Acute crises – Pizza orders – Gold price

Among the various indices, there is one particularly "tasty" one that has already been right several times: the Pentagon Index. It describes when people in the Pentagon have to work particularly late at night. If pizza orders soar and the bars in Pentagon City are empty, the index shows that something bigger is about to happen. Predicting conflicts and crises based on the number of pizza orders near the Pentagon is certainly a remarkable thing.

So if something special is imminent in terms of war or the like, then more pizza will be eaten in the Pentagon offices, because people have to work long hours. Peaks in the capacity utilization of fast food chains can thus serve as a geopolitical indicator of approaching events that affect national security. The indicator was developed by a franchisee of a pizza chain in the 1990s. At the time, the USA believed in the predictive power of pizza. The indicator was correct in January 1991, for example, when Operation Desert Storm began. A pizzeria owner predicted the imminence of a military operation.

The Pentagon has recently announced that the US military will be sending additional fighter jets and warships to the Middle East. This follows an attack on Hamas leader Haniyeh in Tehran. Crises and wars are not a nice thing, but they often have an impact on the price of gold. The precious metal rises in price. It’s good to own physical gold or shares in gold companies such as Osisko Development or Karora Resources.

Osisko Development – https://www.commodity-tv.com/play/osisko-development-ceo-insight-on-current-developments-and-future-potential-of-cariboo-and-tintic/ – develops gold projects in Canada, the USA and Mexico. The focus is particularly on earlier producing projects. The aim is to become a medium-sized gold producer.

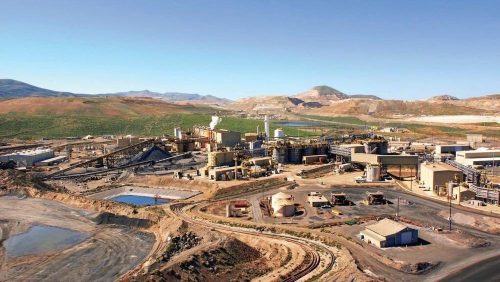

Karora Resources – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/ – is successfully producing gold at two gold projects in Western Australia. The cash operating costs have fortunately fallen, as nickel is also incurred in gold production.

Latest corporate information and press releases from Karora Resources (- https://www.resource-capital.ch/de/unternehmen/karora-resources-inc/ -) and Osisko Development (- https://www.resource-capital.ch/de/unternehmen/osisko-development-corp/ -).

In accordance with §34 WpHG, I would like to point out that partners, authors and employees may hold shares in the companies mentioned and that there is therefore a possible conflict of interest. No guarantee for the translation into German. Only the English version of this news is valid.

Disclaimer: The information provided does not constitute a recommendation or advice. The risks involved in securities trading are expressly pointed out. No liability can be accepted for damages arising from the use of this blog. I would like to point out that shares and in particular warrant investments are always associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the correctness of all content. Despite the utmost care, I expressly reserve the right to make errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but in no way claims to be accurate or complete. Due to court rulings, the contents of linked external pages are also to be answered for (e.g. Hamburg Regional Court, in the ruling of May 12, 1998 – 312 O 85/98), as long as no explicit dissociation from these is made. Despite careful control of the content, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/….

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()