Gold price continues to rise

Gold has risen in price by around 17% since the beginning of March. The guesswork as to why this is the case and how it will continue continues.

Almost 2,400 US dollars must now be paid for 31.1 grams of gold (one ounce). The price forecasts of many banks and analysts have now also shot up. Goldman Sachs, for example, has raised its price target for gold from USD 2,300 to USD 2,700 by the end of 2024. According to the US investment bank, traditional macroeconomic factors cannot explain the enormous rise in the price of gold. The major Swiss bank UBS is even predicting USD 4,000, albeit in the next two to three years.

The history of the gold price shows that there is still time to participate in the gold price upswing. From 1972 to 1974 and from 1978 to 1980, for example, the price of gold exploded and quadrupled. From 2008 to 2011, the price of the precious metal doubled. Conclusion: When the price of gold breaks out, it often does so intensively and quickly. Bank of America also expects gold prices to continue to rise. This is because gold and silver will enjoy even greater popularity, especially when the interest rate cuts come. Bank of America’s price target is 3,000 US dollars per troy ounce. Silver could rise to over 30 US dollars per troy ounce in the next twelve months, especially if industrial demand continues to rise. ANZ Bank is not quite as positive and has a price target of USD 2,500 by the end of the year.

Silver, on the other hand, could rise to USD 31 as investors recognize and appreciate the catch-up potential of gold’s little brother. Should the price of gold fall below USD 2,335, according to ANZ Bank, then it could fall further to USD 2,250, leading to buying opportunities. Gold and gold companies should therefore definitely be in focus now. Solid gold companies include Karora Resources and Sierra Madre Gold and Silver, for example.

Karora Resources – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/ – will merge with Westgold Resources, to the benefit of shareholders. The result will be a medium-sized gold producer operating solely in Western Australia.

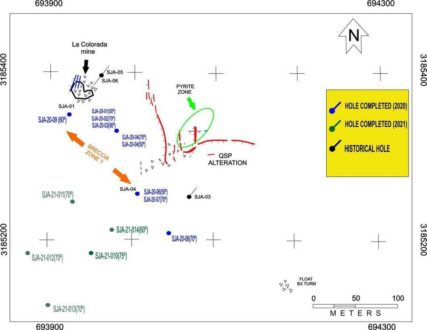

Sierra Madre Gold and Silver – https://www.commodity-tv.com/ondemand/companies/profil/sierra-madre-gold-silver/ – has three projects in Mexico that contain gold and silver. The formerly producing La Guitarra project is particularly promising.

Current corporate information and press releases from Sierra Madre Gold and Silver (- https://www.resource-capital.ch/en/companies/sierra-madre-gold-and-silver-ltd/ -) and Karora Resources (- https://www.resource-capital.ch/en/companies/karora-resources-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()