Gold and silver and seasonality

Overall, the analysis of silver seasonality over a longer period shows that months such as February, May or July are often very different. There are probably many factors affecting silver, which is both an industrial metal and an investment metal. These factors often result from general economic conditions, currency fluctuations and crises or events. In any case, analysts see the big picture as positive for silver and gold in the medium and long term. A safe haven has rarely been in such demand as it is today in the face of multiple trouble spots. Silver benefits from technological progress more than almost any other metal.

In the past, for example in the Roman Empire, some people wore silver amulets to protect the owner from misfortune or to bring healing for many illnesses. It was even said to protect against demonic powers. One of these amulets, which were widespread in late antiquity, was recently found as a burial object in Germany. It dates from the period between 230 and 270 AD. In any case, silver stands for many things, for progress, currency protection, jewelry, investment opportunities and today also for many applications in medicine and everyday life.

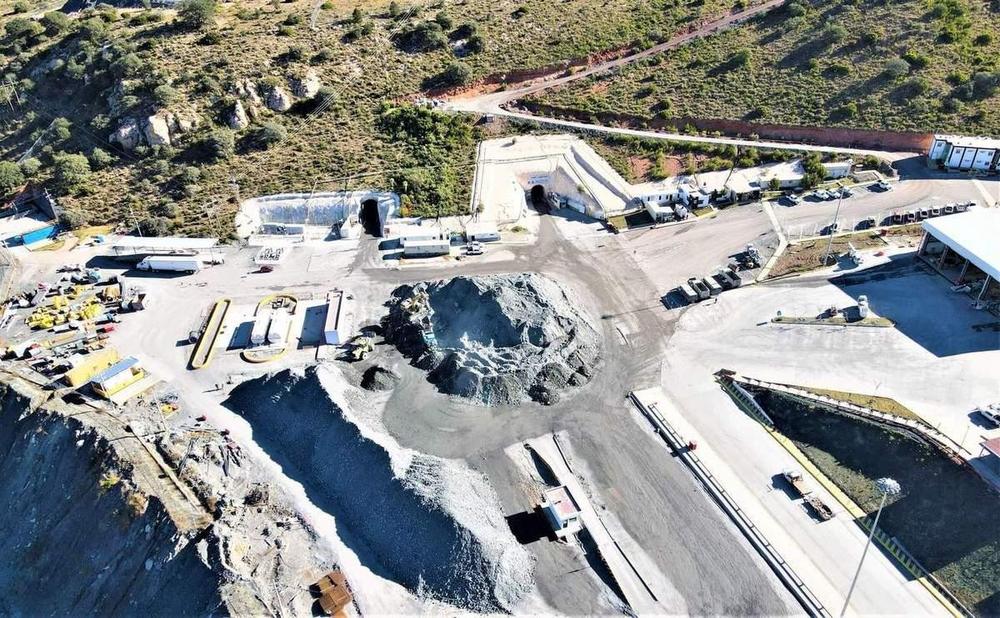

In the mining sector, the Juanicipio silver mine in Mexico scores with high-grade ore grades. MAG Silver – https://www.commodity-tv.com/ondemand/companies/profil/mag-silver-corp/ – is involved in this.

GoldMining – https://www.commodity-tv.com/ondemand/companies/profil/goldmining-inc/ – owns gold and copper in projects in Canada, the USA, Brazil, Colombia and Peru. In addition, there are shares in Gold Royalty, U.S. GoldMining and NevGold.

Current company information and press releases from GoldMining (- https://www.resource-capital.ch/en/companies/goldmining-inc/ -) and MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()