Sibanye-Stillwater production update and trading statement for the year ended 31 December 2023

Production update for the year ended 31 December 2023

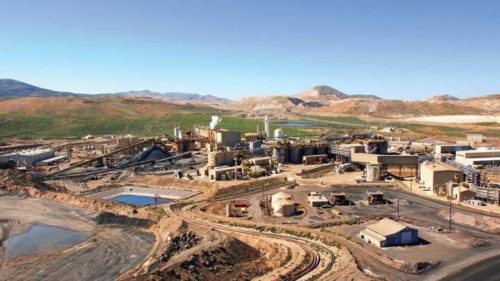

Other than the US PGM recycling business which continued to be impacted by external factors, all of the Group’s operations achieved production guidance for the year ended 31 December 2023 (2023 or the Period). The SA PGM operations delivered another consistent operational performance for 2023 with production of 1,748,430 4Eoz (including attributable production from Mimosa and third-party purchase of concentrate (PoC)) within annual guidance of 1.7 million 4Eoz to 1.8 million 4Eoz. The consolidation of 100% of production from the Kroondal operation from November 2023 following the early closure of the acquisition of Anglo American Platinum’s 50% share in the Kroondal pool and share agreement (the Kroondal Transaction), added a further 20,900 4Eoz to annual production.

Production from the SA gold operations (excluding DRDGOLD) for 2023 of 20,114 kg (646,680 oz) was within revised guidance of 19,500 kg to 20,500 kg (625 koz to 660 koz), following the Kloof 4 shaft incident in mid 2023. Despite the suspension of production from Kloof 4 shaft from July 2023 and the closure of Kloof 4 shaft during Q4 2023, overall production was significantly improved compared to 2022.

Production from the US PGM underground operations steadily improved over the course of 2023, with mined 2E PGM production of 427,272 2Eoz in 2023, 1% higher than in 2022 and in line with the guidance of 420k 2Eoz to 430k 2Eoz (revised following the shaft incident in Q1 2023 which impacted production from Stillwater West).

Total PGM ounces fed of 310,314 3Eoz at US PGM recycling operations was 48% lower year-on-year and below revised guidance of 350k 3Eoz to 400k 3Eoz due to deliveries of used autocatalysts remaining depressed, mainly as a result of the uncertain global economic outlook, recessionary concerns and higher interest rates which have inhibited consumer demand for new vehicles, resulting in light duty vehicles remaining in service for longer periods before being scrapped.

Total nickel production from the Sandouville refinery of 7,125 tonnes was also within guidance of 7.0 kt to 7.5 kt, with production rates improving during H2 2023. Total nickel production included 1,411 tonnes of nickel salts and 5,714 tonnes of nickel metal.

In the Australian region, Sibanye-Stillwater acquired control of New Century Resources Limited on 22 February 2023, enhancing the Group’s exposure to global tailings retreatment and the circular economy. Production from the Century zinc tailings operation was 76 kt zinc of metal (payable) for 2023, with production stabilising during H2 2023 after recovering from the flooding event in March 2023.

Neal Froneman, CEO of Sibanye-Stillwater commented: “2023 has been a challenging year, with a steep decline in the prices of most commodities we produce, with the notable exception of gold. Pleasingly our all South African operations and our Australian operation were profitable before the end of Q4 2023. Despite delivering within 2023 production guidance, the US PGM operations and the Sandouville refinery will require further repositioning to address losses which are impacting Group profitability and considering the depressed commodity price environment, have contributed to significant impairments being recognised. We have already taken proactive steps to address loss-making production at unprofitable operations and the Group remains focussed on ensuring the sustainability of our business and delivering on our strategical essentials through this period of low commodity prices.”

Trading statement for the year ended 31 December 2023In terms of paragraph 3.4(b)(i) of the Listing Requirements of the JSE Limited (JSE), a company listed on the JSE is required to publish a Trading statement as soon as it is satisfied that a reasonable degree of certainty exists that the financial results for the next period to be reported on, will differ by at least 20% from the financial result for the previous corresponding period.

Stakeholders are accordingly advised that the Group expects to report a loss per share for 2023 of between 1,268 SA cents (69 US cents) and 1,401 SA cents (76 US cents) compared with earnings per share (EPS) of 651 SA cents (40 US cents) for the year ended 31 December 2022 (2022), and headline earnings per share (HEPS) of between 60 SA cents (3 US cents) and 66 SA cents (4 US cents) compared with HEPS of 652 SA cents (40 US cents) for 2022. This represents a year-on-year decline of over 100% and 90% to 91% in EPS and HEPS, respectively.

