Interim Results for the six months ended 30 June 2023

Highlights

– Ended the period with a robust cash position of over £7.9m (30 June 2022: £18.8m)

– Loss before tax of £2.3m (30 June 2022: £2.1m)

– The fully funded DFS at Taronga, Australia continued at pace:

- Signed an agreement with BID Energy Partners to provide a feasibility study on renewable energy supply options which has the potential to materially reduce the power costs of the project, supports permitting and is aligned with First Tin’s desire to have the highest ESG credentials for the benefit of all our stakeholders

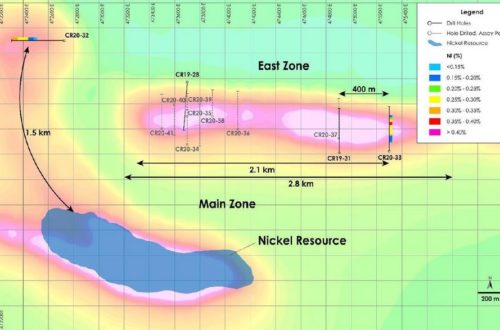

- Completed all confirmatory drilling and exploration work with results from the programme confirming both the widths and grades of mineralisation previously reported by Newmont between 1979 and 1982 and identifying an approximate 400m extension to the southwest

- Discovered the Tin Beetle prospect, with drilling confirming mineralisation over the entire 2.3km tested and validating First Tin’s thesis that Taronga is part of a tin district rather than a singular tin occurrence

- 100% owned Australia subsidiary – Taronga Mines Pty Ltd (“TMPL”) applied for a large (276.6km2) Exploration Licence covering the majority of the Tingha tin field, consolidating First Tin’s control of significant historical tin producing areas in northeastern New South Wales (post period end)

- Crushing testwork results confirmed significant upgrading effect for both high-grade and low-grade mineralisation at the Taronga tin project (post-period end)

- Published an updated JORC compliant Mineral Resource Estimate (“MRE”) which increased the size of the Taronga resource by over 240% to 133 million tonnes, demonstrating the true scale of the Taronga asset (post-period end)

- Results from end-to-end mineral processing testwork identified a simple and cost-effective processing option for the tin mineralisation found at the asset (post-period end)

– Continued to progress the Tellerhäuser project, Germany:

- Saxonian Mining Authority confirmed eligibility to move straight to the construction and operational permitting process, reducing the overall permitting timeframe by up to 12-18 months

- Submitted complete documentation for mine permit application to the Saxonian Mining Authority with a decision expected prior to the end of Q3 2024

- Continuing to expand the current JORC MRE by utilising the recently uncovered historical Wismut drilling data alongside additional drilling

Thomas Buenger, Chief Executive Officer, commented:

" First Tin has made strong progress during the period, executing key workstreams and adding significant value at both its flagship tin assets in Australia and Germany. The management team has focused on advancing both assets through their Definitive Feasibility Studies, while extension development and exploration drill programmes have produced excellent results.

“We remain well-positioned to complete both DFS studies at our Taronga and Tellerhäuser assets, during Q1 2024 and Q3 2024, respectively.

“Tin is fundamental in any plan to decarbonise and electrify the world. At the same time, global tin supply is falling with 75% of global tin production from non-Tier-One, non-OECD countries. Therefore, it is vital that demand is met by companies which are dedicated to supplying tin reliably and responsibly. First Tin remains committed to bringing its assets into production at a pivotal time and is poised to become a material future tin supplier from its conflict-free and low political risk jurisdictions.”

Analyst Presentation

There will be a Zoom webinar for equity analysts at 10:30am BST today, hosted by Thomas Buenger, CEO and Charles Cannon-Brookes, Non-Executive Chairman. Any analysts wishing to register for the event should email firsttin@secnewgate.co.uk.

Investor Presentation Reminder

Additionally, Thomas Buenger, CEO and Tony Truelove, COO, will provide a live presentation for investors via the Investor Meet Company platform at 09:00am BST on Monday 25th September 2023.

