of healthy economic development.

This creates the risk of a recession. It’s still uncertain how long the period of high interest rates will last, meaning the Fed will keep rates high. If the economy goes downhill and the U.S. slides into a recession, then this plays into the hands of the gold price. Most analysts recommend holding about five percent of a portfolio in gold, but there are those who advocate a higher percentage in the face of an impending recession. Gold hedges a portfolio, and if the risks are high, the hedges should also be higher. This can also be achieved by investing in well-positioned gold companies.

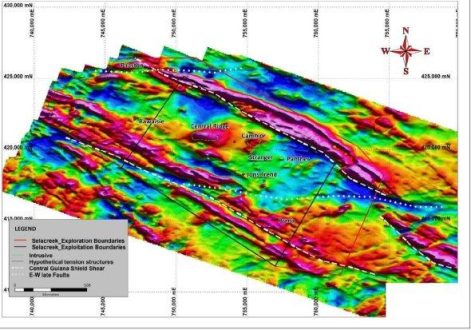

There is Maple Gold Mines – https://www.commodity-tv.com/ondemand/companies/profil/maple-gold-mines-ltd/ -. Two gold projects (Joutel and Douay) are being developed in Quebec with partner Agnico Eagle Mines.

The location of the projects and drill results to date are very good. In Mexico, Sierra Madre Gold and Silver – https://www.commodity-tv.com/ondemand/companies/profil/sierra-madre-gold-silver/ – is working on three highly prospective and high grade gold and silver projects.

Current corporate information and press releases from Maple Gold Mines (- https://www.resource-capital.ch/en/companies/maple-gold-mines-ltd/ -) and Sierra Madre Gold and Silver (- https://www.resource-capital.ch/en/companies/sierra-madre-gold-and-silver-ltd/ -).

In accordance with §34 of the German Securities Trading Act (WpHG), I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and that there is therefore a possible conflict of interest. No guarantee for the translation into German. Only the English version of this news is valid.

Disclaimer: The information provided does not constitute any kind of recommendation or advice. Express reference is made to the risks involved in securities trading. No liability can be accepted for any damages arising from the use of this blog. I give to consider that shares and in particular warrant investments are connected in principle with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make a mistake, especially with regard to figures and prices. The information contained is taken from sources that are considered reliable, but in no way claim to be correct or complete. Due to judicial decisions the contents of linked external pages are to be answered for (so among other things regional court Hamburg, in the judgement of 12.05.1998 – 312 O 85/98), as long as no explicit dissociation from these takes place. Despite careful control of the contents, I do not assume any liability for the contents of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG applies additionally: https://www.resource-capital.ch/de/disclaimer-agb/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()