Kenorland Minerals Welcomes Centerra Gold As Strategic Investor Through Non-Brokered C$9.86M PP

This aligns perfectly with everything else Kenorland is doing, as in my view it is the best prospect generator around by a country mile.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

On May 21, 2024, Kenorland Minerals announced the arrangement of the strategic investment by Centerra Gold of C$9.86M in a non-brokered flow-through (FT) financing, for an approximately 9.9% interest in the company. The FT shares will be sold on a charitable FT basis, meaning even more tax deductions are possible for Centerra. Several types of FT shares were offered at different premiums: 6.2M National FT shares @ C$1.12, 1.4M Quebec resident (QC) FT shares @ C$1.42, and 694k Manitoba resident (MB) FT shares @ 1.296. In total, 8.3M shares were issued for C$9.862M, at an average price of C$1.186. This meant a premium of 59% on the closing price before the announcement, which is decent for a charitable FT premium, but higher than the regular FT premium, which limits dilution.

No warrants were issued, so this helps in this regard as well. Sumitomo likes to keep their interest at 10.1% through the exercising of their equity participation right, meaning they will buy another 1,006,520M shares in this FT financing, being eligible for the C$1.12 shares. The financing will be closed on or about May 28, 2024. The proceeds from the Offering will be used to advance exploration at Kenorland’s Canadian projects in Quebec, Ontario, Manitoba, British Columbia and Saskatchewan.

President and CEO Zach Flood was obviously pleased with Centerra:

"We’re very excited to welcome Centerra as a new strategic investor in Kenorland. Centerra’s strong balance sheet and focus on organic growth through exploration aligns well with our generative strategy. Having partnered with Centerra on the Hunter Project, Quebec, since 2022, we look forward to continuing to build on this relationship as we expand our exploration footprint in North America. The proceeds of this premium financing will go directly towards advancing, and expanding upon, multiple greenfields exploration initiatives, including the completion of several large-scale, property-wide and follow-up geochemical surveys in Quebec, Ontario and Manitoba. Further, the financing will provide Kenorland flexibility to explore accretive opportunities within the business model to increase shareholder value, utilizing our excellent working capital position."

Their working capital position has always been very healthy to begin with, estimated by management around C$22M before the Centerra closing. Since Kenorland allocated C$5.2M for sole funded exploration for 2024, I expect this number to go up significantly. As CEO Flood indicated to spend the proceeds on projects located in Quebec, Ontario and Manitoba, I wondered which 100% owned projects he prioritized here. For Quebec it could be Wabissane, for Ontario South Uchi, and for Manitoba South Thompson. An example could be the Papaonga target (South Uchi):

According to Flood, these funds will be put towards mostly large-scale geochemical surveys at our Quebec, Ontario and Manitoba this season and next. We will be working over 600,000 ha of ground, most of which will be first-pass property-wide sampling in Ontario and Manitoba this season and Quebec next.

This doesn’t mean a slightly shifting focus towards fully owned projects, as Kenorland is very much staying within the project generator model, and actively seeking partners for their projects.

As a reminder, the 4% NSR royalty on the Frotet project is the flagship asset of Kenorland Minerals. As the temporary operator (Sumitomo being the owner), Kenorland just completed the 2024 exploration drill program, consisting of 27 drill holes totaling 18,448m, focusing on infill and step-out drilling. CEO Flood expects the drill results to be released in two batches as usual, with the first batch expected back from the labs shortly, of which the results after interpretation etc will probably be released in 2 weeks from now. The second batch is expected to come up 6-7 weeks later in the cycle.

Keep in mind this 4% NSR on Frotet represents quite a bit of value, and is much better monetizable at any moment, compared to a 20% JV interest. As a 0.5% NSR could be bought back for C$10M, which hypothetically equals C$80M for the entire 4% NSR on paper, these are values priced for more advanced stages, with a NI43-101 resource and an economic study completed. Since CEO Flood estimates that Sumitomo would need at least another 1.5-2 years of drilling for this, this could entail 45,000-60,000m of drilling, costing about C$23-30M. Since royalties typically sell for C$10M per 1Moz per 1% NSR at FS/permitting stage, and my estimate for the deposit stands at about 3Moz Au at the moment (more about this in a minute), this would mean a value of C$120M at FS/permitting stage, which is many years out from now. How to discount to today I have no clue, but taking the buy down rights into account, it seems the 4% NSR could be worth C$30-40M today.

