Karora Announces an 8% Increase to the Beta Hunt Nickel Measured and Indicated Mineral Resource

- Consolidated Nickel Measured and Indicated Mineral Resource increased by 8% to 21,100 nickel tonnes

- Beta Block Nickel Measured and Indicated Mineral Resource increased by 11% to 15,100 nickel tonnes

Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) ("Karora" or the "Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/) is pleased to announce the Beta Hunt Nickel Measured and Indicated Mineral Resources increased by 8% to 21,100 nickel tonnes and Inferred Mineral Resources increased by 2% to 13,400 nickel tonnes, net of mining depletions.

Paul Andre Huet, Chairman & CEO, commented: "We continued to build our nickel inventory with an 8% increase to the Measured and Indicated Mineral Resource to 21,100 nickel tonnes. This increase as of September 30, 2022 is a strong result being just eight months since the last update in January 2022 with only remnant mining completed over the course of 2022 as we await scheduled increased ventilation capacity later this year underground at Beta Hunt. The resource additions were all from the Beta Block area north of the Gamma Fault, primarily in the Beta West zone.

Over the balance of 2023, our nickel resource development drilling at Beta Hunt will be focused on upgrading and extending the East Alpha and 40C Mineral Resources in the Beta zone and the 50C and 10C Mineral Resources in the Gamma zone. As we have stated several times before, we are just beginning to unlock the potential for nickel mineralization south of the Gamma Fault where we have delineated only 800 metres in strike length of 2.6 km from the Fault to our property boundary. Upon expansion of our ventilation capacity via the addition of three vent raises this year, we will be able to increase both our drilling and development efforts in this area at the southern extent of our operation.”

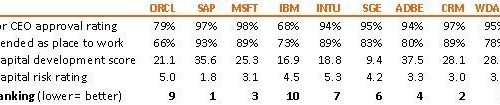

Beta Hunt Nickel Resource Summary

Table 1: Nickel-Mineral Resources as at September 30, 2022

Note: Refer to detailed footnotes below

At September 30, 2022, Measured and Indicated Mineral Resources totaled 745k tonnes grading 2.8% for 21,100 nickel tonnes. This marks an increase of 1,500 nickel tonnes, or 8% compared to the January 31, 2022, Measured and Indicated Mineral Resource estimate (see Karora news release dated May 11, 2022). September 30, 2022 Inferred Mineral Resources totaled 500k tonnes grading 2.7% for 13,400 nickel tonnes. The represents an increase of 200 nickel tonnes, or 2%, compared to the January 31, 2022 Inferred Mineral Resource estimate.

The new Nickel Mineral Resource incorporates the addition of the Beta West Resource and updates to the Beta Central Resource. Beta West covers remnant nickel mineralization west of the main Beta workings and comprises a Measured and Indicated Mineral Resource of 50,000 tonnes grading 2.3% for 1,160 nickel tonnes and an Inferred Mineral Resource of 5,000 tonnes grading 3.3% for 150 nickel tonnes. The updates to the Mineral Resource were undertaken by AMC Consultants Pty Ltd, Perth (AMC). The Beta Hunt Mineral Resource estimate is net of mostly remnant mine production depletion of 17,300 tonnes grading 1.6% for 275 nickel tonnes over the period February 1, 2022 to September 30, 2022. Mining over this period was from the 25C,30C, 40C and 4C positions. The recently discovered 4C deposit is not yet part of the Nickel Mineral Resource inventory (see Karora news release, September 14, 2022).

Drilling for nickel in 2023 is planned to upgrade and extend the East Alpha and 40C resources in the Beta Block and the 50C/10C resources in the Gamma Block.

Compliance Statement (JORC 2012 and NI 43-101)

Mr. Stephen Devlin is Group Geologist for Karora, a full-time employee of Karora and a Fellow of the AusIMM. Mr Devlin has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Devlin has reviewed and approved the disclosure of the technical information for the Beta Hunt Nickel Mineral Resource included in this news release.

The "JORC Code" means the Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Mineral Council of Australia. There are no material differences between the definitions of Mineral Resources under the applicable definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Definition Standards") and the corresponding equivalent definitions in the JORC Code for Mineral Resources.

Detailed Footnotes relating to Mineral Resource Estimates as at September 30,2022

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to produce Mineral Reserves.

- The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are applied.

- The Nickel Mineral Resource is reported within proximity to underground development and nominal 1% Ni lower cut-off grade for the nickel sulphide mineralization.

- The Nickel Mineral Resource assumes an underground mining scenario and a high level of selectivity.

- Mineral Resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

About Karora Resources

Karora is focused on increasing gold production to a targeted range of 185,000-205,000 ounces by 2024 at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. In July 2022, Karora acquired the 1.0 Mtpa Lakewood Mill in Western Australia. At Beta Hunt, a robust gold Mineral Resource and Reserve are hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. The Corporation also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to, among other items, production guidance, the organic growth profile and the potential of the Beta Hunt Mine and Higginsville Gold Operation and the Spargos Reward Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()