Cosa Resources Completes Agreement to Form Joint Ventures with Denison Mines on Multiple Uranium Projects

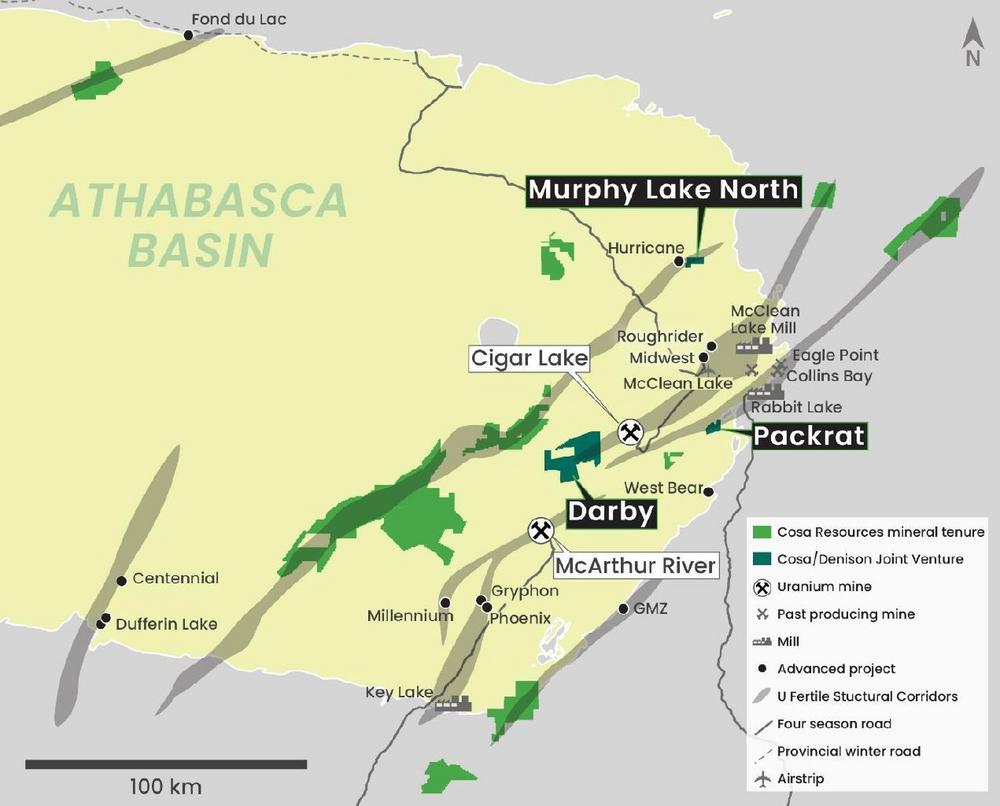

- Cosa has acquired a 70% interest in, and will operate, multiple prospective uranium projects in the infrastructure rich Eastern Athabasca Basin

- Cosa anticipates the commencement of diamond drilling in the coming weeks at the Murphy Lake North Project, located within 4 km of the Hurricane Deposit

- Geoff Smith, Denison’s VP Corporate Development and Commercial, joins Cosa’s Board of Directors

- Chad Sorba, Denison’s VP Technical Services and Project Evaluation; a critical member of the Denison team which discovered both the Phoenix and Gryphon uranium deposits, joins Cosa as Technical Advisor

- Denison is now Cosa’s largest shareholder at 19.95% ownership and is committed to a minimum of C$1,000,000 participation in future equity financings

Cosa Resources Corp. (TSX-V: COSA) (OTCQB: COSAF) (FSE: SSKU) (“Cosa” or the “Company”) – https://www.commodity-tv.com/ondemand/companies/profil/cosa-resources-corp/ – is pleased to announce that it has completed its previously announced acquisition (the “Transaction”) from Denison Mines Corp. (“Denison”) (TSX: DML) (NYSE American: DNN) of a 70% interest in a portfolio of prospective uranium projects (the “Projects”).

