One of many Central Banks betting on Gold – Ecuador

The program adheres to the highest environmental standards while prioritizing transparency and accountability. A crucial element of the program is the due diligence process, which both strengthens participant activities and reduces the risk of illegal actions. Mining companies are visited on-site by officials from the central bank offices, following due diligence practices aligned with the London Bullion Market Association (LBMA).

Ecuador’s gold acquisition program began in 2013 and has since increased the country’s reserves by more than $534 million. The program aims to expand gold purchases further, reduce dependency on the U.S. dollar, and strengthen international reserves. Ecuador is just one example of many central banks, particularly in emerging markets, working to increase their gold reserves. This trend is a positive factor for the gold price and companies with gold-focused mining projects, such as Revival Gold and Fury Gold Mines.

Revival Gold – https://www.commodity-tv.com/ondemand/companies/profil/revival-gold-inc/ – is advancing gold mining projects in the western United States. Notable highlights include the Mercur Gold Project in Utah and the Beartrack-Arnett Gold Project in Idaho.

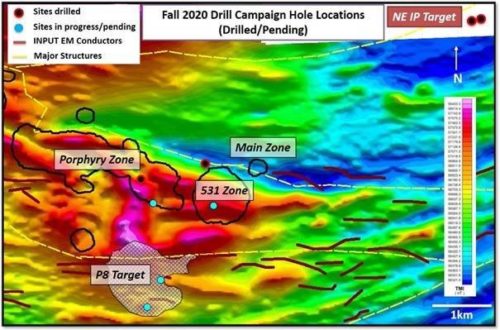

Fury Gold Mines – https://www.commodity-tv.com/play/fury-gold-mines-focus-on-eleonore-south-exploration-and-looking-for-a-partner-for-committee-bay/ – operates in Nunavut and Quebec, is well-funded, and boasts a multi-million-ounce gold platform. The Eau Claire project has already revealed over 12 grams of gold per ton of rock.

For the latest company updates and press releases, visit Fury Gold Mines (- https://www.resource-capital.ch/de/unternehmen/fury-gold-mines-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()