Cosa Resources Executes Agreement to Form Joint Ventures with Denison Mines on Multiple Uranium Projects

- Cosa to acquire a 70% interest in a portfolio of Denison’s prospective uranium projects located in the Eastern Athabasca Basin

- Denison to become 19.95% shareholder of Cosa and commits to a minimum of C$1,000,000 participation in future equity financings

- Cosa’s senior management team is uniquely experienced to advance these mature, discovery-ready projects

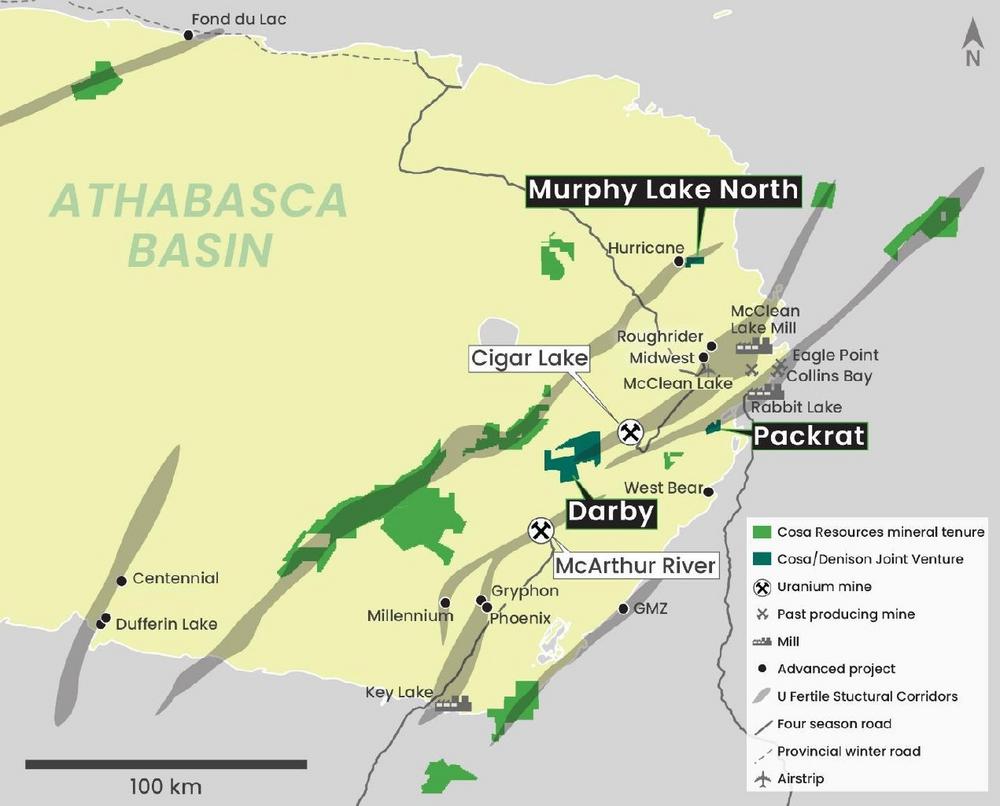

Vancouver, British Columbia, November 27, 2024 – Cosa Resources Corp. (TSX-V: COSA) (OTCQB: COSAF) (FSE: SSKU) (“Cosa” or the “Company”) – https://www.commodity-tv.com/ondemand/companies/profil/cosa-resources-corp/ – is pleased to announce that it has entered into an Acquisition Agreement (the “Acquisition Agreement”) with Denison Mines Corp. (“Denison”) (TSX: DML) (NYSE American: DNN). Pursuant to the Acquisition Agreement, Cosa will acquire (the “Transaction”) an interest in three of Denison’s uranium exploration projects located in the Eastern Athabasca Basin (the “Projects”).

The Projects consist of (a) the Murphy Lake North Project, located within four kilometres of IsoEnergy’s Hurricane Deposit, (b) the Darby Project, located ten kilometres west of Cameco’s Cigar Lake Mine, and (c) the Packrat Project, located 19 kilometres southwest of the Rabbit Lake Mill.

