Aurania Receives Corsica Study from IHC Mining B.V. of Holland

Many critical assumptions were made in this study, and these will be better constrained by a forthcoming environmental study when sonic drilling of the beaches is planned. It is not possible at this point in time to identify a compliant mineral resource. These minerals of interest are accumulated in the sand fraction of the beach deposits of Nonza and Albo and can be extracted using simple magnetic methods. The beach is 40% sand*, with the remaining 60% consisting of pebbles that are, for the purpose of this preliminary study, not considered to have potential economic value. Initial analyses determined that 31.7% of Nonza beach sand is magnetic, and a magnetic concentrate of black beach sand at Nonza yielded 40.1% nickel.

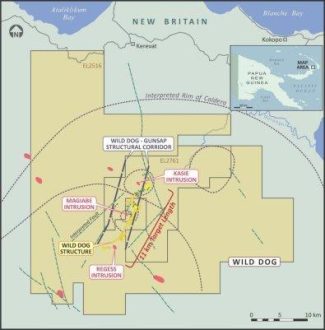

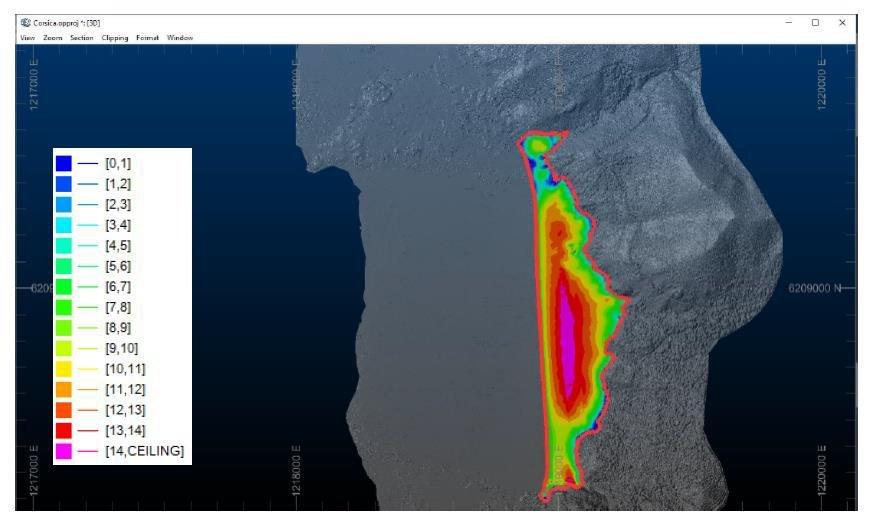

The present-day thickness of the Nonza and Albo beach deposits was estimated by comparison of recent LiDAR topographic and bathymetric survey data of the beach areas with a reconstructed pre-depositional survey that was derived from historical aerial photography and mapping. Wireframes were constructed from both historic and recent survey data sets and the present-day thickness of the beach deposits was estimated by determining the vertical thickness between the wireframes (Figures 1 and 2).

IMAS proposed two different scenarios for recovery of the heavy minerals. The first one is a backhoe mounted on a barge, with a screening plant on board. The second is a floating suction and cutter-head dredge on floating pontoons (like that shown in Figure 3). The dredge is expected to have higher capacity and require less maintenance than the barge-mounted excavator and is regarded by the Company as the favoured proposal.

The cutter suction dredger excavates panels perpendicular to the coastline up to a maximum dredging depth of 14m. Proposed dredging depths were estimated using the calculated thickness of the beach sands and limitations of the equipment (Figures 4 and 5).

The cutter head of the dredger is equipped with grizzly bars (cage) to prevent large rocks from entering the suction pipe of the dredger as they can block the pump or discharge pipeline. Sand and pebbles pass through the dredge pump and are pumped to a beach-based primary screening & slurrification plant via a floating pipeline that is up to 1000 metres long.

This conceptual study produced a potential process flow diagram for the proposed recovery of awaruite and magnetite using the cutter suction dredger and magnetic separation (Figure 6). At the primary screening & slurrification plant the dredging slurry passes a grizzly and double deck vibrating screen where oversized (>6mm) pebbles are removed and the sands fraction (<6mm) reports to a slurrification bin and subsequent magnetic separation. The pebbles and non-magnetic sand are re-distributed to restore the original beach.

