Green Shift Closes Acquisition of the Rio Negro Hard Rock Lithium Project and Appoints New Executive Chairman

- Early Mover Advantage – GCOM is one of only a handful of companies pursuing lithium pegmatite opportunities in Argentina, a premier lithium mining jurisdiction.

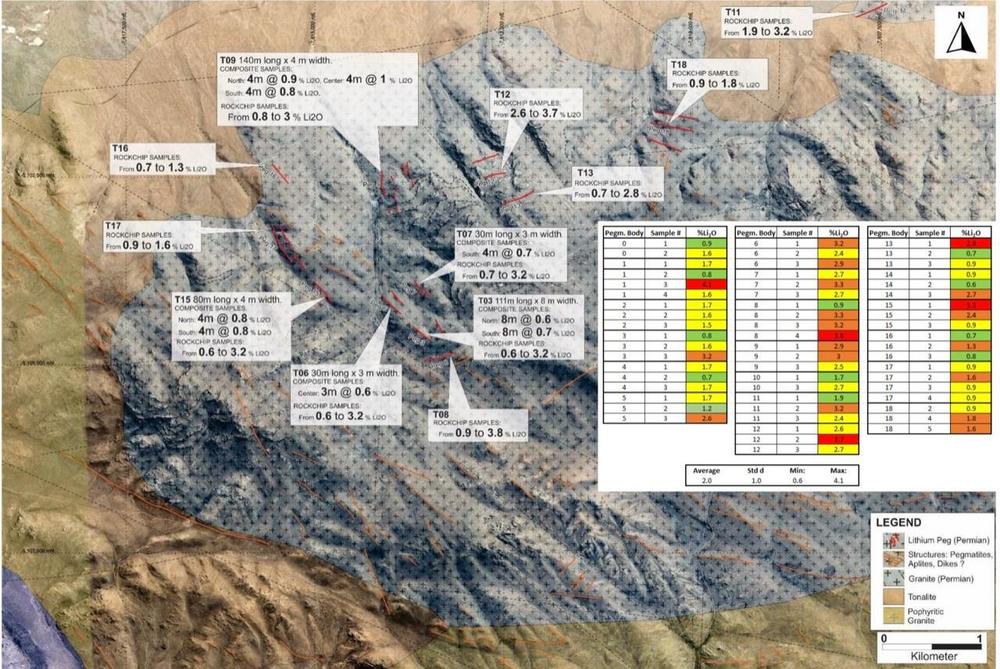

- Large and Prospective Land Position – The Project covers over 500,000 Ha with 19 separate pegmatite bodies identified with assay results from 60 rock chip samples, taken during prior exploration of the Project, ranging from 0.6% Li2O to 4.1% Li2O, averaging 2.0% Li2

- Technical Team in Place – New Executive Chairman, Peter Mullens, brings over 20 years of experience in Argentina and will be leading an in-country expert team that has over 150 years of experience in Argentina with a focus on Lithium.

- Work Programs Commencing Immediately – Programs to include, trenching, mapping and sampling known pegmatites as well as prospecting for new occurrences on the balance of the Project area.

- Additional Opportunities Being Pursued – Based on the team’s extensive experience, additional lithium opportunities have been identified and are being evaluated for possible acquisition with the goal of building out a robust portfolio of projects.

Pursuant to the Acquisition, GCOM acquired all the outstanding shares of LFP for consideration of an up-front payment of USD$75,000 and the issuance of 17,500,000 common shares of GCOM (“Common Shares”), at a deemed price of C$0.14, being the closing price of the Common Shares on the TSX Venture Exchange (the “TSXV”) on the day immediately prior to closing of the Acquisition.

In addition, as a result of the Acquisition, GCOM has the right, but not the obligation, pursuant to two separate option agreements, to acquire an additional approximately 200,000 Ha of prospective lithium ground in Rio Negro, Chubut, and Neuquén Provinces in Argentina for US$50,000 (being US$25,000 under each option agreement).