Keith Bodnarchuk, Cosa President and CEO, commented: “This is a transformational day for Cosa Resources by bringing in an industry-leading shareholder in Denison and adding three strategically selected, discovery-ready exploration projects to Cosa’s Athabasca Basin portfolio. All three projects offer tremendous upside potential for our shareholders. Most notably, Murphy Lake North is within four kilometres of and on trend with IsoEnergy’s Hurricane Deposit – discovered in 2018 by Cosa’s management team and currently the highest grade Indicated Mineral Resource for uranium on the planet at a staggering average grade of 34.5% U3O8. Cosa views this strategic collaboration with Denison as mutually beneficial, allowing Cosa to increase discovery potential while offering Denison exposure to Cosa’s exploration success. Cosa remains committed to advancing priority target areas within our existing exploration portfolio, including the 100% owned Ursa Project where we recently intersected multiple intervals of basement-hosted radioactivity. In this highly competitive uranium market, opportunities to acquire projects of this quality are rare. Opportunities to acquire these projects and bring in a supportive long-term shareholder of Denison’s quality are almost non-existent. This Transaction is expected to create a competitive advantage for Cosa and differentiate us from our peers. We look forward to closing this agreement and continuing to update the market with our remaining 2024 results and plans for 2025.

David Cates, Denison President and CEO, commented: “Denison is pleased to collaborate with Cosa in a way that is mutually beneficial and enhances our exposure to the potential discovery of a meaningful uranium deposit on the Properties and through Cosa’s existing and prospective uranium exploration portfolio. With Denison focused on executing on our core mining and development-stage projects, we believe Cosa is an excellent partner to advance exploration of the Projects. The entire Cosa senior management team has worked with Denison previously and have strong technical capabilities, plus a unique familiarity with the Projects and nearby discoveries.”

The Projects

Murphy Lake North

Murphy Lake North covers a portion of the Larocque Lake trend and is located 3.2 kilometres east of the Hurricane deposit (Figure 2). The Hurricane deposit is the world’s highest-grade Indicated mineral resource for uranium and was discovered and delineated for IsoEnergy Ltd. by current members of Cosa’s management, board of directors, and advisors from 2018 through 2022. The Larocque Lake trend also hosts the Larocque Lake zone, the Yelka Prospect, and the Alligator Lake zone. Murphy Lake North contains approximately six kilometres of conductive strike length oriented sub-parallel to conductive features associated with the Hurricane Deposit. Limited historical drilling completed on Murphy Lake North intersected weak mineralization in the basement and zones of alteration and structure in the sandstone and basement. Historical drilling, completed prior to the discovery of Hurricane, focused on the western extremity of the property and left most of the conductive strike length untested. Abundant drill targets exist at Murphy Lake North and diamond drilling is planned for the first half of 2025.

The depth to the unconformity at Murphy Lake North is approximately 250 metres.

The Darby Project

The Darby Project is located ten kilometres west of the Cigar Lake Mine and 17 kilometres north of the McArthur River Mine (Figure 3). Darby is interpreted to contain more than 25 kilometres of conductive strike length including the 8-kilometre-long 95B trend oriented parallel to the Cigar Lake – Tucker Lake trend. Historical drilling on 95B defined more than 25 metres of unconformity offset where a package of metasedimentary rocks hosting graphitic brittle structure, hydrothermal alteration, and weak uranium mineralization lies in fault contact with underlying granitic rocks. Only one drill hole completed along strike is interpreted to have intersected the optimal target in this prospective geological setting. Weak uranium mineralization has also been intersected in the northeast portion of Darby proximal to the Cigar Lake – Tucker Lake trend, and along the northern extension of the 4A trend north of Darby. Initial work is expected to include diamond drilling to follow-up historical drilling results and geophysical surveying to refine conductive drill targets.

The depth to the unconformity at Darby is between 480 and 650 metres.

