Tin – the best base metal in 2024, copper also in demand

Tin prices have already risen by around 20 percent this year. On the supply side, the metal is at the same level as in 2005, with around 300,000 tons of tin produced per year in the last 20 years. Demand for tin is increasing due to the energy transition and its dependence on green technologies. Warehouses are now almost exhausted. This is because semiconductors, electric vehicles and solar energy require more and more tin. According to the International Tin Association, consumption in the photovoltaic industry alone has increased more than sixfold over the past ten years. Electric cars need around two to three times as much tin as conventional vehicles (combustion engines). This leads to solid fundamental data and should make investors sit up and take notice. According to forecasts, the price of a tonne of tin is set to rise from the current average of USD 32,500 to USD 37,000 by 2026. The largest supplier for the world’s largest tin consumer, China, has not supplied any more tin since a ban was imposed in August 2023.

Another metal that is increasingly being used in modern technologies is copper. The fundamental data has stabilized and Chinese purchases have increased. Here too, the demand drivers of electric vehicles and renewable energies are dominating the market. There is also demand from the defense and AI data centers. If, as expected, the traditional consumption sectors (construction, consumer durables) recover, copper prices could once again please investors and copper companies.

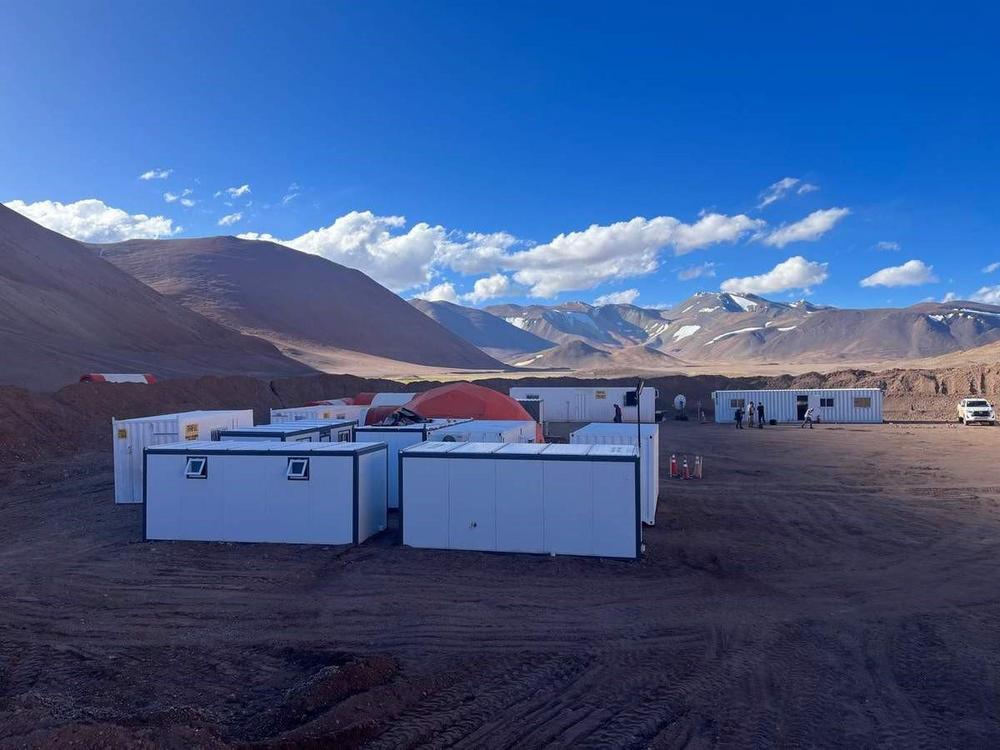

Mogotes Metals, for example – https://www.commodity-tv.com/play/mogotes-metals-exploring-multiple-targets-for-copper-next-to-filo-corp-and-ngex-minerals/ -. The company is searching for copper and gold in the promising Vicuña district in Argentina and Chile. The Filo Sur copper-gold-silver project appears particularly promising.

TinOne Resources – https://www.commodity-tv.com/ondemand/companies/profil/tinone-resources-inc/ – with its tin/tungsten and lithium projects in Tasmania and New South Wales, Australia – is a popular choice for tin.

Current company information and press releases from Mogotes Metals (- https://www.resource-capital.ch/de/unternehmen/mogotes-metals-inc/ -).

In accordance with §34 WpHG, I would like to point out that partners, authors and employees may hold shares in the companies mentioned and that there is therefore a possible conflict of interest. No guarantee for the translation into German. Only the English version of this news is valid.

Disclaimer: The information provided does not constitute a recommendation or advice. The risks involved in securities trading are expressly pointed out. No liability can be accepted for damages arising from the use of this blog. I would like to point out that shares and in particular warrant investments are always associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the correctness of all content. Despite the utmost care, I expressly reserve the right to make errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but in no way claims to be accurate or complete. Due to court rulings, the contents of linked external pages are also to be answered for (e.g. Hamburg Regional Court, in the ruling of May 12, 1998 – 312 O 85/98), as long as no explicit dissociation from these is made. Despite careful control of the content, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/de/disclaimer-agb/.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()