Trumbull Fisher, CEO and Director of GCOM, commented, “We are thrilled to announce the successful acquisition of the Rio Negro Lithium Project in Argentina. This marks a significant milestone for GCOM as we continue to execute our growth strategy and expand our presence in the lithium sector. With the potential to unlock approximately 500,000 hectares of lithium-rich land, we are excited about the prospects and past sample results that this project presents, and we look forward to commencing exploration activities imminently.”

Appointment of Mr. Peter Mullens as Executive Chairman

GCOM is also pleased to announce the appointment of Mr. Peter Mullens as Executive Chairman and a Director of the Company. Dr. Richard Spencer, the current Chairman of the Board of Directors will stay on as a Director of the Company.

Mr. Fisher commented, “We are privileged to welcome Peter Mullens as Executive Chairman. Peter played a key role in bringing this project to GCOM and we are excited to leverage his extensive technical expertise, in combination with our dedicated Argentine technical team. With this appointment and Dr. Richard Spencer remaining on the Board, our team is poised to deliver exceptional growth during one of the most critical stages in the global energy transition.”

Mr. Mullens is a seasoned geologist with 35 years‘ experience across a wide range of commodities and countries. He worked as a mine geologist at Broken Hill Australia from 1983 to 1987 and with Mt. Isa Mines in Queensland from 1987 to 1997. He was appointed district manager for Argentina, and subsequently Central America, from 1994 to 1997, exploring for gold and base metals. Following this, he was based in Lima, Peru and consulted to the mining industry.

Mr. Mullens joined Laramide Resources and Aquiline Resources in 2002. Both companies were successful with Mr. Mullens being responsible for the acquisition of key projects in Argentina for Aquiline, which subsequently led to the buyout by Pan American Silver in 2009 for CAD $645 million. At Laramide, Mr. Mullens was VP Exploration and Director playing a key role in helping to identify and acquire the Westmoreland and Homestake projects in Queensland and the USA, respectively. Laramide was ranked the #1 company on the TSXV in 2005. Mr. Mullens was also a founder and director of Lydian Resources which discovered the 5 million-ounce Amulsar gold deposit located in Armenia.

Peter Mullens, Executive Chairman of GCOM, commented, “I am excited to come on as Executive Chairman of Green Shift following the closing of Rio Negro. Argentina has exceptional potential for both brine and hard rock lithium discovery and production. I look forward to helping guide the Company towards a successful future."

In connection with Mr. Mullens’ appointment, the Company has granted 500,000 stock options to Mr. Mullens pursuant to the terms of the Company’s share-based incentive plan. Each option is exercisable to acquire one common share of the Company at an exercise price of C$0.22 for a period of five years, subject to the approval of the TSXV.

The Rio Negro Project

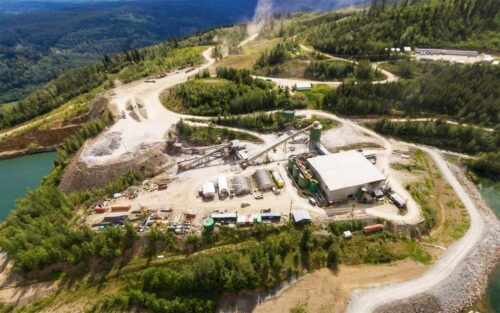

The Rio Negro Project consists of approximately 500,000 Ha of staked and granted claims stretching through the provinces of Chubut, Rio Negro and Neuquén (Figure 2). The Property covers a large portion of an intrusive belt known to host lithium mineralization in pegmatites. Historic work on granitic stocks in the Mamuel Choique (“MC”) (Figure 1) area by the Argentine State in the 1960’s identified 19 separate pegmatite bodies where assay results from 60 rock chip samples ranged from 0.6% Li2O to 4.1% Li2O, averaging 2.0% Li2O. GCOM has not independently verified these reported grades and therefore they cannot be relied upon until these areas have been resampled.

Over 800 structures (possible pegmatite bodies) have been mapped through satellite image interpretation in the MC pegmatite field. This work showed that the identified structures have a total strike length of over 100 km. A recent field visit confirmed the existence of many of the target structures identified on satellite imagery. Many of the trenches sampled by the State in the 1960’s are still open and accessible for resampling in the planned exploration program.

