Green Bridge Metals Corporation Outlines Strategic Plan for the Titac Deposit

In addition, the Company has exploration plans to drill the Titac East area, which the Company views to have geologic potential similar to Titac South and North (Figure 2). Drill targets will be defined based on the results of an upcoming VTEM airborne geophysical survey scheduled to commence in late November.

A Message from David Suda, CEO of Green Bridge Metals

“Based on the current MRE at Titac South, the Company sees an exceptional value proposition with the confirmed rare combination of titanium, copper, and vanadium mineralization found at Titac. We believe that the expansion potential in the immediate area is significant and recent advances in metallurgical processing demonstrate potential economic viability. The Company plans to aggressively expand the resource and conduct advanced metallurgical work moving toward preliminary economic studies.”

Key Technical Points:

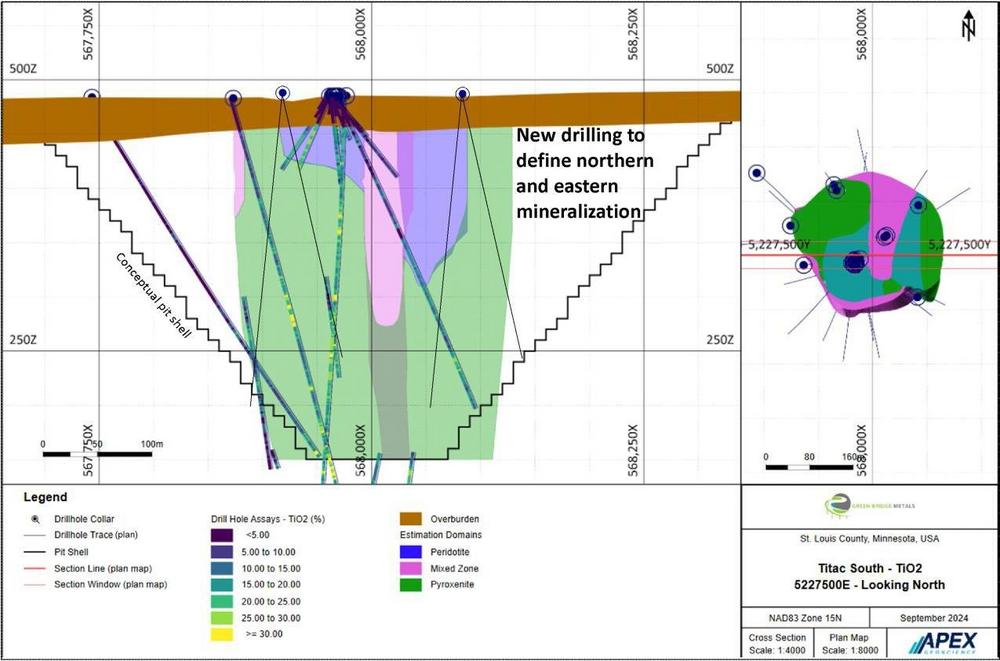

- The inferred mineral resource for the South Titac area includes 46.6 million tonnes of mineralized rock at 15% titanium dioxide (TiO2) that is mostly comprised of ilmenite mineralization.

- Based on an average grade of 28.5% ilmenite (FeTiO3), there are 13.3 million tonnes of ilmenite delineated with an average value of $350 (US) per tonne, demonstrating the potential to create significant value at the Titac South deposit. (Dufresne et. al., Table 14.3, TiO2Pro https://tio2.pro/index.php/2024/08/02/2146-6/ accessed on October 4, 2024)

- Significant copper and vanadium grades in the Titac South drilling demonstrate the potential for significant value to be added on a per tonne basis to the current MRE as they have not been included in the current resource estimate. Future drilling undertaken by Green Bridge will systematically assay for these elements so that they can be included in future MRE updates.

- Recent advances in hydrometallurgical processing at Titac demonstrate that 70% of the titanium can be recovered, along with the potential to separately recover Cu and V, which could be significant value drivers.

- Historical drilling at Titac North demonstrate significant Titanium dioxide and vanadium mineralization has the potential to significantly add to the current MRE. Historical drill results from 2010 are presented in Table 2.

- Significant exploration upside exists at Titac East, currently defined by similar magnetic responses as observed at Titac South and North.

- Titanium, copper, and vanadium hosted in OUI have a distinct, high magnetic and high conductivity signature. A planned VTEM survey over the Titac – Boulder area will confirm the presence of OUIs and provide robust drill targets at Titac East.

