Whether gold could be confiscated

Some people think that anti-American policies could lead to a currency crisis. Large national debts can lead to a currency crisis. That, in turn, could raise thoughts of confiscating gold from investors. In 1998, for example, South Korea called on its people to donate gold to the government. The appeal was very successful. The government in China recently tried again to motivate its citizens to buy gold. If the population of the own country possesses much gold, this could be useful. Gold reserves are an important element of reserve diversification for governments. And China is striving to build up large gold reserves. So "storing gold by the people" is China’s motto right now. If a country is flirting with a gold-backed currency, there should be plenty of gold. After all, the more gold, the more banknotes, and the greater the power. In Australia, by the way, the confiscation of gold and silver is enshrined in law.

There were gold bans in several democratic countries in the 20th century, for example in the USA in 1933 or in France in 1936 or in India in 1963. In Great Britain, a law was passed in 1966 stating that British citizens could own no more than four gold coins, and the rest would have to be surrendered. The government at the time wanted to counteract the decline in the state’s gold reserves. In 1971, this law was repealed again. So gold is always in the interest of governments and of investors. In any case, you should not go wrong with the stocks of solid gold companies. Gold, moreover, copper in the projects own GoldMining or Torq Resources.

Torq Resources – https://www.commodity-tv.com/… – has prospective interests in Chile, such as the Santa Cecilia project.

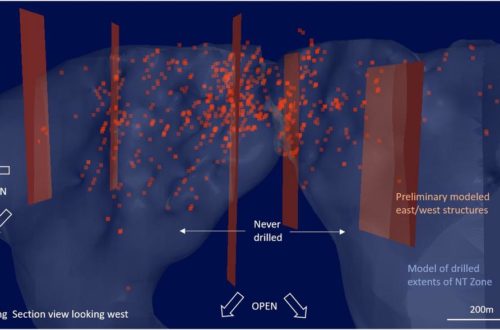

GoldMining – https://www.commodity-tv.com/… – is active in North and South America. The portfolio also includes a large block of shares in Gold Royalty and U.S. GoldMining.

Current corporate information and press releases from Torq Resources (- https://www.resource-capital.ch/… -) and GoldMining (- https://www.resource-capital.ch/… -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/…

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()