Nuclear power plants need uranium

More than 50 nuclear power plants are currently being built on Earth. The price of uranium has already risen significantly. And the more expensive uranium becomes, the more worthwhile it is to bring closed uranium mines back to life. And this is also necessary to meet global uranium demand, which is growing. Supply and demand are not yet in balance, so a further increase in the price of uranium as a raw material is to be expected. The energy turnaround, and with it the move away from fossil fuels, will make nuclear energy even more attractive. Today, around 450 nuclear power plants worldwide supply about ten percent of the global electricity supply. Incidentally, uranium accounts for only about five percent of the operating costs of a nuclear reactor. So higher uranium prices are not a problem for their operators.

Nuclear power advocates are on the rise worldwide. And a discussion has arisen about low-CO2 hydrogen from nuclear power. Hydrogen is produced from water by electrolysis. It can be used for driving or heating. If the electricity used to produce it comes from renewable sources, it is called green hydrogen. If it is produced with nuclear power via electrolysis, it is called red hydrogen. Today, hydrogen is used primarily in the chemical industry or in oil refineries. For steel production, for example, which is difficult to electrify, hydrogen could replace the coal or natural gas now used. Basically, from a technical point of view, hydrogen can be used in industry, in buildings, in transportation. Whether in nuclear power plants or in the hydrogen sector, raw materials are indispensable.

When it comes to uranium, one might think of Iso Energy. IsoEnergy – https://www.commodity-tv.com/ondemand/companies/profil/isoenergy-ltd/ – owns high-grade uranium projects in the Athabasca Basin in Saskatchewan. This basin is famous for its high-grade uranium deposits. In the hydrogen sector, one raw material is important for the electrolyzers, it is platinum with its effect as a catalyst.

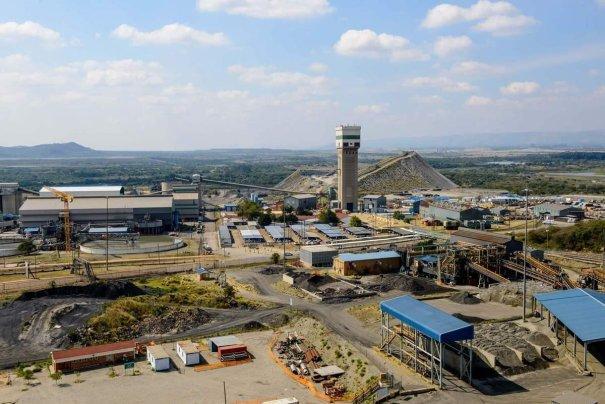

Sibanye-Stillwater – https://www.commodity-tv.com/ondemand/companies/profil/sibanye-stillwater-ltd/ – is a major producer of platinum (and palladium) and gold. The company’s projects are located in South Africa and in North and South America. Sibanye-Stillwater is also involved in battery metals such as lithium.

Latest corporate information and press releases from Sibanye-Stillwater (- https://www.resource-capital.ch/en/companies/sibanye-stillwater-ltd/ -) and IsoEnergy (- https://www.resource-capital.ch/en/companies/iso-energy-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()