Keith Bodnarchuk, Cosa President and CEO, commented: “We are thrilled to have completed this transaction and are eager to continue our exploration efforts with our new joint venture partner and largest strategic shareholder Denison Mines. With a growing portfolio of highly prospective and drill-ready projects in the Eastern Athabasca Basin paired with strong corporate, technical, and financial support from Denison, there has never been a more exciting time for Cosa and our shareholders. Cosa welcomes Geoff Smith to our Board of Directors, with his extensive experience in capital markets, finance, and the mining sector as a whole. Additionally, we welcome Chad Sorba as a Technical Advisor. Among his various accomplishments, Mr. Sorba is an instrumental member of the Denison team which discovered and is developing Denison’s Phoenix and Gryphon uranium deposits at its Wheeler River project. We thank the team at Denison for working to complete this transaction in a timely manner, allowing us to prepare for a highly anticipated and fully funded winter drilling campaign at the Murphy Lake North project. We encourage our shareholders to stay tuned as we finalize our upcoming exploration plans and prepare for what is sure to be an exciting year for Cosa.”

Additions to the Cosa Team

The following appointments have been made in connection with the Transaction:

Geoff Smith, Director

Mr. Smith brings to Cosa extensive experience in capital markets and the mining and resource sector. Mr. Smith currently serves as the VP of Corporate Development and Commercial for Denison focusing on investor and customer engagement, the evaluation and execution of growth opportunities and financing arrangements, and the development and oversight of the Company’s uranium sales and contracting strategies. Mr. Smith previously served as Managing Director in the Global Mining & Metals group at Scotiabank. Mr. Smith holds an Honours Bachelor of Commerce from Queen’s University and is a CFA Charterholder. Mr. Smith also serves as a Director of EMX Royalty Corporation (TSX-V: EMX, NYSE American: EMX).

Chad Sorba, Technical Advisor

Mr. Sorba is a Professional Geoscientist with almost two decades of experience in Canadian and international uranium exploration, evaluation, and development. As a Project Geologist for Denison Mines, Mr. Sorba was a project lead and critical team member for the discovery of Denison’s Gryphon and Phoenix uranium deposits at their flagship Wheeler River project. Appointed as Vice President Technical Services & Project Evaluation in 2024, Mr. Sorba leads the Denison team that is pioneering the use of the In-Situ Recovery (“ISR”) mining method for extraction of high-grade unconformity style uranium deposits in the Athabasca Basin. Mr. Sorba has previously worked alongside several of Cosa’s team members, including Chairman Steve Blower and President and CEO Keith Bodnarchuk, and is expected to bring a wealth of experience in uranium exploration and development to Cosa’s award-winning technical team.

Transaction

The Transaction was completed pursuant to the terms of an acquisition agreement dated November 26, 2024 (the “Acquisition Agreement”) between the Company and Denison.

The Projects consist of (a) the Murphy Lake North Project, located within four kilometres of IsoEnergy’s Hurricane Deposit, (b) the Darby Project, located ten kilometres west of Cameco’s Cigar Lake Mine, and (c) the Packrat Project, located 19 kilometres southwest of the Rabbit Lake Mill.

Under the terms of the Acquisition Agreement, Cosa has acquired a 70% interest in each of the Projects from Denison. Cosa and Denison have entered into a joint venture on each of the Projects (each, a “Joint Venture”) with Cosa as operator of all Projects. In addition, Denison has agreed to participate in subsequent equity financings of Cosa for aggregate total proceeds of a minimum of C$1,000,000, the timing and amount to be at Cosa’s discretion.

As consideration for the Transaction, Cosa issued to Denison 14,195,506 common shares (the “Consideration Shares”) at a deemed price of $0.225 per share, equivalent to 19.95% of the outstanding common shares of Cosa as of the closing date (the “Closing Date”).