The Packrat Project

The Packrat Project is located 28 kilometres east of the Cigar Lake Mine and 19 kilometres southwest of the Rabbit Lake Mill (Figure 4). Packrat covers a prominent magnetic break and basement-hosted resistivity low trend lying along interpreted magnetic lineaments related to the Cigar Lake – Tucker Lake magnetic low trend. Limited historical drilling on Packrat which targeted the resistivity low trend and magnetic break intersected weak uranium mineralization and zones of structural disruption and alteration of basement rocks. Initial work at Packrat is expected to include compilation and reinterpretation of historical geophysical and drilling data.

The depth to the unconformity at Packrat is less than 100 metres.

Transaction Summary

Under the terms of the Acquisition Agreement, Cosa will acquire a 70% interest in each of the Projects from Denison. Upon closing of the Transaction, the parties will enter into a joint venture on each of the Projects (each, a “Joint Venture”). Cosa will initially be the operator for all Joint Ventures. In addition, Denison has agreed to participate in subsequent equity financings of Cosa for aggregate total proceeds of a minimum of C$1,000,000.

As consideration for the Transaction, Cosa will issue 14,195,506 common shares (the “Consideration Shares”), equivalent to 19.95% of the outstanding Common Shares of Cosa upon completion of the Transaction.

Additionally, Cosa will be required to:

- issue Denison a further C$2,250,000 in deferred consideration shares (the “Deferred Consideration Shares”) within a five-year period beginning at the closing date (the “Closing Date”) of the Transaction;

- fund 100% of the first C$1,500,000 in exploration expenditures on the Murphy Lake North Project by December 31, 2027. Failure to do so will result in Denison’s ownership in the Murphy Lake North Project reverting to 51% and Denison will assume operatorship; and

- fund 100% of the first C$5,000,000 in exploration expenditures on the Darby Project by June 30, 2029. Failure to do so will result in Denison’s ownership in the Darby Project reverting to 51% and Denison will assume operatorship.

The Darby Project is subject to a buydown (the “Buydown”) which permits Denison to reclaim up to 60% of the Darby Project and is to be the greater of: (i) C$50,000,000 or (ii) 450% of Cosa’s exploration expenditures to date (excluding the initial C$5,000,000 in Cosa funded expenditures) incurred on the Darby claim(s) for the proportion of the property interest subject to the Buydown. The Buydown can be completed through a combination of cash payments and Denison sole-funded work, and must be a minimum of 25% cash. The Buydown will be extinguished if Denison’s interest in the Darby Project claims subject to the Buydown fall below 10%, or upon commercial production of 500,000 lbs of U3O8 from the claims subject to the Buydown. Cosa is to appoint a technical advisor nominated by Denison for a period of five years from the Closing Date or until all of Cosa’s obligations under the Acquisition Agreement have been fulfilled.

The Transaction is an Arm’s Length Transaction under the policies of the TSXV. The Transaction will constitute a “Reviewable Transaction” under the policies of the TSX Venture Exchange (the “TSXV”). No finder’s fees are expected to be paid by the Company in connection with the Transaction. The Consideration Shares and the Deferred Consideration Shares will be subject to a statutory hold period of four months and one day from the date of issuance thereof. Trading of the Company’s common shares on the TSXV is expected to remain halted, pending receipt and review of documentation relating to the Transaction.

Completion of the Transaction is subject to a number of conditions precedent, including, but not limited to: (i) acceptance by the TSXV and receipt of other applicable regulatory approvals and (ii) certain other closing conditions customary for a transaction of this nature.

Upon completion of the Transaction: (a) current shareholders of Cosa will hold approximately 80.05% of the Common Shares and (b) Denison will hold approximately 19.95% of the outstanding Common Shares.

Ancillary Agreements

In connection with closing of the Transaction, Cosa and Denison will enter into a royalty agreement for each Project (the “Royalty Agreements”), an investor rights agreement (the “Investor Rights Agreement”), and a joint venture agreement for each Project (the “Joint Venture Agreements”).