Strategic Plan at Titac

The Company plans to expand the inferred MRE at Titac South through drilling approximately 2,000 meters of core. Additional resource expansion potential will be pursued at Titac North via a core drill program of approximately 2,500 meters, validating historical drill results. Once successfully drilled, the Company will use material from drilling to pursue advanced metallurgical work in order to optimize titanium recovery as well as the potential to recover iron, copper, and vanadium. Based on drilling at Titac South and Titac North the Company plans to aggressively pursue an updated MRE, followed by a preliminary economic assessment (PEA).

All scientific and technical information, and written disclosure in this news release has been prepared by, or approved by Ajeet Milliard, Ph.D., CPG, Chief Geologist for Green Bridge Metals and a qualified person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The Mineral Resource Estimate and Technical Report has been prepared by Michael Dufresne, M.Sc., P.Geol., P.Geo., is a qualified person as defined by National Instrument 43-10.

ON BEHALF OF GREEN BRIDGE METALS,

“David Suda”

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928-3101

investors@greenbridgemetals.com

About Green Bridge Metals

Green Bridge Metals Corporation (formerly Mich Resources Ltd.) is a Canadian based exploration company focused on acquiring ‘battery metal’ rich mineral assets and the development of the South Contact Zone (the “Property”) along the basal contact of the Duluth Intrusion, north of Duluth, Minnesota. The South Contact Zone contains bulk-tonnage copper-nickel and titanium-vanadium in ilmenite hosted in ultramafic to oxide ultramafic intrusions. The Property has exploration targets for bulk-tonnage Ni mineralization, high grade Ni-Cu-PGE magmatic sulfide mineralization and titanium.

Forward Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the exploration and development of the South Contact Zone Properties.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements in this news release include statements about: the proposed scope and timing of expansion drilling programs; the timing and results (drill targets) of an upcoming VTEM airborne geophysical survey; and the development of the South Contact Zone Property. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: the proposed expansion drilling programs and upcoming VTEM airborne geophysical survey may not occur as currently contemplated, or at all; the exploration and development of the South Contact Zone Properties may not result in any commercially successful outcome for the Company; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Certain figures and references contain information supported by public and corporate references that may have been updated, changed, or modified since their referenced date.

References

1. Dufresne, M.B., Turner, A.J., Fallon, C.T., Bohm, C. 2024. Technical Report and Mineral Resources Estimate for the South Contact Zone Project, St Louis County, Minnesota, USA”. Apex Geoscience. Green Bridge Metals Corp. September 18.2026.

1. The independent and qualified person for the mineral resources estimate, as defined by NI 43-101, is Michael Dufresne, P.Geo.,from APEX Geoscience Ltd.

2. Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resources tabulated above as an indicated or measured mineral resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no guarantee that any part of the mineral resources discussed herein will be converted into a mineral reserve in the future. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The mineral resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum standards on mineral resources and reserves, definitions, and guidelines prepared by the CIM standing committee on reserve definitions and adopted by the CIM council (CIM 2014 and 2019).

3. The Mineral Resources Estimate is underpinned by data from 24 diamond drillholes totaling 4,751.17 m of drilling that intersected the mineralized domains.

4. The mineral resource is reported at a lower cut-off of 8.0 % TiO2 for the conceptual open pit. The lower cut-off grades and potential mining scenarios were calculated using the following parameters: mining cost = US$5.0/t; G&A = US$2.00/t; processing cost = US$10.00/t; recoveries = 70%; Ilmenite Price = US$350/t, to meet the requirement that the reported Mineral Resources show “reasonable prospects for eventual economic extraction”.

5. Original TiO2 assays were composited to 1.8 m with 2,702 composites generated overall in the mineralized domains including 370 composites generated for the peridotite domain, 646 for the mixed domain, and 1,693 for the pyroxenite domain.

6. Grade interpolation was performed by ordinary kriging (OK) using 1.8-meter composites (block size of 10 m x10 m x 10 m).

7. Bulk density ranges from 2.27 g/cm3 to 4.28 g/cm3 depending on the domain Reported Fe2O3 has been lowered to reflect the amount of Fe estimated to be contained in ilmenite based on the assumption that all Ti has been assigned to ilmenite. At this time, accurately quantifying the amount of magnetite contained within this estimate is not possible.

8. Reported Fe2O3 has been lowered to reflect the amount of Fe estimated to be contained in ilmenite based on the assumption that all Ti has been assigned to ilmenite. At this time, accurately quantifying the amount of magnetite contained within this estimate is not possible.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()