The presentation is open to all existing and potential shareholders. Questions can be submitted pre-event via the Investor Meet Company dashboard up until 9:00am the day before the meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and click "Add to Meet" First Tin via:

https://www.investormeetcompany.com/first-tin-plc/register-investor

Enquiries:

First Tin

Via SEC Newgate below

Thomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt 020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell 020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Molly Gretton 07900 248 213

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

CHAIRMAN’S STATEMENT

FOR THE PERIOD ENDED 30 JUNE 2023

I am pleased to report that during the six months ended 30 June 2023, First Tin has achieved strong operational progress, completing key workstreams at both of its flagship tin projects in Australia and Germany. Despite persistent macroeconomic challenges such as the ongoing war in Ukraine, increasing geopolitical tensions and volatility of global stock exchanges, our teams in Australia and Germany have worked diligently to add value and to reduce risk at both our assets.

After a rollercoaster year in 2022 where the tin price hit record high prices of c.US$50k per tonne in March and then hit a two-year price low of c.US$17k in October, the period under review has seen a much less volatile price range of between US$20k-US$30k. This has been set against a market backdrop where falling global supply has been more than countered by weak global demand.

On the supply side, material disruptions from a number of leading tin-producing countries such as Bolivia, Peru, Indonesia, China and Wa State, impacted the global tin market. Market forecasts indicate that an excess of 10,000 tonnes could be removed from the annual global tin supply in 2023 alone. Against such a bearish supply picture, one would have expected to see a significant increase in tin spot prices. However, this supply weakness has been more than offset by a general drop-off in global demand. This demand reduction has predominantly come from traditional tin sectors such as tinplate and chemicals and from a general drop in the demand for consumer electronics driven by low global GDP growth forecasts and high interest rates which have curtailed demand for luxury goods. While it is hard to accurately forecast when aggregate tin demand will strengthen, tin is experiencing strong levels of demand in some individual sectors such as in solar ribbon and electric vehicles. The longer-term picture for tin remains bright with material deficits still forecast to start in 2026 exactly when First Tin intends to bring its two flagship assets into production.

Tin remains a vital ingredient for global decarbonisation and is a key component in the production of semiconductors, artificial intelligence technology, electric vehicles, batteries, solar panels, and renewable technology. The pressures facing companies to decarbonise their supply chains mean that it is essential that this demand is met by companies which are dedicated to supplying tin reliably and responsibly. First Tin remains committed to bringing its assets into production at a pivotal time and is poised to become a material future tin supplier from its conflict-free and low political risk jurisdictions.

During the period, the management team focused on advancing both assets through their respective Definitive Feasibility Studies (“DFS”). We have made strong operational progress at our Taronga asset, successfully completing all drilling and exploration work and publishing an updated JORC compliant Mineral Resource Estimate (“MRE”) which increased the size of the Taronga resource by over 240% to 133 million tonnes. This updated JORC MRE statement demonstrates the true scale of our Taronga asset and I am pleased to report that there remains plenty of scope to further increase the size of total resource both from the Taronga asset itself and from its satellite orebodies.

However, perhaps the most promising development at Taronga in the interim period has been the results from the beneficiation and processing work undertaken on high-grade and low-grade bulk samples. This work showed that the high-grade bulk sample (0.18% Sn head grade) was simply and cheaply upgraded to 0.63% Sn using only a simple coarse crushing and screening technique followed by jigs and spirals while the mass was reduced by 73% and 79% of the tin content was retained. This low-cost and simple beneficiation solution is a unique feature of the Taronga orebody corroborating previous historical work undertaken by Newmont. Furthermore, the estimated 73% reduction in the tonnage that needs to be processed after the beneficiation process will have a material positive impact on future capex and opex forecasts. The DFS at Taronga is on track to be completed during Q1 2024.

At our Tellerhäuser asset, we have made solid progress in terms of permitting the project, receiving confirmation that the mine permit will go through a fast-track process. Work on the ground in Germany and in relation to the ongoing DFS has been focussed on permitting work, metallurgy, and processing, as well as on expanding the current JORC MRE by utilising the recently uncovered historical Wismut drilling data. We expect to be able to release an updated MRE on both Hammerlein and Dreiberg deposits before the end of the year, with the DFS forecast to be released in Q3 2024 and the granting of the mining license shortly thereafter.

