Why lithium prices should be on the rise

Despite prophecies of doom that see the price of white gold falling to between ten and 15 US dollars per kilogram, things are looking good for the price of lithium. For one thing, demand for electric vehicles and thus lithium is rising again. Sales fell sharply in December and January. This had an impact along the supply chains. The normal seasonality on the Chinese market had a causal effect. Concerns about the cancellation of subsidies for electric vehicles and the extended New Year holidays also had an impact. These influences are now easing. And year-on-year, sales from January to March 2023 are still up by around 20 percent. A further increase in sales is to be expected. This will mean that demand for batteries and lithium will recover. However, this could take some time to show up on the supply chain to lithium and thus the lithium price.

Another issue is lithium carbonate inventories. While they have gone up threefold in the past three months, it should be remembered that demand for lithium carbonate has almost quadrupled between 2019 and 2022. In terms of days of consumption, inventories are currently at 50 to 54 days of consumption, but corrected for demand in the fourth quarter of 2022, that works out to only 35 to 38 days of consumption. So basically, not much. Lithium hydroxide inventories are likely to be as low as less than one week’s supply. Those who want to bet on the transformation in the automotive sector, which is just beginning, can do so with investments in lithium companies such as Alpha Lithium or ION Energy.

ION Energy – https://www.commodity-tv.com/ondemand/companies/profil/ion-energy-inc/ – owns two lithium projects in Mongolia. Urgakh Naran covers 80,000 hectares of land. In addition, there is the flagship Baavhai Uul project. Exploration work is underway.

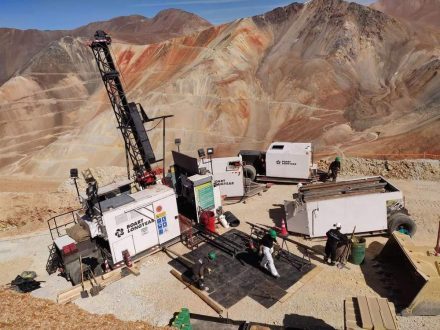

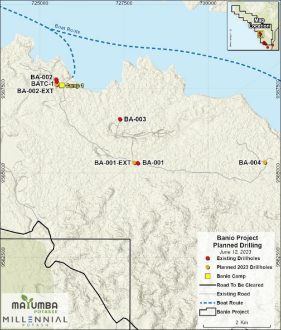

Alpha Lithium – https://www.commodity-tv.com/ondemand/companies/profil/alpha-lithium-corp/ – is located with its lithium projects in the famous lithium triangle in Argentina. The construction of the pilot plant and thus the test production are imminent.

Current corporate information and press releases from Alpha Lithium (- https://www.resource-capital.ch/en/companies/alpha-lithium-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()