Revival Gold Completes Acquisition of Ensign Minerals and Announces Release of Escrowed Funds and Conversion of Subscription Receipts

In addition, the Company is also pleased to announce that it has satisfied the outstanding conditions for the release of the escrowed funds from the previously announced C$7,167,464 brokered private placement of 22,398,325 subscription receipts of Revival Subco (the “Subscription Receipts”) at a price of $0.32 per Subscription Receipt, which closed on May 2, 2024 (the “Offering”).

Hugh Agro, President, CEO and director of Revival Gold stated, “With the completion of this transaction, Revival Gold is poised to capitalize on rising gold prices, boasting one of the largest pure gold development portfolios in the United States. Our assets in Utah and Idaho comprise approximately 12,000 hectares (almost 30,000 acres) in complementary, proven mining camps, offering excellent infrastructure, exciting exploration potential, and local community support. We look forward to providing further updates as work progresses to transform Revival Gold into an emerging heap leach gold producer, with targeted aggregate gold production of 150,000 ounces per year”.

Transaction Details

The Transaction was completed pursuant to a business combination agreement dated April 9, 2024, between Revival Gold, Ensign, and Revival Subco, pursuant to which Revival Gold acquired all the issued and outstanding common shares of Ensign (the “Ensign Shares”) in consideration for 61,376,098 common shares of Revival at a deemed price per share of $0.3569 (the “Consideration Shares”). The Consideration Shares were distributed to holders of Ensign Shares on a pro rata basis based on a share exchange ratio of 1.1667 Consideration Shares for each Ensign Share (the “Exchange Ratio”). Further, under the Transaction, all of Ensign’s outstanding options (the “Ensign Options”) and warrants (the “Ensign Warrants”) to acquire Ensign Shares will adjust in accordance with the terms thereof such that the holders thereof are entitled to acquire Revival Shares in lieu of Ensign Shares based on the Exchange Ratio.

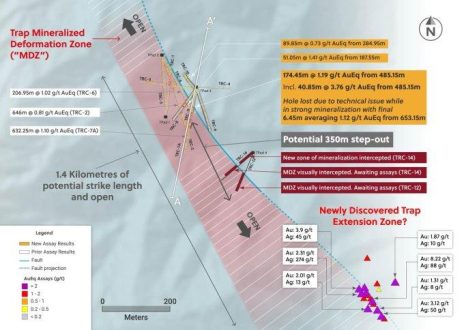

Upon completion of the Transaction, Revival Gold became the parent company and the sole shareholder of Amalco and will indirectly carry on the current business of Ensign. The Company expects to pursue engineering and economic studies at the newly acquired Mercur Gold Project (“Mercur”) located in Utah, USA while continuing to advance permitting preparations and ongoing exploration at the Company’s Beartrack-Arnett Gold Project (“Beartrack-Arnett”) located in Idaho, USA.

Further details of the Transaction can be found in the Company’s press release dated April 10, 2024 (the “Announcement Press Release”).

Technical Report

In connection with the Transaction, Revival Gold has filed a technical report with respect to Mercur titled, “NI 43-101 Technical Report for the Mercur Project, Camp Floyd and Ophir Mining Districts, Tooele & Utah Counties, Utah, USA”, prepared by Lions Gate Geological Consulting Inc., RESPEC Company LLC, and Kappes, Cassidy & Associates, dated May 24, 2024 and with an effective date of December 5, 2023 (the “Technical Report”). A summary of the Technical Report was included in the Announcement Press Release.

Since the date of the Announcement Press Release, the Technical Report was updated to add Revival Gold as the addressee of the Technical Report and certain other minor amendments were made to ensure full compliance with NI 43-101 – Standards of Disclosure for Mineral Projects and the requirements of the TSX Venture Exchange. The effective date of the Technical Report was not changed and amended Technical Report does not change the mineral resource estimates, conclusions, and recommendations provided in the original technical report dated February 1, 2024, for Mercur. The Technical Report supersedes and replaces all prior technical reports written for Mercur. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the mineral resource estimate. The Technical Report may be accessed under Revival Gold’s SEDAR+ profile (www.sedarplus.ca). The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Automatic Conversion of Subscription Receipts

Prior to the Amalgamation taking effect and upon satisfaction of the escrow release conditions of the Offering, each Subscription Receipt was converted into one unit comprised of one common share of Revival Subco (each, a “Revival Subco Share”) and one-half of one common share purchase warrant of Revival Subco (each whole warrant, a “Revival Subco Warrant”). Upon completion of the Amalgamation, each Revival Subco Share was exchanged for one common share of the Company (a “Revival Share”), and each Revival Subco Warrant was exchanged for one Revival Share purchase warrant (a "Revival Warrant"). Each Revival Warrant is exercisable by the holder thereof for one Revival Share (each, a “Revival Warrant Share”) at an exercise price of C$0.45 per Revival Warrant Share at any time on or before May 30, 2027. The Revival Shares and Revival Warrants are not subject to a hold period under applicable Canadian securities laws.

The net proceeds of the Offering have been released from escrow and the Company anticipates using such proceeds to complete a Preliminary Economic Assessment on Ensign’s Mercur Project, advance permitting preparations and continue exploration for high-grade material at Beartrack-Arnett, and for working capital and general corporate purposes.

