Exciting golden age

The dynamics on the gold market are more interesting than ever.

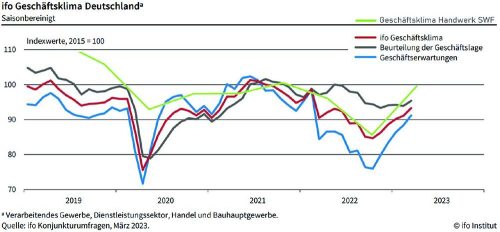

In 2023, investors were still reluctant to invest in gold. But now the markets are nervous. There are many reasons for this, such as ever-increasing government debt, conflicts in the Middle East and the upcoming election in the US. It is helpful to take a look at the bull markets from 1979 to 1980 and from 2010 to 2011, when inflation was very high and central banks were pushing up interest rates. In 2010, interest rates fell because there was a recession. Investors turned to gold to hedge their portfolios.

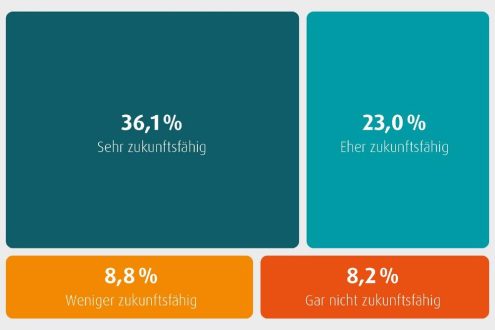

Gold and silver prices rose sharply. Silver even significantly outperformed gold in terms of price. The mood today could be similar. If the US dollar fulfills its function as a reserve currency, the attractiveness of gold will decline. But this is not the case today, on the contrary. Countries, above all China, want to become less dependent on the US dollar and are therefore increasingly turning to gold. In 2023, central banks worldwide bought more than a third of the gold produced globally (around 1,200 tons).

From a seasonal perspective and from price statistics going back to 1970, July is a month with large price movements, as investors also look at. Overall, July ranks seventh in the year. With the exception of February, the price of the precious metal has risen every month in 2024. Especially after the euro crisis, the price of gold rose twice in July by around eight percent. Many factors influence seasonality, such as traditional festive periods in China or the gift-giving season in India. Global events, economic developments and market conditions also have a significant impact on the price of gold. However, as the medium and longer-term outlook is good, investors should also look at gold companies.

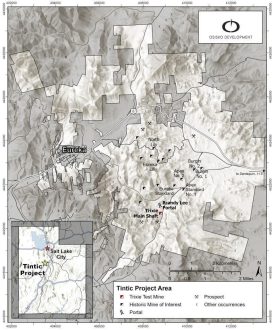

Fury Gold Mines‘ – https://www.commodity-tv.com/ondemand/companies/profil/fury-gold-mines-ltd/ – projects are located in Quebec and Nunavut. The company’s gold platform comprises several million ounces. This is still to be expanded.

Fortuna Silver Mines (new name Fortuna Mining) – https://www.commodity-tv.com/ondemand/companies/profil/fortuna-silver-mines-inc/ – produces gold and silver. The company’s five mines are located in Mexico, Peru, Burkina Faso, Argentina and the Ivory Coast.

Current company information and press releases from Fortuna Silver Mines (- https://www.resource-capital.ch/en/companies/fortuna-silver-mines-inc/ -) and Fury Gold Mines (- https://www.resource-capital.ch/en/companies/fury-gold-mines-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()