Additional processing and metallurgical studies to refine the process are underway at SGS Laboratories (Lakefield).

In this conceptual study IMAS has calculated the Cutter Suction Dredge Scenario to have a total potential capital cost (“CAPEX”) of € 7,830,581 for the dredging equipment, with the estimated potential CAPEX for the processing plant an additional € 5,225,920.

The estimated potential Operating Expenditure (“OPEX”) calculated in the conceptual study for the recovery of the heavy minerals (dredging and screening for size) is presented in Table 1 with details of the potential OPEX for magnetic separation of awaruite and magnetite presented in Table 2.

IMAS has worked independently of SGS Labs who are currently working with 130 kilos of magnetic sand collected from Nonza Beach to assess the best way of obtaining 1.) a potentially saleable magnetite-awaruite concentrate, and also 2.) exploiting the significant density contrast between the two minerals*, an awaruite concentrate with a separate magnetite concentrate. A mixed magnetite-awaruite concentrate could be saleable for nickel matte production which may present a more profitable and marketable option. SGS is also assessing the need for the currently proposed grinding of the <6mm magnetite concentrate in the proposed circuit.

The proposed extraction activities would be halted each year during the tourist season and the beach pebbles, and the non-magnetic sand would be returned to the beach which would be recontoured after extraction at the end of each season.

*Specific gravities and particle size analysis from P. Bernier, J-B Guidi and M. E. Bottcher, “Coastal progradation and very early diagenesis of ultramafic sands as a result of rubble discharge from asbestos excavations (northern Corsica, western Mediterranean)” published in Marine Geology, volume 144, 1997.

Qualified Persons:

The geological information contained in this news release and the IMAS report has been verified and approved by Aurania’s VP Exploration, Mr. Jean-Paul Pallier, MSc. Mr. Pallier is a designated EurGeol by the European Federation of Geologists and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition, and exploration of mineral property interests, with a focus on precious metals and copper in South America. Its flagship asset, The Lost Cities – Cutucú Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

Information on Aurania and technical reports are available at www.aurania.com and www.sedarplus.ca, as well as on Facebook at https://www.facebook.com/auranialtd/, Twitter at https://twitter.com/auranialtd, and LinkedIn at https://www.linkedin.com/company/aurania-resources-ltd-.

For further information, please contact:

Carolyn Muir

VP Corporate Development & Investor Relations

Aurania Resources Ltd.

(416) 367-3200

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains forward-looking information as such term is defined in applicable securities laws, which relate to future events or future performance and reflect management’s current expectations and assumptions. The forward-looking information includes Aurania’s objectives, goals or future plans, statements, exploration results, potential mineralization, the tonnage and grade of mineralization which has the potential for economic extraction and processing, the merits and effectiveness of known process and recovery methods, the corporation’s portfolio, treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration, timing of the commencement of operations, the Company’s teams being on track ahead of any drill program, the commencement of any drill program and estimates of market conditions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to Aurania, including the assumption that, there will be no material adverse change in metal prices, all necessary consents, licenses, permits and approvals will be obtained, including various local government licenses and the market. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. Risk factors that could cause actual results to differ materially from the results expressed or implied by the forward-looking information include, among other things: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; the inability to recover and process mineralization using known mining methods; the presence of deleterious mineralization or the inability to process mineralization in an environmentally acceptable manner; commodity prices, supply chain disruptions, restrictions on labour and workplace attendance and local and international travel; a failure to obtain or delays in obtaining the required regulatory licenses, permits, approvals and consents; an inability to access financing as needed; a general economic downturn, a volatile stock price, labour strikes, political unrest, changes in the mining regulatory regime governing Aurania; a failure to comply with environmental regulations; a weakening of market and industry reliance on precious metals and base metals; and those risks set out in the Company’s public documents filed on SEDAR+. Aurania cautions the reader that the above list of risk factors is not exhaustive. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()