Paradigm Capital Inc. and BMO Capital Markets, acted as co-lead agents, on behalf of a syndicate of agents, which included Beacon Securities Limited (the “Agents”), in connection with the Offering. As consideration for their services, the Agents received: (i) a cash commission of $430,047; and (ii) 1,343,900 non-transferable compensation warrants (the “Compensation Warrants”). Following completion of the Transaction, each Compensation Warrant entitles the holder to purchase one Revival Share at a price of $0.32 at any time on or before May 30, 2026. The Compensation Warrants and 50% of the Agent’s aggregate cash commission was issued and paid, respectively, to the Agents upon closing of the Offering, and the remaining 50% has been released to the Agent’s in connection with the satisfaction of the escrow release conditions for the Offering.

Board Reconstitution & Key Management

As a result of the completion of the Transaction, Norm Pitcher, a former director of Ensign, has been appointed to the board of directors of Revival Gold (the “Board”) and Michael Mansfield has resigned from the Board. Additionally, Revival Gold has designated independent Director Tim Warman as Non-Executive Chairman of the Board. Wayne Hubert will continue on the Board as a non-executive Director.

“Mike Mansfield was a founding investor and Company director and has been a keen champion for Revival Gold’s shareholders over the years”, said Hugh Agro. “We are grateful to have benefited from Mike’s pragmatic advice and keen understanding of the public markets as we’ve worked to build the business to-date. On behalf of our entire management team and board, I wish to thank Mike for his commitment and service to Revival Gold and to say that we look forward to Mike’s continued involvement as a senior advisor to the Company going forward”, added Agro.

Key management of Revival Gold is unchanged and consists of Hugh Agro serving as President & CEO and Director, John Meyer as Vice President, Engineering & Development, and Lisa Ross as Vice President & CFO.

Advisors and Counsel

MPA Morrison Park Advisors Inc. (“MPA”) acted as financial advisor to Revival Gold. Peterson McVicar LLP acted as Revival Gold’s legal counsel. Osler, Hoskin & Harcourt LLP acted as Ensign’s legal counsel. Bennett Jones LLP acted as legal counsel to the Agents.

In connection with the Transaction, MPA provided financial advisory services including delivery of a fairness opinion to the Company’s Board of Directors and certain other ancillary matters (the “Services”). The Company paid MPA a success fee of $250,000 and issued to MPA 657,895 Revival Shares at a deemed price of $0.38 per Revival Share.

None of the securities issued pursuant to the Transaction or the Offering have been, nor will they be, registered under the U.S. Securities Act and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful. “United States” and “U.S. person” are as defined in Regulation S under the U.S. Securities Act.

Qualified Persons

John P.W. Meyer, Vice President, Engineering and Development, P.Eng., and Steven T. Priesmeyer, C.P.G., Vice President Exploration, Revival Gold Inc., are the Company’s designated Qualified Persons for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects and have reviewed and approved its scientific and technical content.

About Revival Gold Inc.

Revival Gold is one of the largest, pure gold, mine developers in the United States. The Company is advancing engineering and economic studies on the Mercur Gold Project in Utah and mine permitting preparations and ongoing exploration at the Beartrack-Arnett Gold Project located in Idaho.

Revival Gold is listed on the TSX Venture Exchange under the ticker symbol "RVG" and trades on the OTCQX Market under the ticker symbol "RVLGF". The Company is headquartered in Toronto, Canada, with its exploration and development office located in Salmon, Idaho.

Additional disclosure including the Company’s financial statements, technical reports, news releases and other information can be obtained at www.revival-gold.com or on SEDAR+ at www.sedarplus.ca.

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This press release includes certain "forward-looking information" within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of U.S. securities legislation (collectively “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking statements could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements.

Forward-looking statements in this document include, but are not limited to, Revival Gold being poised to capitalize on rising gold prices, Revival Gold’s assets in Utah and Idaho having exciting exploration potential, progressing work to transform Revival Gold into an emerging heap leach gold producer with an expected target of aggregate gold production of at least 150,000 ounces per year, advancement of permitting preparations and ongoing exploration at Beartrack-Arnett, the inability of the Company to apply the use of proceeds from the Offering as anticipated; the resale restrictions of the securities issued pursuant to the Offering, the Company’s objectives, goals and future plans, and statements of intent, the implications of exploration results, mineral resource/reserve estimates and the economic analysis thereof, exploration and mine development plans, timing of the commencement of operations, estimates of market conditions, and statements regarding the results of the pre-feasibility study, including the anticipated capital and operating costs, sustaining costs, net present value, internal rate of return, payback period, process capacity, average annual metal production, average process recoveries, concession renewal, permitting of the project, anticipated mining and processing methods, proposed pre-feasibility study production schedule and metal production profile, anticipated construction period, anticipated mine life, expected recoveries and grades, anticipated production rates, infrastructure, social and environmental impact studies, availability of labour, tax rates and commodity prices that would support development of the Project. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to maintain the modelling and assumptions upon which the interpretation of results are based after further testing, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, changes in regulatory requirements, political and social risks, uncertainties relating to the availability and costs of financing needed in the future, uncertainties or challenges related to mineral title in the Company’s projects, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity and in particular gold prices, delays in the development of projects, capital, operating and reclamation costs varying significantly from estimates, the continued availability of capital, accidents and labour disputes, and the other risks involved in the mineral exploration and development industry, an inability to raise additional funding, the manner the Company uses its cash or the proceeds of an offering of the Company’s securities, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, future climatic conditions, the discovery of new, large, low-cost mineral deposits, the general level of global economic activity, disasters or environmental or climatic events which affect the infrastructure on which the project is dependent, and those risks set out in the Company’s public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Specific reference is made to the most recent Annual Information Form filed on SEDAR+ for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this presentation. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

President and CEO

Telefon: +1 (416) 366-4100

E-Mail: info@revival-gold.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()