Rebounding in 2020 and where are we now

Czech Republic – May 2020

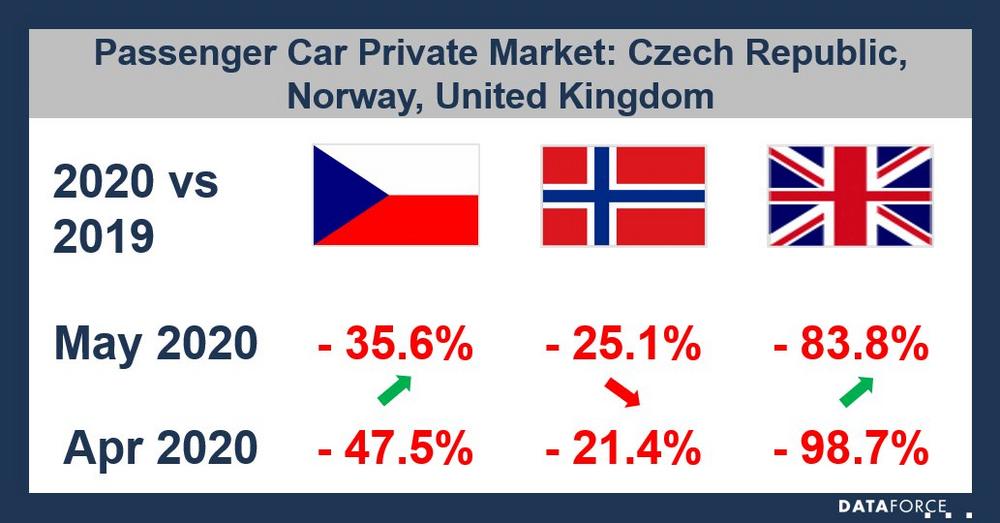

The Czech Republic became the first European country to relax its lockdown measures and first to introduce the wearing of masks in public. On current new car registrations figures they are on the way back to working it’s pre-COVID19 pandemic numbers. With a little under 13,500 registrations the market is still down by 44.4% but then when compared to April’s -53.4 % this is a jump in the right direction. For the retail channels the Private market came closest to it previous May figures (-35.6%) with a little over 4,500 registrations. And while True Fleet registered the most volume for any of the channels, they were still down by 48.7%, the same percentage loss as seen in April for the corresponding month of 2019.

Norway – May 2020

While Norway had started to ease restrictions at the start of May with their government choosing to prioritise children going back to school, then working life and finally other activities, we see that the effect on the market remained mostly negative, in all but one channel, True Fleet. The Total market was down by 39.0% for May in comparison to only 34.0% in April. Both the Private Channel and RAC continued to decline in comparison to May 2019 and this was certainly seen in the RAC channel, it dropped by 1,500 registrations whereas for April 2020 vs. 2019 the decline was only 450 registrations. True Fleets however may well have gotten over the hump as their decline shortened from 50.8% in April to 46.2% for May, hopefully signalling the start of the recovery there.

United Kingdom – May 2020

The UK for May was still under a significant amount of restrictions though as of the 13th May people in England were given the go ahead to return to work (only if they could not work from home). As one of the countries that was late in imposing restrictions and with a high infection rate it has been one of the hardest hit in terms of decline. For April’s new car registrations there was not a channel that was not in decline by less than 95%, however it appears from May that this percentage has eased some with both the Private market and True Fleet not as heavily hit. The Private market was still down by around 66,500 (-83.8%) registrations in comparison to May 2019 but did manage to hit a low five-digit volume for the month whereas for April this was merely a three-digit total. True Fleets, while down by a similar volume to the April registrations, saw an improvement in percentage decline moving from a loss of 95.1% in April to -90.8% for May when comparing the corresponding months of 2019.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-253

Fax: +49 (69) 95930-333

E-Mail: richard.worrow@dataforce.de

![]()