Gold is a liquid investment with a value-preserving function

Gold is regarded as a safe haven and gold shines with liquidity, among other things.

As a rule, gold bars can be exchanged for cash without any problems. In fact, almost 90 percent of global annual gold production changes hands every day. According to data from the World Gold Council, gold is the second most liquid asset of all.

The US dollar and ten-year government bonds are also currently in demand. Over the past three months, the US dollar index DXY has risen by 2.7% and the yield on ten-year US government bonds by around 14%. Private investors are selling coins, gold bars and jewelry because they are attracted by the record high gold prices. This is understandable, but perhaps not the right way to go, because who knows where the gold price is heading. The situation with gold ETFs is that gold is flowing out and not flowing in. This is absolutely unusual, but recently gold and the US dollar have gone up in parallel. It was different between 1998 and 2008, for example, when the US dollar fell sharply in value. At that time, the price of gold almost tripled.

Gold has been anchored in the financial system for decades. Gold dates back some 5,000 years in the history of mankind. Gold was and still is a symbol of wealth. Gold is still revered in numerous cultures today and has never lost its significance. And gold is still a rare commodity, with only around four kilograms of gold per billion kilograms of the earth’s crust. Gold in the ground is owned by gold companies such as Tudor Gold and Revival Gold.

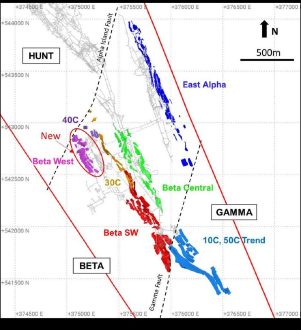

Tudor Gold – https://www.commodity-tv.com/ondemand/companies/profil/tudor-gold-corp/ – has the Treaty Creek project in British Columbia. It contains gold, silver and copper. According to an updated mineral resource estimate, it contains 16 percent more gold, 14 percent more silver and 32 percent more copper.

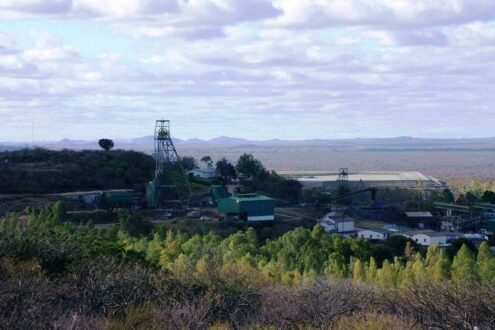

Revival Gold – https://www.commodity-tv.com/ondemand/companies/profil/revival-gold-inc/ – owns the largest previously producing gold mine in Idaho, USA. The exploration area has just been expanded.

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()