Blackstone Resources receives BUY rating for CHF 5.57

On 6 August 2020, Blackstone Resources announced that it had achieved a series of important milestones for producing printed battery cells and solid state batteries. Subsequently, AlphaValue revisited its previous target price and BUY rating, which it later adjusted and reaffirmed.

Recent developments at Blackstone Technology

The company has been investing in the next generation of battery technology for the last few years. It is focused on printing technology, which it believes will be the cornerstone for the future production of solid-state batteries.

On 6 August 2020, Blackstone Technology announced that it had manufactured the first functional battery cells with thick printed electrodes. The planning of the first production plant has also begun, which uses production technology that is both more flexible and cost-effective than the current technology used to produce lithium-ion batteries.

In the medium term, Blackstone Technology plans to print at extremely high speeds complete battery cells, which includes their housings.

The changes AlphaValue has made to Blackstone Resources valuation target

Following the news, Alphavalue amended the peer group that was used as a comparison to Blackstone Resources has led to a new target price of CHF 5.57. The new peer group includes more battery technology names, which has led to a higher price-to-earnings ratio of 24.6 times.

Meanwhile the half year earnings 2020E have increased to CHF 0.56 per share from CHF 0.13 for the year 2019.

Blackstone’s price earnings ratio, P /E ratio, now a strong 5.6 times for 2020E compared to the peer group of mining and battery producers which presents an average of a P/E ratio of 24.6 times.

In addition price earnings ratios for battery technology companies tend to be significantly higher than what’s seen elsewhere in the market. For instance CATL, which forms part of the peer group that AlphaValue used, has a forward-looking price to earnings ratio of 103 times. Tesla meanwhile, has a P/E ratio of 1,054 times, which is typical for most high-growth and high tech companies such as Blackstone.

Our management team expects that battery technology will increase significantly as a proportion of our company’s activities as we continue to progress. Therefore, we expect the market will eventually price in these fundamentals, which will inevitably lead to a much higher price-to-earnings ratio in excess of 100. Blackstone is after all, a high-growth company

The Alphavalue report also calculates a present net asset value of CHF 11.80 per share.

This shows that the actual share price of Blackstone is presently highly undervalued versus the peer groups.

AlphaValue is an independent equity research house that covers over 470 European stocks, split between 32 seasoned analysts. The report is readily downloadable from Blackstone Resources’ website and can be accessed on Blackstone homepage or on Bloomberg’s research portal.

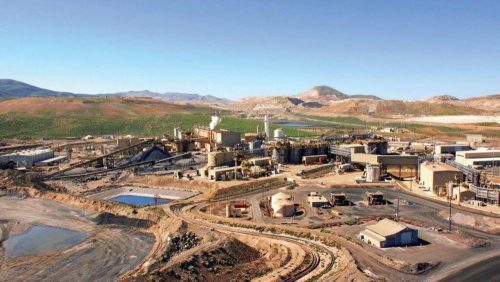

Blackstone Resources is a Swiss Holding Company, with its legal domicile in Baar, Kanton Zug and is concentrating on the battery metals market as primary metals. In addition, it sets up, develops and manages refineries used for gold and battery metals. It offers direct exposure to the battery metal revolution that is being driven by the demand of electric vehicles that need vast quantities of these metals. These include cobalt, manganese, graphite, nickel, copper and lithium. Blackstone Resources has developed the new Battery code BBC. In addition, Blackstone Resources has started a research programme on new battery technologies on solid state batteries and its production process.

Blackstone Resources AG

Blegistrasse 5

CH6340 Baar

Telefon: +41 (41) 44961-63

Telefax: +41 (41) 44961-69

http://www.blackstoneresources.ch

![]()