Tailwind from India for nickel

Short-term fie, long-term hui – this is how the nickel market could be summarized. Long-term traders should get in now.

"However, the trend towards strong growth in demand from India and a possible global economic recovery in the second half of 2024 should also provide a tailwind for nickel prices." That is the conclusion experts at Deutsche Bank (DB) draw about the nickel market. In the short term, however, market participants are more likely to "mope around." Why? Currently, the Chinese industry would not yet show any new strength. In addition, the real estate market there would cast a shadow over the entire economic development.

But the nickel price is heavily dependent on Chinese demand. "Two-thirds of the nickel supply is used for stainless steel production, half of it again in China," says the analysis of the DB experts. In the medium term, however, a global economic recovery should drive nickel demand up again. This could start as early as the second half of 2024. In addition, demand for nickel is likely to increase significantly in India in particular. And then there is electromobility. With the current prevailing technology, a lot of nickel is needed for the batteries required. The sector will therefore absorb more and more of the industrial metal from the market. In the medium to long term, therefore, there is much to be said for a recovery in the nickel price. Those who would like to bet on the end of the downward slide already today – as is well known, the nickel price has plummeted since the beginning of the year – can get in indirectly with the shares of companies with nickel products.

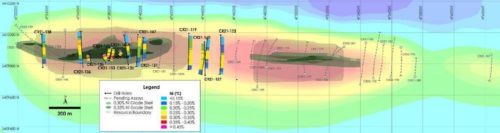

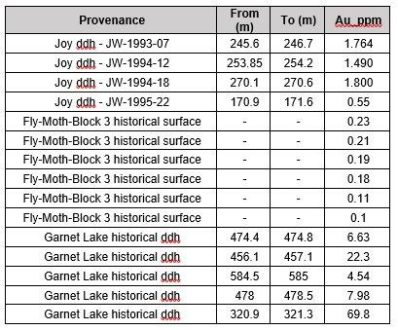

One might think of the Canada Nickel Company – https://www.commodity-tv.com/ondemand/companies/profil/canada-nickel-company-inc/ . Canada Nickel Company’s flagship project is the Crawford nickel-cobalt project in Ontario, Canada. In addition to nickel, lithium is also needed for electromobility and the energy transition.

In the lithium sector, Targa Exploration – https://www.commodity-tv.com/ondemand/companies/profil/targa-exploration-corp/ – is working on its lithium projects in Quebec, Manitoba, Saskatchewan and Ontario. Acquisitions will bring the total area of Canadian lithium projects to around 412,000 hectares.

Current corporate information and press releases from Canada Nickel Company (– https://www.resource-capital.ch/en/companies/canada-nickel-company-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()