On behalf of the Board, I would like to thank the First Tin management team and employees for their ongoing determination and hard work, which has resulted in a series of significant operational achievements during the period. I would also like to thank all of our stakeholders for their continued support and commitment. We look forward to the second half of 2023 with great excitement as we continue to progress our flagship assets.

C Cannon Brookes

Chairman

CHIEF EXECUTIVE OFFICER’S REPORT

FOR THE PERIOD ENDED 30 JUNE 2023

First Tin has a clear ambition: to develop a sustainable, reliable, conflict-free supply of tin which meets the stringent ESG values that are increasingly driving the purchasing behaviour of consumers globally, and therefore the businesses which serve them.

With customers and brands alike scrutinising the provenance and Scope 3 emissions associated with the materials and products they purchase, there is a significantly growing demand for high-quality, traceable, ESG-compliant sources of tin. These customers and brands now expect to receive tin which has been produced in a way which benefits the communities in which the mine is located, and which upholds best-in-class health and safety practices.

This embodies First Tin’s approach to mining and together our assets represent the fifth largest undeveloped tin reserves globally, outside of Russia, Kazakhstan, and the DRC. Our assets are located in the low-risk, conflict-free jurisdictions of Australia and Germany and their development is being led by a management team with significant personal investment committed to bringing them into production in an environmentally compliant way.

Tin is a designated critical material due to its vital role in decarbonising and electrifying the world. First Tin is positioned to deliver its first production to coincide closely with a market deficit which is forecast to start in 2026 and remain in deficit for many years thereafter unless material new sources of tin supply can be found.

Taronga – Australia

Taronga is located in New South Wales. It is a low-risk asset in a low-risk jurisdiction. Acquired in 2022 by First Tin, it is surrounded by excellent existing infrastructure and benefits from over a century of development and abundant underexplored tin showings, providing major exploration upside potential. Significant exploration work was undertaken by BHP in 1933, 1958, and 1964, and by the Newmont Joint Venture from 1979 to 1983.

Since our IPO in April 2022, we have been focused on drilling at Taronga to confirm the historical data and extend the mineralisation and I am pleased to say that we have been successful on both fronts. As recently announced, the Company’s JORC compliant Mineral Resource Estimate (“MRE”) increased by 240% to a new total of 138,300 tonnes contained tin with significant potential for further increases.

The MRE was completed by independent geological consultants H&S Consultants Pty Ltd and prepared in accordance with the 2012 JORC Code & Guidelines.

It was reported using a 0.05% tin ("Sn") cut-off to a maximum depth of 300m below surface (650mRL):

Aus Tin Mining Ltd’s previous MRE, reported in 2014, was calculated using a 0.10% Sn cut-off. The lower cut-off for the updated MRE is based on revised economic considerations including higher 3-year trailing tin prices, lower AUD:USD exchange rates and preliminary estimates of mining, processing and G&A costs.

When comparing the two Mineral Resources, we are pleased to see that the updated MRE represents a 40% increase in total contained tin metal based on the same cut-off. This has been successfully delivered due to exploration drilling by First Tin extending the Mineral Resource to the southwest of the existing estimate, a new geological interpretation, and a reconfigured grade interpolation technique.

We believe that Taronga should not be seen as a stand-alone asset, but rather as the most developed asset in what is a tin district. In May 2023, we were delighted to confirm our thesis through the receipt of the first drill hole from our Tin Beetle satellite prospect, 9km from the Taronga tin deposit. The first hole returned 7 metres @ 0.63% Sn within a broader intersection of 48 metres @ 0.18% Sn from 2 metres depth. Tin Beetle is one of six potential satellite deposits for Taronga, and we look forward to initialising further exploration and drilling programmes in the coming months.