Additionally, Cosa will be required to:

- Issue Denison a further C$2,250,000 in deferred consideration shares (the “Deferred Consideration Shares”) within five years of the Closing Date. The Deferred Consideration Shares will be issuable every six months after the Closing Date at the price which is equal to the volume weighted average price of the Company’s common shares for the five-trading day period prior to the issuance date (provided that any further issuance to Denison of Cosa common shares will not result in Denison’s ownership exceeding 19.95% of Cosa’s issued and outstanding shares). Notwithstanding the foregoing, if required by the TSX Venture Exchange (the “TSXV”), the Deferred Consideration Shares will be issued at a floor price of $0.17;

- Pay Denison the remainder of the value of the Deferred Consideration Shares in cash should the Company fail, or otherwise be unable, to issue the full value of the Deferred Consideration Shares within the required timeline;

- Fund 100% of the first C$1,500,000 in exploration expenditures on the Murphy Lake North Project by December 31, 2027. Failure to do so will result in Denison’s ownership in the Murphy Lake North Project increasing to 51% and Denison assuming operatorship;

- Post a deficiency deposit in the amount of up to C$35,000 to maintain the Murphy Lake North mineral claims and, if required, reimburse Denison for any deficiency deposit posted or for expenses incurred towards exploration at Murphy Lake North up to a maximum of C$150,000;

- Fund 100% of the first C$5,000,000 in exploration expenditures on the Darby Project by June 30, 2029. Failure to do so will result in Denison’s ownership in the Darby Project increasing to 51% and Denison will assume operatorship; and

- Appoint a technical advisor nominated by Denison for a period of five years from the Closing Date or until all of Cosa’s obligations under the Acquisition Agreement have been fulfilled.

The Darby Project is subject to a buydown (the “Buydown”) which permits Denison to reclaim up to 60% of the Darby Project and is to be the greater of: (i) C$50,000,000 or (ii) 450% of Cosa’s exploration expenditures to date (excluding the initial C$5,000,000 in Cosa funded expenditures) incurred on the Darby claim(s) for the proportion of the property interest subject to the Buydown. The Buydown can be completed through a combination of cash payments and Denison sole-funded project expenditures, and must be a minimum of 25% cash. The Buydown will be extinguished if Denison’s interest in the Darby Project claims subject to the Buydown fall below 10%, or upon commercial production of 500,000 lbs of U3O8 from the claims subject to the Buydown.

The Consideration Shares are subject to a statutory hold period of four months and one day from the Closing Date. The Deferred Consideration Shares will be subject to a statutory hold period of four months and one day from the date of issuance thereof.

The Transaction is an Arm’s Length Transaction under the policies of the TSXV.

Ancillary Agreements

In connection with closing of the Transaction, Cosa and Denison have entered into a royalty agreement for each Project (the “Royalty Agreements”), an investor rights agreement (the “Investor Rights Agreement”), and a joint venture agreement for each Project (the “Joint Venture Agreements”).

The Royalty Agreements provide Denison with a 2% Net Smelter Royalty (“NSR”) on the Darby and Packrat Projects, and a 0.5% NSR on the Murphy Lake North Project. Cosa retains the right to repurchase 50% of the royalties on the Darby Project and the Packrat Project in exchange for a cash payment of C$2,000,000 per project.

The Investor Rights Agreement provides, among other things, that for so long as Denison holds at least 5% of the issued and outstanding Common Shares, it will have a pre-emptive right and top-up rights entitling it to maintain and/or otherwise acquire up to a 19.95% interest in Cosa. Additionally, Denison may nominate one director to Cosa’s board of directors for so long as Denison holds at least 5% of the issued and outstanding Common Shares and an additional director to Cosa’s board of directors for so long as Denison holds at least 10% of the issued and outstanding Common Shares.

Pursuant to the Joint Venture Agreements, the parties have formed Joint Ventures in which Cosa owns a 70% interest and Denison owns a 30% interest in each Project. Cosa will be the operator for all Projects and is entitled to charge an industry standard operator fee to the Joint Venture.

The Projects

Murphy Lake North

Murphy Lake North covers a portion of the Larocque Lake trend and is located 3.2 kilometres east of the Hurricane deposit (Figure 2). The Hurricane deposit is the world’s highest-grade Indicated mineral resource for uranium and was discovered and delineated for IsoEnergy Ltd. by current members of Cosa’s management, board of directors, and advisors from 2018 through 2022. The Larocque Lake trend also hosts the Larocque Lake zone, the Yelka Prospect, and the Alligator Lake zone. Murphy Lake North contains approximately six kilometres of conductive strike length oriented sub-parallel to conductive features associated with the Hurricane Deposit. Limited historical drilling completed on Murphy Lake North intersected weak mineralization in the basement and zones of alteration and structure in the sandstone and basement. Historical drilling, completed prior to the discovery of Hurricane, focused on the western extremity of the property and left most of the conductive strike length untested. Abundant drill targets exist at Murphy Lake North and diamond drilling is planned for Q1 of 2025.

