Fertilizer as gold for the portfolio

Precious metals or important industrial metals such as copper are suitable for investment, but potash companies are also promising.

Potash prices are currently below expectations. However, demand for potash in Brazil has picked up again and Brazil is an important potash customer. The fact is that fertilizer, and therefore potash, will be a very sought-after commodity in the longer term. The world population is growing and there are still many hungry people on earth. Opportunities could now arise for investors in the potash sector, because fertilizer prices, and therefore potash prices, are expected to rise in the short or long term.

Between early 2021 and spring 2022, fertilizer stocks were among the winners. The Russia-Ukraine war reinforced this development. After that, however, prices went down. This, in turn, could now make for favorable entry prices. And fertilizers are always in demand, because they are essential for efficient cultivation in agriculture. Thus, many expect supplies to tighten. This means that the years in which fertilizers could be obtained cheaply will probably soon be over.

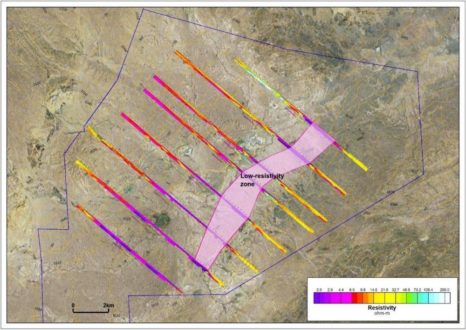

Of extreme note in the potash sector is Millennial Potash – https://www.commodity-tv.com/ondemand/companies/profil/millennial-potash-corp/ -. In Africa, in Gabon, the company is developing the Banio potash project.

Investors who want to rely additionally or more on gold, the proven store of value, cannot avoid investments in gold stocks. The Fed’s cycle of interest rate hikes is coming to an end, the U.S. dollar could tend to weaken, and whatever storms are still forming in the geopolitical skies, who knows, gold and gold stocks always make sense in the long run, much like potash should.

For example, Torq Resources – https://www.commodity-tv.com/ondemand/companies/profil/torq-resources-inc/ – has gold and also copper in the ground at its prospective Santa Cecilia gold-copper project in Chile.

Current corporate information and press releases from Millennial Potash (- https://www.resource-capital.ch/en/companies/millennial-potash-corp/ -) and from Torq Resources (- https://www.resource-capital.ch/en/companies/torq-resources-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()