Gold as protection against inflation and loss of value

Whether or when the digital euro will come is uncertain, but work is underway. The ECB Governing Council is currently in the preparatory phase. This began on November 1, 2023, and is expected to last two years. It will then decide whether to continue preparations to introduce a digital euro. A digital euro could be used like cash; it would be a new means of payment, not a new currency. Euroland is not alone with these plans; around 93 percent of global central banks are said to have similar projects. If the digital euro becomes a reality, critics say there is a threat of cash being abolished. Many also fear for data security. After all, cash is anonymous, it works without a smartphone and without electricity.

That’s where gold and silver come in. Everyone wants to preserve their wealth, or at best increase it. A look at the past shows that anyone who invests part of their assets in precious metals is on the safe side. If you want to avoid the issue of storing precious metals, you can familiarize yourself with the stocks of companies that hold gold or silver in their projects, are located in safe jurisdictions, are financially well positioned and have experienced management. These include GoldMining and Skeena Resources, for example.

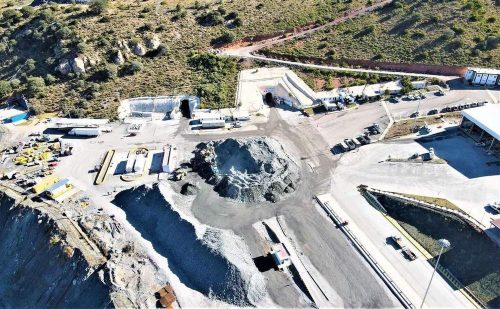

GoldMining – https://www.commodity-tv.com/ondemand/companies/profil/goldmining-inc/ – not only has a large portfolio of gold and gold-copper properties in the USA and a uranium project, but also shareholdings in Gold Royalty, U.S. GoldMining and NevGold.

Skeena Resources – https://www.commodity-tv.com/ondemand/companies/profil/skeena-resources-ltd/ – is working hard to revitalize the Eskay Creek and Snip gold projects in British Columbia. A final positive feasibility study has been completed.

Current company information and press releases from GoldMining (– https://www.resource-capital.ch/en/companies/goldmining-inc/ -) and Skeena Resources (- https://www.resource-capital.ch/en/companies/skeena-resources-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()