The depth to the unconformity at Murphy Lake North is approximately 250 metres.

The Darby Project

The Darby Project is located ten kilometres west of the Cigar Lake Mine and 17 kilometres north of the McArthur River Mine (Figure 3). Darby is interpreted to contain more than 25 kilometres of conductive strike length, including the 8-kilometre-long 95B trend oriented parallel to the Cigar Lake – Tucker Lake trend. Historical drilling on 95B defined more than 25 metres of unconformity offset where a package of metasedimentary rocks hosting graphitic brittle structure, hydrothermal alteration, and weak uranium mineralization lies in fault contact with underlying granitic rocks. Only one drill hole completed along strike is interpreted to have intersected the optimal target in this prospective geological setting. Weak uranium mineralization has also been intersected in the northeast portion of Darby proximal to the Cigar Lake – Tucker Lake trend, and along the northern extension of the 4A trend north of Darby. Initial work will include diamond drilling to follow-up historical drilling results and geophysical surveying to refine conductive drill targets.

The depth to the unconformity at Darby is between 480 and 650 metres.

The Packrat Project

The Packrat Project is located 28 kilometres east of the Cigar Lake Mine and 19 kilometres southwest of the Rabbit Lake Mill (Figure 4). Packrat covers a prominent magnetic break and basement-hosted resistivity low trend. Limited historical drilling on Packrat targeting the resistivity low trend and magnetic break intersected weak uranium mineralization and zones of structural disruption and alteration of basement rocks. Initial work at Packrat will include the compilation and reinterpretation of historical geophysical and drilling data.

The depth to the unconformity at Packrat is less than 100 metres.

About Denison Mines

Denison is a leading uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. Denison has an effective 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. In mid-2023, the Phoenix feasibility study was completed for the Phoenix deposit as an ISR mining operation, and an update to the previously prepared 2018 Pre-Feasibility Study was completed for Wheeler River’s Gryphon deposit as a conventional underground mining operation. Based on the respective studies, both deposits have the potential to be competitive with the lowest cost uranium mining operations in the world. Permitting efforts for the planned Phoenix ISR operation commenced in 2019 and several notable milestones were achieved in 2024 with the submission of federal licensing documents and the acceptance of the final form of the project’s Environmental Impact Statement by the Province of Saskatchewan and the Canadian Nuclear Safety Commission .

Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake Joint Venture (‚MLJV‘), which includes unmined uranium deposits (planned for extraction via the MLJV’s SABRE mining method starting in 2025) and the McClean Lake uranium mill (currently utilizing a portion of its licensed capacity to process the ore from the Cigar Lake mine under a toll milling agreement), plus a 25.17% interest in the Midwest Joint Venture (‚MWJV‘)’s Midwest Main and Midwest A deposits, and a 69.44% interest in the Tthe Heldeth Túé (‚THT‘) and Huskie deposits on the Waterbury Lake Property (‚Waterbury‘). The Midwest Main, Midwest A, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill. Taken together, Denison has direct ownership interests in properties covering ~384,000 hectares in the Athabasca Basin region.

Additionally, through its 50% ownership of JCU (Canada) Exploration Company, Limited (‚JCU‘), Denison holds interests in various uranium project joint ventures in Canada, including the Millennium project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU, 34.4508%).

In 2024, Denison celebrated its 70th year in uranium mining, exploration, and development, which began in 1954 with Denison’s first acquisition of mining claims in the Elliot Lake region of northern Ontario.

Denison has a market capitalization of approximately ~$2.5 billion (~US$1.7 billion) and its common shares are listed on the Toronto Stock Exchange (the ‚TSX‘) under the symbol ‚DML‘ and on the NYSE American exchange under the symbol ‚DNN‘. As at September 30, 2024 Denison’s financial position includes over $105,000,000 in cash and cash equivalents and over $240,000,000 in uranium investments (Denison MD&A dated 30 September 2024).