The Royalty Agreements will provide Denison with a 2% Net Smelter Royalty (“NSR”) on the Darby and Packrat Projects, and a 0.5% NSR on the Murphy Lake North Project. Cosa will have the right to repurchase 50% of the royalties on the Darby Project and the Packrat Project in exchange for a cash payment of C$2,000,000 per project.

The Investor Rights Agreement will provide, among other things, that for so long as Denison holds at least 5% of the issued and outstanding Common Shares, it will have a pre-emptive right and top-up rights entitling it to maintain and/or otherwise acquire up to a 19.95% interest in Cosa. Additionally, Denison will have the right to nominate one director to Cosa’s board of directors for so long as Denison holds at least 5% of the issued and outstanding Common Shares and an additional director to Cosa’s board of directors for so long as Denison holds at least 10% of the issued and outstanding Common Shares.

Pursuant to the Joint Venture Agreements, the parties will form joint ventures in which Cosa will have a 70% interest and Denison will have a 30% interest in each Project as of the closing date.

The Transaction is expected to be completed by early 2025.

About Denison Mines

Denison is a leading uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. Denison has an effective 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. In mid-2023, the Phoenix feasibility study was completed for the Phoenix deposit as an ISR mining operation, and an update to the previously prepared 2018 Pre-Feasibility Study was completed for Wheeler River’s Gryphon deposit as a conventional underground mining operation. Based on the respective studies, both deposits have the potential to be competitive with the lowest cost uranium mining operations in the world. Permitting efforts for the planned Phoenix ISR operation commenced in 2019 and several notable milestones were achieved in 2024 with the submission of federal licensing documents and the proposed final versions of the Environmental Impact Statement (“EIS”) to the Canadian Nuclear Safety Commission and the Province of Saskatchewan.

Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake Joint Venture (‚MLJV‘), which includes unmined uranium deposits (planned for extraction via the MLJV’s SABRE mining method starting in 2025) and the McClean Lake uranium mill (currently utilizing a portion of its licensed capacity to process the ore from the Cigar Lake mine under a toll milling agreement), plus a 25.17% interest in the Midwest Joint Venture (‚MWJV‘)’s Midwest Main and Midwest A deposits, and a 69.44% interest in the Tthe Heldeth Túé (‚THT‘) and Huskie deposits on the Waterbury Lake Property (‚Waterbury‘). The Midwest Main, Midwest A, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill. Taken together, Denison has direct ownership interests in properties covering ~384,000 hectares in the Athabasca Basin region.

Additionally, through its 50% ownership of JCU (Canada) Exploration Company, Limited (‚JCU‘), Denison holds interests in various uranium project joint ventures in Canada, including the Millennium project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU, 34.4508%).

In 2024, Denison is celebrating its 70th year in uranium mining, exploration, and development, which began in 1954 with Denison’s first acquisition of mining claims in the Elliot Lake region of northern Ontario.

Denison has a market capitalization of approximately ~$2.9 billion (~US$2.0 billion) and its common shares are listed on the Toronto Stock Exchange (the ‚TSX‘) under the symbol ‚DML‘ and on the NYSE American exchange under the symbol ‚DNN‘. As at September 30, 2024 Denison’s financial position includes over $105,000,000 in cash and cash equivalents and over $240,000,000 in uranium investments (Denison MD&A dated 30 September 2024).

About Cosa Resources Corp.

Cosa Resources is a Canadian uranium exploration company operating in northern Saskatchewan. The portfolio comprises roughly 237,000 ha across multiple 100% owned and Cosa operated Joint Venture projects in the Athabasca Basin region, all of which are underexplored, and the majority reside within or adjacent to established uranium corridors.

Cosa’s award-winning management team has a long track record of success in Saskatchewan. In 2022, members of the Cosa team were awarded the AME Colin Spence Award for their previous involvement in discovering IsoEnergy’s Hurricane deposit. Prior to Hurricane, Cosa personnel led teams or had integral roles in the discovery of Denison’s Gryphon deposit and 92 Energy’s Gemini Zone and held key roles in the founding of both NexGen and IsoEnergy.

