Gold price 2024

A turnaround in interest rates is imminent in the USA. US inflation rates are falling, which is good for gold.

Expectations of interest rate cuts and falling bond yields are paving the way for higher gold prices. Last year, the price of the precious metal soared above the 2,000 US dollar mark. It is understandable that the new record price at the end of the year led to profit-taking. The price of gold is currently defending levels above the USD 2,000 mark. New record prices appear to be within reach. Should prices actually fall below USD 2,000 per troy ounce of gold this year, this should result in enormous buying.

When the Fed implemented interest rate hikes, the price of gold nevertheless remained strong, barely falling below USD 2,000. If interest rates are cut, this should drive the gold price up all the more. Even if the Fed is not yet talking about interest rate cuts in the near future, most analysts are assuming this. Many also believe that inflation will remain at three or four percent. Further cuts could only be achieved through action by the Fed, but this is unlikely to happen for fear of another financial crisis. After all, the Fed will not want to risk the USA going bankrupt.

In view of the immense national debt, high interest rates are poison for the USA. All of this should lift the price of gold to new heights in the course of this year. The all-time high for the price of the precious metal from December 2023 could therefore soon be surpassed. It would therefore be advisable to own physical gold and gain exposure to gold companies with leverage on the gold price. Solid stocks such as OceanaGold or GoldMining could be considered.

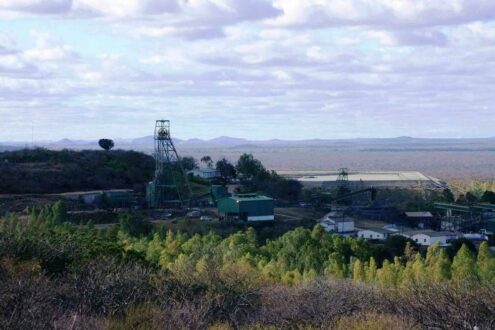

OceanaGold – https://www.commodity-tv.com/ondemand/companies/profil/oceanagold-corp/ – produces gold and copper and has four active mines in the USA and the Philippines.

GoldMining – https://www.commodity-tv.com/ondemand/companies/profil/goldmining-inc/ – has a large portfolio of gold and gold-copper properties in the USA, shareholdings and a uranium project.

Current company information and press releases from GoldMining (- https://www.resource-capital.ch/en/companies/goldmining-inc/ -) and OceanaGold (- https://www.resource-capital.ch/en/companies/oceanagold-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()