Copper – Past, Present, and Future

The reddish metal boasts remarkable corrosion resistance and is 100% recyclable. Copper alloys have been essential both in ancient and modern times. One of the first metals worked by humans is bronze, an alloy of copper and another metal, usually tin. Recently, a diver discovered tens of thousands of ancient bronze coins near Sardinia at the bottom of the sea. They date back to the first half of the fourth century, a period when Rome’s influence was reflected in bronze and copper. These coins are in an extraordinary state of preservation. A nearby shipwreck is suspected. Today, copper is an essential component in the field of renewable energy, and electric vehicles require significantly more copper during production compared to conventional vehicles. UBS analysts currently forecast a deficit of at least 200,000 tons of copper by 2025. This is because supply is steadily declining. They estimate that a ton of copper will cost an average of $10,500 next year and around $11,000 in 2026.

The energy transition is the main driver behind the rising copper price. The recent dip in the metal’s price does not change this trend. After the US presidential election, the strong US dollar negatively impacted copper prices. When the dollar is strong, commodities priced in dollars become more expensive for participants using other currencies, which affects demand.

Looking at major copper consumer China and the Chinese purchasing manager indices, there are positive signs that stimulus measures in China may already be taking effect. Companies with copper in their projects include Mogotes Metals and Meridian Mining.

Mogotes Metals – https://www.commodity-tv.com/play/mining-news-flash-with-green-bridge-metals-mawson-gold-millennial-potash-and-mogotes-metals/ – operates in Chile and Argentina. The Filo Sur copper project in the Vicuña district of Argentina is particularly notable.

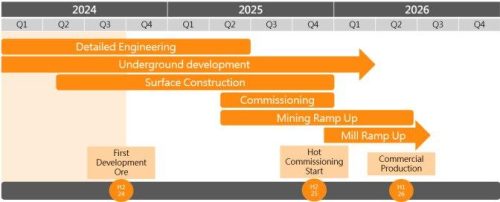

In Brazil, Meridian Mining – https://www.commodity-tv.com/play/mining-news-flash-with-uranium-royalty-cosa-resources-and-meridian-mining/ – has projects that include gold, silver, copper, and zinc. The Cabaçal deposit in Argentina, nearing production, stands out with an excellent preliminary economic assessment.

For current company information and press releases from Mogotes Metals (- https://www.resource-capital.ch/de/unternehmen/mogotes-metals-inc/ -) and Meridian Mining (- https://www.resource-capital.ch/de/unternehmen/meridian-mining-uk-societas/ -).

According to §34 WpHG, it should be noted that partners, authors, and employees may hold shares of the mentioned companies, posing a potential conflict of interest. No guarantees are provided for the translation into German; the only valid version is the English version of these reports.

Disclaimer: The provided information is not a recommendation or advice. Readers are reminded of the risks associated with stock trading. No liability is accepted for damages arising from the use of this blog. Note that stock investments and particularly options can carry risk, including the total loss of capital. All data and sources are thoroughly researched, but no guarantee is provided for accuracy. Despite careful preparation, errors, especially regarding numerical data and prices, are expressly reserved. The information originates from sources considered reliable but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites must be considered (e.g., Hamburg Regional Court, judgment from 05/12/1998 – 312 O 85/98), unless explicitly disclaimed. Although I take care in content review, no responsibility is taken for the content of external links. The respective site operators are solely responsible for their content. The Swiss Resource Capital AG disclaimer applies: https://www.resource-capital.ch/de/disclaimer-agb/.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()