Banking on the future with uranium

The elections in Russia have cast a shadow. In an interview on 12 March, Vladimir Putin once again emphasized that Russia was ready for a nuclear war. This is probably all just sabre-rattling. But with such domineering despots, not even the most experienced political pundits can say for sure whether Putin would actually let it get that far. "From a military-technical point of view, of course we are ready," the 71-year-old Putin told the television and news agency RIA "Rossiya-1" when asked whether the country was really ready for a nuclear war. This was reported by the news service provider Thomson Reuters.

From today’s perspective, a nuclear war is not likely. Nevertheless, countries with nuclear weapons such as Russia, the USA, France and the UK will want to arm themselves. This includes warheads. For uranium as a raw material, this could again mean increased demand from the military sector.

But let’s not assume a nuclear war. One solution or another will be found in the Ukraine conflict, even without an extreme escalation. For the global economy, this means that slight growth is likely to continue over the next few years. This in turn means that the conversion of the energy supply to CO2-neutral media will continue. Nuclear power plants are one of the power generation technologies earmarked for this. Nuclear power plants are being planned or have already been built in many leading economies. The demand for the uranium required to operate them will therefore increase. The fact that there is no longer enough radiating material on the market has been reflected in the price of uranium in recent months. At times, it climbed above the 100 US dollar mark per 454-gram pound.

The prospects for the uranium price look good in the coming months. Supply is limited, demand is rising, and strategic stockpiles are likely to be built up rather than reduced. This should also benefit the shares of companies with promising uranium projects. Premier American Uranium and IsoEnergy, for example, come to mind.

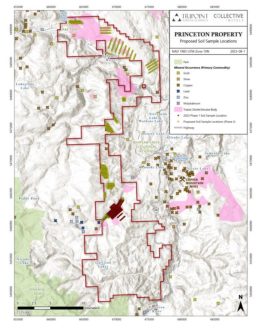

Premier American Uranium – https://www.commodity-tv.com/ondemand/companies/profil/premier-american-uranium-inc/ – owns uranium projects in Wyoming and Colorado.

IsoEnergy’s – https://www.commodity-tv.com/ondemand/companies/profil/isoenergy-ltd/ – uranium projects are located in the Athabasca Basin in Saskatchewan. Uranium production at the Tony M uranium mine in the USA is scheduled to restart in 2025.

Current company information and press releases from IsoEnergy (- https://www.resource-capital.ch/en/companies/iso-energy-ltd/ -) and Premier American Uranium (- https://www.resource-capital.ch/en/companies/premier-american-uranium-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()