Denison will be filing an early warning report, under National Instrument 62-103, in respect of the acquisition by Denison of the 14,195,506 Consideration Shares on closing of the Transaction. Prior to the issuance of the Consideration Shares by Cosa, Denison held no common shares of Cosa. Immediately after giving effect to the issuance of the Consideration Shares, Denison had beneficial ownership of, or control and direction over, 14,195,506 Consideration Shares representing approximately 19.95% of the issued and outstanding common shares of Cosa as of the date hereof. The Consideration Shares were acquired by Denison for investment purposes. Denison intends to review, on a continuous basis, various factors related to its investment in Cosa, and may decide to acquire or dispose of additional securities of Cosa as future circumstances may dictate, including pursuant to the terms of the Acquisition Agreement and/or its pre-emptive rights under the Investor Rights Agreement.

Further information regarding the Transaction is available in the Early Warning Report filed under Cosa’s profile on SEDAR+ at www.sedarplus.ca or by contacting Denison:

Geoff Smith, Vice President Corporate Development & Commercial

info@denisonmines.com

Denison at 1100 – 40 University, Toronto, Ontario M5J 1T1

About Cosa Resources Corp.

Cosa Resources is a Canadian uranium exploration company operating in northern Saskatchewan. The portfolio comprises roughly 237,000 ha across multiple 100% owned and Cosa operated Joint Venture projects in the Athabasca Basin region, all of which are underexplored, and the majority reside within or adjacent to established uranium corridors.

Cosa’s award-winning management team has a long track record of success in Saskatchewan. In 2022, members of the Cosa team were awarded the AME Colin Spence Award for their previous involvement in discovering IsoEnergy’s Hurricane deposit. Prior to Hurricane, Cosa personnel led teams or had integral roles in the discovery of Denison’s Gryphon deposit and 92 Energy’s Gemini Zone and held key roles in the founding of both NexGen and IsoEnergy.

Cosa’s primary focus through 2024 was initial drilling at the 100% owned Ursa Project, which captures over 60-kilometres of strike length of the Cable Bay Shear Zone, a regional structural corridor with known mineralization and limited historical drilling. It potentially represents the last remaining eastern Athabasca corridor to not yet yield a major discovery, which the Company believes is primarily due to a lack of modern exploration. Modern geophysics completed by Cosa in 2023 identified multiple high-priority target areas characterized by conductive basement stratigraphy beneath or adjacent to broad zones of inferred sandstone alteration – a setting that is typical of most eastern Athabasca uranium deposits. Guided by a recently completed Ambient Noise Tomography (ANT) survey, Cosa’s second and most recent drilling campaign at Ursa intersected a significant zone of unconformity-style sandstone hosted structure and alteration underlain by several intervals of anomalous radioactivity in the basement rocks.

In January of 2025, the Company entered a transformative strategic collaboration with Denison Mines involving the acquisition of a 70% interest in and the formation of multiple joint ventures for highly prospective eastern Athabasca uranium exploration projects. Denison is Cosa’s largest shareholder and gains exposure to Cosa’s potential for exploration success and its pipeline of uranium deposits.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements

This press release contains forward-looking information within the meaning of Canadian securities laws (collectively “forward-looking statements”). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. These forward-looking statement or information may relate to exploration and development of the Projects; the impact of the Transaction on Cosa’s business; the business plan of Cosa; and anticipated development, expansion and exploration activities.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct Cosa’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by Cosa in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: that there is no assurance that the parties hereto will obtain the requisite shareholder and regulatory approvals for the Transaction, and there is no assurance that the Transaction will be completed as anticipated, or at all; there is no assurance that any proposed financings will be completed or as to the actual offering price or gross proceeds to be raised in connection with such financings; following completion of the Transaction, Cosa may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect Cosa’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of Cosa’s securities, regardless of its operating performance; the ongoing military conflict in Ukraine, and other risk factors set out in Cosa’s public disclosure documents.

The forward-looking information contained in this news release represents the expectations of Cosa as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Cosa does not undertake any obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()