GCOM plans to mobilise field crews to Rio Negro to commence its three-month Phase 1 exploration program immediately. The plan of work consists of prospecting, rock chip sampling and trenching on the highest priority areas located in the Rio Negro Project. The use of a LIBS (Laser Induced Breakdown Spectroscopy) analyzer provides a real-time estimate of lithium grade and therefore is an invaluable tool for the field teams to assess potential and prioritize targets for further work. After estimation of grade by the LIBS analyzer, the field teams then channel sample the priority areas for determination of lithium grade by an independent, certified laboratory. Official assays typically take approximately 6 weeks at certified labs.

The Phase 1 work program is expected to focus on areas surrounding the township of Comallo in Rio Negro Province.

Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Peter Mullens (FAusIMM), Executive Chairman of the Company, who is a “Qualified Person” in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Green Shift Commodities Ltd.

Green Shift Commodities Ltd. is focused on the exploration and development of commodities needed to help decarbonize and meet net-zero goals.

The Company is developing the Berlin Deposit in Colombia. Apart from uranium, for clean nuclear energy, the Berlin Deposit contains battery commodities including nickel, phosphate, and vanadium. Phosphate is a key component of lithium-ion ferro-phosphate (“LFP”) batteries that are being used by a growing list of electric vehicle manufacturers. Nickel is a component of various lithium-ion batteries, while vanadium is the element used in vanadium redox flow batteries. Neodymium, one of the rare earth elements contained within the Berlin Deposit, is a key component of powerful magnets that are used to increase the efficiency of electric motors and in generators in wind turbines.

The Company recently acquired the district scale Rio Negro Project in Argentina. This Project represents an exciting opportunity to unlock the potential of over 500,000 Ha of land, known to contain hard rock lithium pegmatite occurrences that were first discovered in the 1960s but have seen little exploration since.

For further information, please contact:

Trumbull Fisher, CEO, Green Shift Commodities Ltd.

E: tfisher@greenshiftcommodities.com

Tel: (416) 917-5847

Forward-Looking Statements

This news release includes certain “forward looking statements”. Forward-looking statements consist of statements that are not purely historical, including statements regarding beliefs, plans, expectations or intensions for the future, and include, but not limited to, statements with respect to: the completion of future exploration work and the potential metallurgical recoveries and results of such test work; the future direction of the Company’s strategy; and other activities, events or developments that are expected, anticipated or may occur in the future. These statements are based on assumptions, including that: (i) the ability to achieve positive outcomes from test work; (ii) actual results of exploration, resource goals, metallurgical testing, economic studies and development activities will continue to be positive and proceed as planned, (iii) requisite regulatory and governmental approvals will be received on a timely basis on terms acceptable to Green Shift (iv) economic, political and industry market conditions will be favourable, and (v) financial markets and the market for uranium, battery commodities and rare earth elements will continue to strengthen. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements, including, but not limited to: (1) changes in general economic and financial market conditions, (2) changes in demand and prices for minerals,

(3) the Company’s ability to source commercially viable reactivation transactions and / or establish appropriate joint venture partnerships, (4) litigation, regulatory, and legislative developments, dependence on regulatory approvals, and changes in environmental compliance requirements, community support and the political and economic climate,

(5) the inherent uncertainties and speculative nature associated with exploration results, resource estimates, potential resource growth, future metallurgical test results, changes in project parameters as plans evolve, (6) competitive developments, (7) availability of future financing, (8) the effects of COVID-19 on the business of the Company, including, without limitation, effects of COVID-19 on capital markets, commodity prices, labour regulations, supply chain disruptions and domestic and international travel restrictions, (9) exploration risks, and other factors beyond the control of Green Shift including those factors set out in the “Risk Factors” in our Management Discussion and Analysis dated May 2, 2022 for the fiscal year ended December 31, 2021 and other public documents available on SEDAR at www.sedar.com. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Green Shift assumes no obligation to update such information, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()