Cosa’s primary focus through 2024 was initial drilling at the 100% owned Ursa Project, which captures over 60-kilometres of strike length of the Cable Bay Shear Zone, a regional structural corridor with known mineralization and limited historical drilling. It potentially represents the last remaining eastern Athabasca corridor to not yet yield a major discovery, which the Company believes is primarily due to a lack of modern exploration. Modern geophysics completed by Cosa in 2023 identified multiple high-priority target areas characterized by conductive basement stratigraphy beneath or adjacent to broad zones of inferred sandstone alteration – a setting that is typical of most eastern Athabasca uranium deposits. Guided by a recently completed Ambient Noise Tomography (ANT) survey, Cosa’s second and most recent drilling campaign at Ursa intersected a significant zone of unconformity-style sandstone hosted structure and alteration underlain by several intervals of anomalous radioactivity in the basement rocks. Follow-up is currently in planning for 2025.

Technical Disclosure

Historical drilling and geophysical results for the Murphy Lake North, Darby, and Packrat projects were sourced from the Saskatchewan Mineral Assessment Database (SMAD). SMAD sources for the Murphy Lake North Project include file numbers 74I-0060, 74I09-0057, 74I09-0064, 74I09-0066, 74I09-0077, 74I09-0098, and MAW00510.

SMAD sources for Darby include file numbers 74H14-0021, 74H14-0023, 74H15-0041, 74H15-0053, 74H15-0055, 74H15-0056, 74H15-0066, 74H15-0067, 74I02-0031, 74I02-0042, 74I02-0053, 74I02-0080, 74I02-0095, and MAW00516. SMAD sources for the Packrat Project include file numbers MAW00608, 74I01-0087, and 74I01-0130. Additionally, Denison provided drill hole databases for each of the Murphy Lake North, Darby, and Packrat Projects which comprised compilations of historical drilling results, and, for the Packrat Project, Denison’s own drilling results including drill core photographs. Verification of drilling results included comparing historical data to Denison’s drill hole database and to segments of drill core from a limited number of drill holes completed at the Murphy Lake North and the Darby Projects. Denison’s Packrat Project drilling results were confirmed by reviewing photographs of drill core.

Drill hole collar locations were verified from air photos. A total of five drill hole collar locations from Murphy Lake North and Darby were ground-truthed using a handheld GPS. Verification of historical geophysical results was limited to confirming the locations of geophysical survey grids from air photos and evaluating whether interpreted geophysical targets could be reasonably explained by historical drilling results.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Andy Carmichael, P.Geo., Vice President, Exploration for Cosa. Mr. Carmichael is a Qualified Person as defined under the terms of National Instrument 43-101. This news release refers to neighboring properties in which the Company has no interest. Mineralization on those neighboring properties does not necessarily indicate mineralization on the Company’s properties.

Contact

Keith Bodnarchuk, President and CEO

+1 888-899-2672 (COSA)

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains forward-looking information within the meaning of Canadian securities laws (collectively “forward-looking statements”). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. These forward-looking statement or information may relate to: obtaining the required regulatory approvals and fulfilling other closing conditions related to the Transaction; closing of the Transaction; exploration and development of the Projects; commencement of trading of the Common Shares; the impact of the Transaction on Cosa’s business; mining operations; the business plan of Cosa; anticipated development, expansion and exploration activities; viability of Cosa’s projects and properties; and the entering into of ancillary agreements in connection with the Transaction.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct Cosa’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by Cosa in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: that there is no assurance that the parties hereto will obtain the requisite shareholder and regulatory approvals for the Transaction, and there is no assurance that the Transaction will be completed as anticipated, or at all; there is no assurance that any proposed financings will be completed or as to the actual offering price or gross proceeds to be raised in connection with such financings; following completion of the Transaction, Cosa may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect Cosa’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of Cosa’s securities, regardless of its operating performance; the ongoing military conflict in Ukraine, and other risk factors set out in Cosa’s public disclosure documents.

The forward-looking information contained in this news release represents the expectations of Cosa as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Cosa does not undertake any obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()