Auction smuggled gold online

The value of the gold, about 6,349 ounces, is about $11.7 million. This is a record value, which is auctioned by the Japanese customs authority. The gold accumulated at various airports from 2015 to 2017, mostly in the form of jewelry. The government processed it all into one-kilo gold bars. The illegal gold imports were probably intended to circumvent the excise tax. The proceeds of the auction then go to the Japanese treasury. Japanese investors had backed the right horse this year, as gold prices in Japan have risen by 18 percent since the beginning of the year.

The gram currently costs around 68 US dollars there. The background is certainly also the development of the yen, which is close to its all-time low compared to the U.S. dollar. The Japanese seem to be doing it right, because they are holding gold now. Normally, when the price goes up, they sell less now. Usually, when the price of gold weakens, they buy. Many Japanese are relying on a gold accumulation program to increase their assets. According to the World Gold Council, gold-backed ETFs are growing in Japan, so they are trading against the global trend of exiting these ETFs. In August alone, $18.3 million in gold-backed ETFs were added.

The investment of assets should be placed on different feet. Besides physical gold, gold stocks are also part of it. Among the compelling companies that own gold in the projects are Caledonia Mining and Aurania Resources.

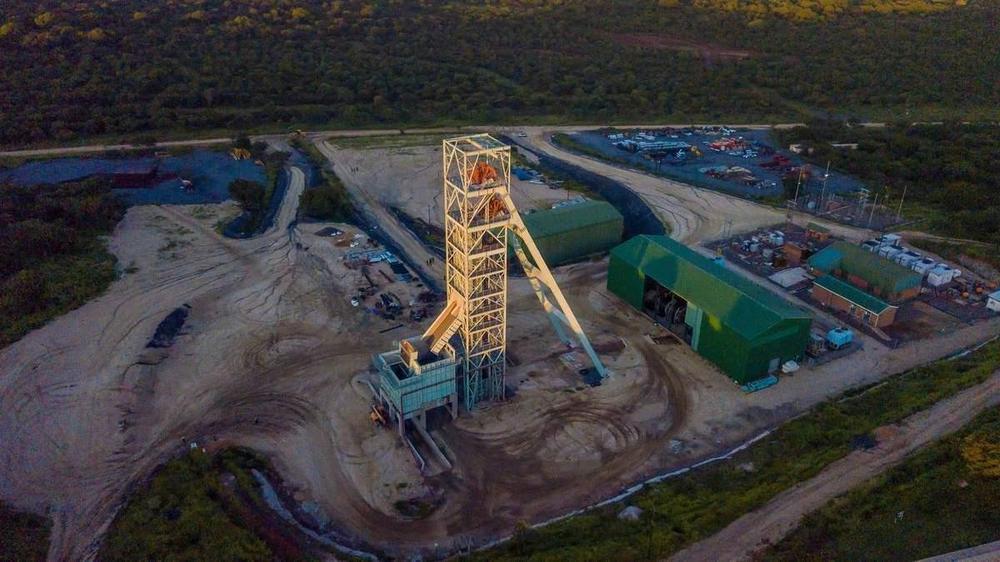

Caledonia Mining – https://www.commodity-tv.com/ondemand/companies/profil/caledonia-mining-corporation-plc/ – is producing successfully in Zimbabwe. The Blanket gold mine will produce approximately 75,000 to 80,000 ounces of gold this year.

Aurania Resources – https://www.commodity-tv.com/ondemand/companies/profil/aurania-resources-ltd/ – owns, among others, the flagship project The Lost Cities-Cutucu in Ecuador. It contains gold and copper.

Current corporate information and press releases from Aurania Resources (- https://www.resource-capital.ch/en/companies/aurania-resources-ltd/ -) and Caledonia Mining (- https://www.resource-capital.ch/en/companies/caledonia-mining-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()