The decrease in EPS and HEPS for 2023 compared to 2022 is primarily due to:

· A significant decline in profitability due to lower average metal prices (other than gold) for 2023 compared with 2022

· A 32% decline in the average rand 4E PGM basket price and a 33% decline in the average US dollar 2E PGM basket price significantly impacted the profitability and earnings of the SA PGM and US PGM operations for 2023. These operations contributed the majority of the Group’s profit and earnings during 2022

· The deterioration in metal prices and specific operational factors contributed to impairments of R47,454 million (US$2,576 million) being recognised by the Group (no impact on HEPS). Impairments were recognised at the US PGM operations (operational repositioning and above inflationary cost increases), the SA gold operations (Kloof 4 shaft closure and deferral of Burnstone project), the Century zinc operation (above inflationary cost increases and deferral of expansion projects), the Sandouville nickel refinery (lower forecast production, cost inflation and onerous supply contract) and the Group’s equity accounted investment in the Mimosa PGM mine (decrease in the expected average recovered grade resulting from a change in the mineralogy of the ore and above inflationary cost increases)

These negative financial impacts were partially offset by:

- the 13% depreciation of the average rand/dollar exchange rate, which supported the rand commodity prices received by our SA operations, where most costs are rand-based

· improved financial results from the SA gold operations compared with 2022, primarily due to a 21% increase in the average rand gold price year-on-year and a more stable operational performance

· a net fair value gain on financial instruments compared to a net fair value loss for 2022

· a gain on acquisition and remeasurement of previous interest relating to the Kroondal Transaction

· a decrease in royalties and mining and income taxes due to lower revenue and profitability, respectively

The conversion of rand amounts into US dollar is based on an average exchange rate of R18.42/US$ for 2023 and R16.37/US$ for 2022. This is provided as supplementary information only.

The financial information on which this trading statement is based has not yet been reviewed or reported on by Sibanye-Stillwater’s auditors.

Results webcast and conference call

Sibanye-Stillwater will release its full operating and financial results for the six-months and year ended 31 December 2023 on Tuesday, 5 March 2024 and will host a virtual presentation shared via a webcast and conference call at 14h00 (CAT) / 12h00 (GMT) / 07h00 (EST) / 05h00 (MT).

Webcast link: https://themediaframe.com/mediaframe/webcast.html?webcastid=vUKD60Xu and Conference call pre-registration: https://services.choruscall.za.com/DiamondPassRegistration/register?confirmationNumber=7354248&linkSecurityString=15532d8230. Results information will be available at https://www.sibanyestillwater.com/news-investors/reports/quarterly/ on the day.

About Sibanye-Stillwater

Sibanye-Stillwater is a multinational mining and metals processing group with a diverse portfolio of operations, projects and investments across five continents. The Group is also one of the foremost global recyclers of PGM autocatalysts and has interests in leading mine tailings retreatment operations.

Sibanye-Stillwater has established itself as one of the world’s largest primary producers of platinum, palladium, and rhodium and is a top tier gold producer. It also produces and refines iridium and ruthenium, nickel, chrome, copper and cobalt. The Group has recently begun to diversify its asset portfolio into battery metals mining and processing and increase its presence in the circular economy by growing its recycling and tailings reprocessing exposure globally. For more information refer to www.sibanyestillwater.com.

Investor relations contact:

Email: ir@sibanyestillwater.com

James Wellsted

Executive Vice President: Investor Relations and Corporate Affairs

Tel: +27 (0) 83 453 4014

Website: www.sibanyestillwater.com

LinkedIn: https://www.linkedin.com/company/sibanye-stillwater

Facebook: https://www.facebook.com/SibanyeStillwater

YouTube: https://www.youtube.com/@sibanyestillwater/videos

X: https://twitter.com/SIBSTILL

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Sponsor: J.P. Morgan Equities South Africa Proprietary Limited

DISCLAIMER

FORWARD LOOKING STATEMENTS

The information in this document may contain forward-looking statements within the meaning of the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 with respect to Sibanye Stillwater Limited’s (Sibanye-Stillwater or the Group) financial condition, results of operations, business strategies, operating efficiencies, competitive position, growth opportunities for existing services, plans and objectives of management for future operations, markets for stock and other matters. These forward-looking statements, including, among others, those relating to Sibanye-Stillwater’s future business prospects, revenues and income, climate change-related targets and metrics, the potential benefits of past and future acquisitions (including statements regarding growth, cost savings, benefits from and access to international financing and financial re-ratings), gold, PGM, nickel and lithium pricing expectations, levels of output, supply and demand, information relating to Sibanye-Stillwater’s new or ongoing development projects, any proposed, anticipated or planned expansions into the battery metals or adjacent sectors and estimations or expectations of enterprise value, adjusted EBITDA and net asset, are necessarily estimates reflecting the best judgment of the senior management and directors of Sibanye-Stillwater and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in this document.

All statements other than statements of historical facts included in this document may be forward-looking statements. Forward-looking statements also often use words such as “will”, “would”, “expect”, “forecast”, “goal”, “vision”, “potential”, “may”, “could”, “believe”, “aim”, “anticipate”, “target”, “estimate” and words of similar meaning. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in this disclaimer. Readers are cautioned not to place undue reliance on such statements.