Let’s see why I believe Kenorland is coming close to a hypothetical 3Moz+ Au. The latest reported results didn’t appear to extend R1, so we still arrive for R1 at 1100 x 300 x 5 x 2.75 = 4.5Mt, at a slightly higher average guesstimated grade of 6.2 g/t Au because of the recent high grade intercepts, this would mean a hypothetical 897koz Au.

The R2 vein only saw further infill drilling although narrow and high grade, so R2 is estimated unchanged at 1800 x 200 x 2 x 2.75 = 1980kt, at a slightly higher average guesstimated grade of 8.3g/t Au this results into a hypothetical 528koz Au. For the R3 structure it is the same, so the envelope could still be estimated at 1500 x 100 x 2 x 2.75 = 825kt, at a slightly higher average estimated grade of 7.4g/t Au this results in a hypothetical 196koz Au.

The R4 structure was drilled with broad step-outs, which also intersected much wider (but lower average grade) intercepts (35.45m @ 2.9g/t Au and 8.95m @ 6.34g/t Au) so this mineralized envelope increased considerably, and is guesstimated at 300 x 300 x 6 x 2.75 = 1.485Mt, at a lower average guesstimated grade of 5g/t Au (coming from 10g/t Au) this could imply a hypothetical 238.75koz Au (coming from 36koz Au so this is significant). This results in a total hypothetical estimate for R1-R4 of 1.86Moz Au.

Step-out results were also reported for the R5-R8 veins. For the R5 vein, the envelope is estimated this time at 900 x 75 x 5 x 2.75 = 928kt, at a slightly lower average estimated grade of 8.5g/t this results in a hypothetical 254koz Au.

For the R6 vein (including a second vein in between R5 and R6), the envelope is estimated a 100m longer now and slightly thicker due to the headline 19.25m @ 19.95g/t Au intercept, and sits at 1200 x 75 x 6.5 x 2.75 = 1608.75kt, at a slightly higher average estimated grade of 8.5g/t this results in a hypothetical 440koz Au. For the R7 vein (including a second vein in between R7 and R8), the envelope is estimated at 1050 x 50 x 7 x 2.75 = 1Mt, at an average estimated grade of 8g/t this results in a hypothetical 260koz Au. For the R8 vein, the envelope is estimated at 1050 x 80 x 3 x 2.75 = 693kt, at an average estimated grade of 7.5g/t this results in a hypothetical 167koz Au.

For the deepest structures R9, R10 and R11, up dip drilling was completed to test extensions towards the surface, but unfortunately intersected mineralization wasn’t economic so far:

“Two drill holes were designed to test the shallower portions of the Regnault diorite up dip from the 2023 winter discovery holes that intersected mineralization down to 1,000m vertical depth including 23RDD172 which returned 2.56 g/t over 41.85m including 11.96 g/t Au over 4.45m (see press release dated August 8, 2023).

These large step-outs (200-300m) returned narrow, moderate grade mineralization within the R9, R10, and R11 shear zones including 23RDD174 which returned 3.70m at 2.14 g/t Au including 0.40m at 10.70 g/t Au, a 215m up dip step-out from 23RDD159 that returned 1.20m at 55.70 g/t Au (see press release dated May 31, 2023).”

Therefore I go with my earlier estimates for these 3 veins. For the R9 vein I arrived at 1250 x 50 x 3 x 2.75 = 516.5kt, at an average grade of 8g/t this remains at a hypothetical 133koz Au. My existing estimates for the other veins resulted in 3 x 450 x 50 x 1 x 2.75 = 185kt @ 10g/t = 60koz Au for R10, and 3 x 450 x 50 x 2 x 2.75 = 371kt @ 15g/t = 179koz Au for R11.

These R5-R11 veins result in a total, hypothetical number of 1.49Moz Au.

Adding those two sub totals together, my overall estimate for Regnault would increase quite a bit, and would go from a hypothetical 2.98Moz Au to a hypothetical 3.35Moz Au for now. For average grade I prefer to go slightly lower because of R4, from 7-8g/t Au to 6.5-7.5g/t Au.

