Demographic change – Inflation – Gold

It is not lower demand that is slowing down the economy, but rather the shortage of labor. This could fuel inflation. And as a country’s population ages, less is produced. If demand remains the same, this indicates increasing inflation. Ageing populations spend more money on health, less is saved, and inflation tends to rise. It remains to be seen whether a country will counteract this. If so, then key interest rates can be lowered more easily. Rising inflation and falling key interest rates are factors that are good for the gold price.

The independent precious metals consultancy Metals Focus is positive about the price of gold. An average price of USD 2,250 per troy ounce is forecast for the precious metal in 2024. This would be an increase of 16% compared to the previous year and a new record price. Strong central bank purchases and uncertain geopolitical conditions have already boosted the price in 2023. This is continuing this year. Despite a strong US dollar in some cases and interest rate cuts by the US Federal Reserve that have not yet taken place, the price of gold has climbed to record highs. Other price-driving factors are the immense mountain of debt in the USA and the upcoming elections. In addition, the uncertain prospect of a recovery in the Chinese economy has prompted investors to flock to the safe haven of gold. In any case, gold investments are part of wealth provision. Well-positioned gold companies such as Victoria Gold and Calibre Mining also score highly in this respect.

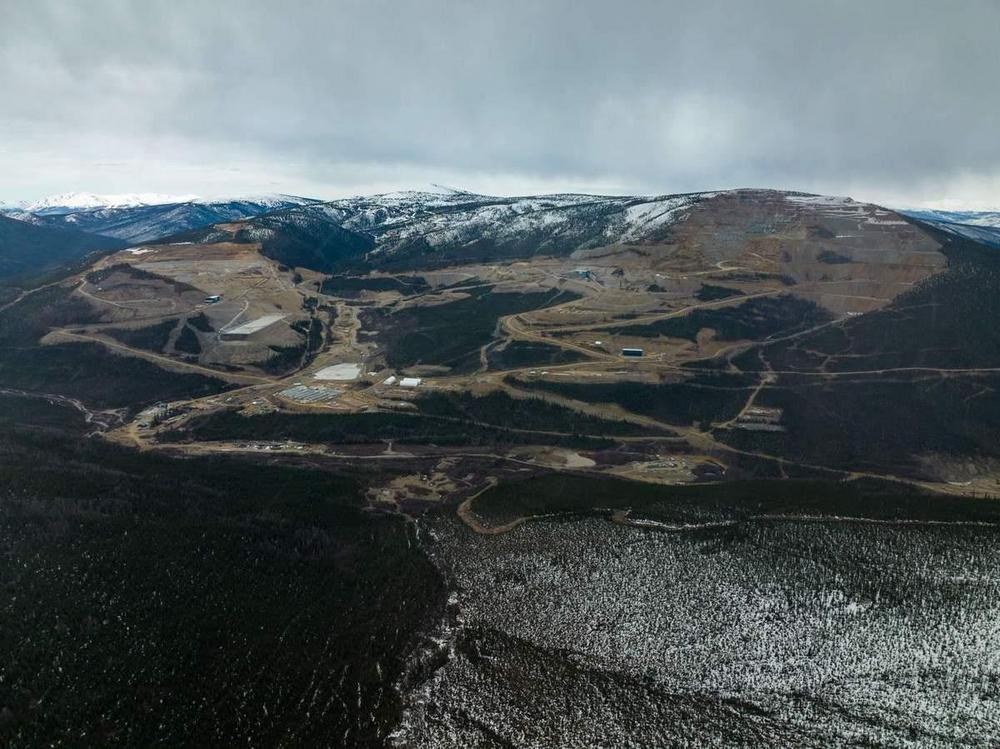

Victoria Gold – https://www.commodity-tv.com/ondemand/companies/profil/victoria-gold-corp/ – expects gold production from its Eagle gold mine in the Yukon to be between 165,000 and 185,000 ounces of gold in the current year. Gold production in the first quarter amounted to almost 30,000 ounces of gold.

Calibre Mining – https://www.commodity-tv.com/ondemand/companies/profil/calibre-mining-corp/ -, active in Nicaragua and the USA, is a medium-sized gold producer. Recent drilling has yielded up to almost 37 grams of gold per ton of rock.

Current company information and press releases from Calibre Mining (- https://www.resource-capital.ch/en/companies/calibre-mining-corp/ -) and Victoria Gold (- https://www.resource-capital.ch/en/companies/victoria-gold-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()