The important factors that could cause Sibanye-Stillwater’s actual results, performance or achievements to differ materially from estimates or projections contained in the forward-looking statements include, without limitation, Sibanye-Stillwater’s future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings, financing plans, debt position and ability to reduce debt leverage; economic, business, political and social conditions in South Africa, Zimbabwe, the United States, Europe and elsewhere; plans and objectives of management for future operations; Sibanye-Stillwater’s ability to obtain the benefits of any streaming arrangements or pipeline financing; the ability of Sibanye-Stillwater to comply with loan and other covenants and restrictions and difficulties in obtaining additional financing or refinancing; Sibanye-Stillwater’s ability to service its bond instruments; changes in assumptions underlying Sibanye-Stillwater’s estimation of its Mineral Resources and Mineral Reserves; any failure of a tailings storage facility; the ability to achieve anticipated efficiencies and other cost savings in connection with, and the ability to successfully integrate, past, ongoing and future acquisitions, as well as at existing operations; the ability of Sibanye-Stillwater to complete any ongoing or future acquisitions; the success of Sibanye-Stillwater’s business strategy and exploration and development activities, including any proposed, anticipated or planned expansions into the battery metals or adjacent sectors and estimations or expectations of enterprise value (including the Rhyolite Ridge project); the ability of Sibanye-Stillwater to comply with requirements that it operate in ways that provide progressive benefits to affected communities; changes in the market price of gold, PGMs, battery metals (e.g., nickel, lithium, copper and zinc) and the cost of power, petroleum fuels, and oil, among other commodities and supply requirements; the occurrence of hazards associated with underground and surface mining; any further downgrade of South Africa’s credit rating; the impact of South Africa’s grey listing; a challenge regarding the title to any of Sibanye-Stillwater’s properties by claimants to land under restitution and other legislation; Sibanye-Stillwater’s ability to implement its strategy and any changes thereto; the outcome of legal challenges to the Group’s mining or other land use rights; the occurrence of labour disputes, disruptions and industrial actions; the availability, terms and deployment of capital or credit; changes in the imposition of industry standards, regulatory costs and relevant government regulations, particularly environmental, sustainability, tax, health and safety regulations and new legislation affecting water, mining, mineral rights and business ownership, including any interpretation thereof which may be subject to dispute; increasing regulation of environmental and sustainability matters such as greenhouse gas emissions and climate change; being subject to, and the outcome and consequence of, any potential or pending litigation or regulatory proceedings, including in relation to any environmental, health or safety issues; the ability of Sibanye-Stillwater to meet its decarbonisation targets, including by diversifying its energy mix with renewable energy projects; failure to meet ethical standards, including actual or alleged instances of fraud, bribery or corruption; the effect of climate change or other extreme weather events on Sibanye-Stillwater’s business; the concentration of all final refining activity and a large portion of Sibanye-Stillwater’s PGM sales from mine production in the United States with one entity; the identification of a material weakness in disclosure and internal controls over financial reporting; the effect of US tax reform legislation on Sibanye-Stillwater and its subsidiaries; the effect of South African Exchange Control Regulations on Sibanye-Stillwater’s financial flexibility; operating in new geographies and regulatory environments where Sibanye-Stillwater has no previous experience; power disruptions, constraints and cost increases; supply chain disruptions and shortages and increases in the price of production inputs; the regional concentration of Sibanye-Stillwater’s operations; fluctuations in exchange rates, currency devaluations, inflation and other macro-economic monetary policies; the occurrence of temporary stoppages or precautionary suspension of operations at its mines for safety or environmental incidents (including natural disasters) and unplanned maintenance; Sibanye-Stillwater’s ability to hire and retain senior management and employees with sufficient technical and/or production skills across its global operations necessary to meet its labour recruitment and retention goals, as well as its ability to achieve sufficient representation of historically disadvantaged South Africans in its management positions; failure of Sibanye-Stillwater’s information technology, communications and systems; the adequacy of Sibanye-Stillwater’s insurance coverage; social unrest, sickness or natural or man-made disaster at informal settlements in the vicinity of some of Sibanye-Stillwater’s South African-based operations; and the impact of HIV, tuberculosis and the spread of other contagious diseases, including global pandemics.

Further details of potential risks and uncertainties affecting Sibanye-Stillwater are described in Sibanye-Stillwater’s filings with the Johannesburg Stock Exchange and the United States Securities and Exchange Commission, including the 2022 Integrated Report and the Annual Financial Report for the fiscal year ended 31 December 2022 on Form 20-F filed with the United States Securities and Exchange Commission on 24 April 2023 (SEC File no. 333-234096).

These forward-looking statements speak only as of the date of the content. Sibanye-Stillwater expressly disclaims any obligation or undertaking to update or revise any forward-looking statement (except to the extent legally required). These forward-looking statements have not been reviewed or reported on by the Group’s external auditors.

Websites

References in this document to information on websites (and/or social media sites) are included as an aid to their location and such information is not incorporated in, and does not form part of, this document.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()