This is it for Frotet/Regnault. As we know, Kenorland has dozens of other projects in its portfolio, and is working on 13 different projects at this time. For a comprehensive update on all projects I would like to refer to the news release of April 17, 2024. Some of the most important projects are:

Chebistuan Project, Quebec: In 2023, the Company made a new gold discovery at the Deux Orignaux target area during the 2,170m, 7 drillhole maiden diamond drill program. Drilling intercepted 157.20m at 0.41g/t Au including 20.61m at 0.97 g/t Au from hole 23DODD005. A follow-up drill program, initially planned for the first quarter of this year, has been delayed, and is now anticipated in the first half of 2025, subject to final approval from Newmont.

South Uchi Project, Ontario: Kenorland plans to follow-up on the recently identified, large-scale gold-in-till anomaly at the Papaonga target area identified during the 2023 exploration campaign (see press release dated February 28, 2024). The Papaonga target is located within Confederation Volcanic Assemblage rocks, controlled by major east-west trending deformation zones, a similar geologic setting to that of the Great Bear Project located along strike to the west. Exploration planned for the summer of 2024 includes detailed mapping and prospecting within the gold-in-till dispersal plume, as well as 10kg heavy mineral concentrate (HMC) till sampling across the target area for gold grain counts and geochemical analysis. The objective of the summer field program is to define drill targets for testing in 2025.

South Thompson Project, Manitoba: The Company’s district scale South Thompson Project encompasses approximately 307,000 hectares of mineral exploration licences covering the southwest extension of the Thompson Nickel Belt below the Phanerozoic sedimentary cover rocks. Compilation of historical exploration identified extensive gaps in modern geophysical data over prospective Ospwagen Group stratigraphy. The Company is currently flying a regional scale, ~11,900 line-km VTEM survey (200m spaced lines) to acquire detailed, property wide electromagnetic data to prioritize and advance targets for follow-up ground surveys and drill targeting.

Opinaca Project, Quebec: Kenorland will remain operator for Targa Exploration’s Opinaca Project during two phases of planned exploration to be completed in 2024. Kenorland entered into a purchase agreement with Targa Exploration (see press release dated December 13, 2022), in which Targa acquired 100% of the Opinaca Project, granting Kenorland a 3% net smelter return royalty. Phase one work will include additional regional till sampling, expanding on the significant gold-in-till, as well as lithium anomalies identified in 2023, along with reconnaissance style mapping and prospecting. The second phase of exploration will include detailed, infill till sampling based on phase one results, with more detailed mapping and prospecting with the goal of defining possible bedrock sources to the geochemical anomalies and future drill targets. Drill targets will likely be determined in H1 2025.

It can be concluded Kenorland Minerals really is a busy exploration company, specialized in grassroots discoveries. With so many projects being explored, there are many chances of finding something big, as all projects in portfolio have considerable size, enabling potential Tier I discoveries. Time will tell.

Conclusion

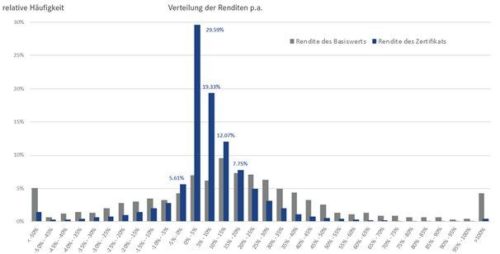

The Centerra involvement as a strategic investor is a significant stamp of approval, as producers have the most stringent form of due diligence out there. It also provides Kenorland with even more financial backing, and a strong treasury at the moment, standing over C$30M for now, supporting their exploration efforts for fully owned projects for several years at least. I’m definitely looking forward to what Kenorland can achieve on these projects, as any discovery here would provide much more torque to the share price. Notwithstanding this, Regnault has shown what a JV is capable of, as the resulting 4% NSR can conservatively valued at C$30-40M at the moment. And Kenorland has exploration ongoing at many more JV-ed/optioned projects, and any of their projects could generate a genuine discovery. It could take a while, but the downside is very limited as the chart shows since inception. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Kenorland Minerals. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()