The Company has also been focussing on advancing the mineral processing work at Taronga in order to finalise its final flow sheet and preferred processing route. As recently announced, crush, jig and spiral test results confirmed the premise that the cassiterite (SnO2 – tin ore mineral) is easily liberated at a coarse crush size and that a good quality concentrate can be obtained using very simple gravity separation techniques. Using coarse gravity techniques only (i.e. no fine tin recovery) and a processing route that consists only of crushing, jigs, spirals and shaking tables, it has been demonstrated that 55% of the total tin can be recovered into a 56% low impurity Sn concentrate.

Due to the simplicity of the coarse tin only circuit, this processing flow sheet has now been chosen as the go-forward option for the Definitive Feasibility Study (“DFS”), with the possible additions of a fine tin recovery circuit and/or supplementary crushing options being investigated as part of future optimisation work to further increase recovery rates. Ongoing recovery studies on lower grade samples are currently in progress, designed to obtain a realistic grade-recovery curve for use in the DFS and will be announced when received.

It is also worth noting that during the period, we partnered with BID Energy Partners, an Australia-based energy company, to provide a feasibility study on renewable energy supply options for Taronga. This is a critical element for the Company’s efforts to minimise its carbon footprint and be energy efficient. Fortunately, we are well placed to take advantage of renewable energy due to a number of factors, including our freehold ownership over a significant portion of land around the project which is sufficient to develop significant solar and/or wind farms, with high-solar capacity and good wind speed characteristics.

In summary, the material increase in the Taronga JORC MRE, including the inclusion of a Measured Resource category for the first time, alongside the validation of a low-cost and simple beneficiation process, positions the Company well. We aim to complete the DFS at this asset during Q1 2024.

Tellerhäuser – Germany

Our Tellerhäuser project is one of the world’s most advanced tin deposits. It is located in the tin district of Saxony, which showcases an exceptionally long history of mining and has an active Mining Licence for the extraction of mineral resources valid until 30 June 2070. A Scoping Study previously undertaken on Tellerhäuser in 2021, showed positive overall economics for the project with a very low up-front CAPEX number of US$49m. First Tin’s current efforts are to drive forward a DFS on the project with a targeted completion date in H2 2024.

As part of this DFS effort, further deep drilling was completed during the period in the Dreiberg target. We successfully intersected high-grade tin mineralisation at depth and along strike from the previous holes drilled by Wismut with each of the four holes drilled. The results were highly encouraging, confirming the skarn horizon is present, continuous and mineralised with high-grade tin which corroborates the legacy Wismut drilling from over 40 years ago.

We were also able to benefit from the ongoing data mining of a considerable amount of historical drilling data for the Tellerhäuser project area. Following granting of the Mining Licence in 2021, Saxore was able to request additional historical data, in particular drillholes targeting uranium mineralisation, that were also assayed for tin and other metals. This data is currently being added to the main database and should lead to additional resource tonnes being added very cost effectively. We expect to publish an updated JORC compliant MRE for Tellerhäuser during December 2023.

During the period, we also made positive progress in relation to permitting. Having already received confirmation from the Saxonian Mining Authority that the asset is eligible to move straight to the construction and operational permitting process, we announced the submission of the complete documentation for our mine permit application in June 2023. The Company expects that a mining license will be issued in Q3 2024 shortly after the release of the DFS.

Finance Review

Interim 2023 represents a period of investment by the Company as it progresses both its flagship assets through permitting and their respective DFS studies.

In respect of the financial results, First Tin posted a comprehensive loss for the period of GBP£1.4m and ended the period with a healthy cash position of GBP£8.0m and a net asset value of GBP£39.5m.

Expenditure during the period was primarily focused on drilling activities and other DFS related costs as well as on strategic land, property, and machinery acquisitions.

Outlook

The work undertaken during the period has significantly progressed the development of both of the Company’s core assets and has increased value. With the expected release of a DFS at our Taronga asset due in Q1 2024, we are making positive strides towards our 2026 production target and remain excited at the momentum we are building.

I would like to thank our valued investors for their continued support, and I look forward to reporting on our ongoing progress.

T Buenger

Chief Executive Officer

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()