Torq Trenches 34 metres of 0.89 g/t Gold and 0.22% Copper in the Falla 13 Discovery Area at Margarita, Provides Financing and Corporate Updates

Trenching Technical Discussion:

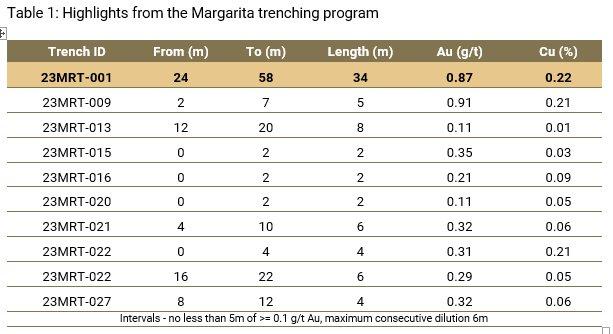

The mineralized west-northwest structure that trench 23MRT-001 crossed was previously drilled in the Company’s phase II drill program last year, when 30 m of 1.02 g/t gold and 0.57% copper (88 m – 118 m in depth) was intercepted within a larger interval of 130 m of 0.36 g/t gold and 0.28% copper in drill hole 22MAR-023R (see November 28, 2022 news release) (Figures 2 – 3). Trench 23MRT-001 is the most significant result from the trenching program as it demonstrates that the mineralization in drill hole 22MAR-023R continues to surface and has the potential to extend 1 km along the west-northwest structure (Figure 2). Table 1 below summarizes the highlights of the recently completed trench results.

Margarita Phase III Drill Results:

The Company has also received the results from the remaining seven drill holes from the phase III drill program. While intersecting some zones of anomalous mineralization, the results did not materially add to the known information about the project. The Company will now continue to focus on the discoveries made at the Falla 13, Cototuda and Margarita structural corridors. In addition, the Company will continue to refine its targeting based on the results from drill hole 23MAR-031R, where 42 m of 1.1 g/t gold and 0.48% copper was intercepted from 246 m – 288 m in depth 200 m to the west of the original Falla 13 discovery. There was no geochemical anomaly present on surface, making this a ’blind’ discovery based on permissive geology. Results from the final seven drill holes of the phase III drill program are presented below in Table 2.

Financing and Corporate Updates:

The Company advises that its Chief Financial Officer (“CFO”), Elizabeth Senez, will be leaving the Company by year-end to pursue a CFO role at a mid-tier mining company. While the Company completes the recruitment process for a successor, an accounting services firm, which performed the CFO role during the recent 4-month parental leave of the departing CFO, will again step into the interim role until a permanent replacement is recruited. The Company’s CEO, Shawn Wallace, stated “On behalf of Torq and the Board, I would like to thank Libby for her meaningful contributions to the Company over the last three years. We wish her all the best in her future endeavours.”

The Company’s previously announced prospectus supplement offering of a minimum of $4 million to a maximum of $6 million of equity units is now expected to complete by mid-December 2023. The Company also announces that the maturity date of the Company’s 2022 credit facility, currently drawn in the amount C$2.5 million, has been extended by agreement with the lender from July 11, 2024 until July 11, 2025. In consideration of the extension, the Company has agreed to cancel the lender’s July 11, 2024 share purchase warrants (3,333,333 at $0.60 and 769,231 at $0.65) and issue a total of 7,500,000 share purchase warrants with an exercise price of $0.35 with expiry date of July 11, 2025. The creditor warrants have a blocker limiting exercise to the extent the holder would thereby exceed 9.9% of issued shares.

The Company’s principal shareholder, Gold Fields Atacama Holdings Inc., a wholly owned affiliate of Gold Fields Limited (“Gold Fields”), has reaffirmed its commitment to purchase equity in connection with the supplement offering, but given the terms of its September 6, 2022 investment agreement with the Company (filed at sedarplus.ca on September 20, 2022) Gold Fields’ affiliate will do so by concurrent private placement of units with the same terms as the prospectus supplement units. The units to be purchased by Gold Fields will differ from the units offered under the supplement in that the warrants included in those units will be subject to a blocker provision limiting exercise of the warrants to a percentage of issued common shares of Torq, which percentage is still under discussion. The common shares and warrants of Torq that will be issued to Gold Fields will have a four month hold and the warrants will have a term of up to 60 months because of the requirements of the blocker and the terms of the 2022 investment agreement. Both the credit facility warrants and the Gold Fields’ affiliate’s participation are subject to customary TSX Venture Exchange approval.

Michael Henrichsen (Chief Geological Officer), P.Geo is the QP who assumes responsibility for the technical contents of this release.

ON BEHALF OF THE BOARD,

Shawn Wallace

CEO

For further information on Torq Resources, please visit www.torqresources.com or contact Natasha Frakes, VP, Communications at (778) 729-0500 or info@torqresources.com.

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

About Torq Resources

Torq is a Vancouver-based copper and gold exploration company with a portfolio of premium holdings in Chile. The Company is establishing itself as a leader of new exploration in prominent mining belts, guided by responsible, respectful and sustainable practices. The Company was built by a management team with prior success in monetizing exploration assets and its specialized technical team is recognized for their extensive experience working with major mining companies, supported by robust safety standards and technical proficiency. The technical team includes Chile-based geologists with invaluable local expertise and a noteworthy track record for major discovery in the country. Torq is committed to operating at the highest standards of applicable environmental, social and governance practices in the pursuit of a landmark discovery. For more information, visit www.torqresources.com.

2023 Margarita Trench Sampling

Approximately 2-5 kg of material were taken from each 2 m trench interval and sent to ALS Lab in Copiapo, Chile for preparation and then to ALS Labs in Santiago, Chile and Lima, Peru for analysis. Preparation included crushing core sample to 90% < 2mm and pulverizing 1,000 g of crushed material to better than 85% < 75 microns. All samples are assayed using 30 g nominal weight fire assay with AAS finish (Au-AA23), multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61), and copper sulphuric acid leach with AAS finish (Cu-AA05). QA/QC programs for 2023 trench samples using internal standard samples, field and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

Margarita RC Drilling

Analytical samples were taken using 1/8 of each 2 m interval material (chips) and sent to ALS Lab in Copiapo, Chile for preparation and then to ALS Labs in Santiago, Chile and Lima, Peru for analysis. Preparation included crashing core sample to 90% < 2mm and pulverizing 1,000 g of crushed material to better than 85% < 75 microns. All samples are assayed using 50 g nominal weight fire assay with AAS finish (Au-AA24), multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61), and copper sulphuric acid leach with AAS finish (Cu-AA05). Where MS61 results were greater or near 10,000 ppm Cu the assays were repeated with ore grade four acid digest method (Cu-OG62). QA/QC programs for 2023 RC drilling samples using internal standard samples, field and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

Canadian mineral terminology and standards differ from those of other countries. The Company’s public disclosure filings highlight some of these differences.

Forward Looking Information

This release includes certain statements that may be deemed “forward-looking statements”. Forward-looking information is information that includes implied future performance and/or forecast information including information relating to, or associated with, exploration and or development of mineral properties, completion of the prospectus supplement offering, and TSX Venture Exchange approval of share and share purchase warrant issuances. These statements or graphical information involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by such forward-looking statements. For a discussion of risk factors which could adversely affect the forward looking statements, see the Company’s public record filings at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()