Gold, uranium and copper for the portfolio

At the Vancouver Resource Investment Conference there was a noteworthy presentation by Resource Maven, an expert in the mining sector, on the subject of putting together a successful portfolio. Knowledge, timing and patience are important, as is the mood of the investors or the stage a project is at. The development of the uranium sector is remarkable. From 2016 to 2022, the uranium market tried to balance out the oversupply. The production cuts by Kazatomprom, responsible for 40 percent of global production, have given the market a boost. The uranium market is now in deficit after uranium regained popularity as a clean energy source. Uranium is no longer a speculation, but a market with very good fundamentals. In December 2023, the US House of Representatives also passed legislation to ban Russian uranium imports. This will limit imports of Russian uranium. This not only affects Russian uranium, but also any uranium transportation through the port of St. Petersburg.

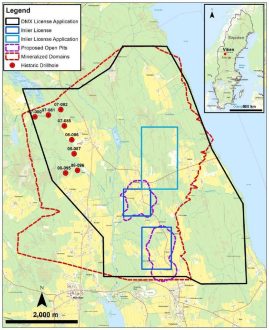

In the uranium sector, American Future Fuel – https://www.commodity-tv.com/ondemand/companies/profil/american-future-fuel-corp/ – is a good example. With its Cebolleta uranium project, the company is located in an outstanding area in the Grants Mineral Belt in the USA.

Gold shares are also attractive. Despite high interest rates, the price of gold has remained relatively stable. The gold price normally performs well when the US dollar is weak and interest rates are low. Experts are optimistic about the future price trend for gold, as interest rate cuts are imminent. However, it is not easy to find the best time to invest in gold shares. It will probably be a few months before the gold price makes a big move, but it is impossible to predict exactly.

The outlook for copper as a raw material is somewhat more long-term. Hardly any new copper mines have been built or significant new deposits discovered in recent years. However, demand for the metal will increase. There is still plenty of copper available, but new projects will be needed in the future.

In the gold sector, investors could take a look at Gold Royalty – https://www.commodity-tv.com/ondemand/companies/profil/gold-royalty-corp/ -. As a royalty company with over 200 royalties, the company offers very good diversification, particularly in the gold sector but also in the copper sector.

Current company information and press releases from American Future Fuel (- https://www.resource-capital.ch/en/companies/american-future-fuel-corp/ -) and from Gold Royalty (- https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()