Copper and gold rooster

Like a phoenix rising from the ashes, the new bird now watches over Paris and Notre-Dame. It stands for resilience and when it found its place on the tower, it was a special event. Incidentally, its predecessor was dented by the fire in 2019 but survived surprisingly well. It will move into a museum. Copper and gold are pretty durable goods. The price of copper has gone up and down this year. However, the copper supply is now limited and should ensure higher prices. Overall, the price of copper has risen by eight percent since the beginning of the year. Although, according to the International Copper Study Group, 2024 should bring a supply surplus of 469,000 tons of copper.

In 2025, however, this surplus is expected to fall to 194,000 tons of the reddish metal. The ICSG is forecasting slower supply growth of 1.6% for next year. At the same time, demand will increase by 2.7 percent. That sounds good in terms of the copper price. In China, the production of refined copper has risen faster than mine production this year. Smelting and processing fees are falling, copper production is becoming less profitable. This is resulting in production restrictions. This is because smelting capacities are now lagging behind production volumes. Copper as the metal for the transition away from fossil fuels should be in high demand, especially from China due to the strong demand resulting from electromobility.

In terms of gold, the Chinese central bank has now increased its gold reserves again for the first time after a six-month break, by around five tons of gold. If China’s central bank continues to buy gold, this would certainly be positive for the price of the precious metal.

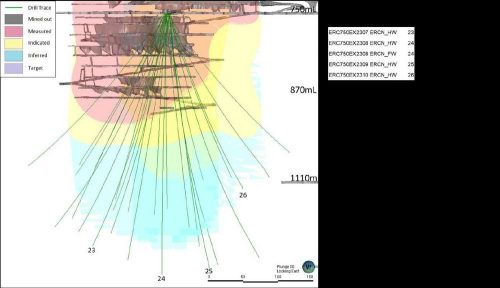

Collective Mining – https://www.commodity-tv.com/ondemand/companies/profil/collective-mining/ – owns copper, silver, gold and tungsten in Colombia. The Guayabales project is extremely high-grade.

When it comes to copper, Mogotes Metals – https://www.commodity-tv.com/ondemand/companies/profil/mogotes-metals-inc/ -, which operates in Chile and Argentina, is very popular. The Filo Sur copper project in the Vicuña district in Argentina is particularly noteworthy.

Current company information and press releases from Mogotes Metals (- https://www.resource-capital.ch/en/companies/mogotes-metals-inc/ -) and Collective Mining (- https://www.resource-capital.ch/en/companies/collective-mining-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()