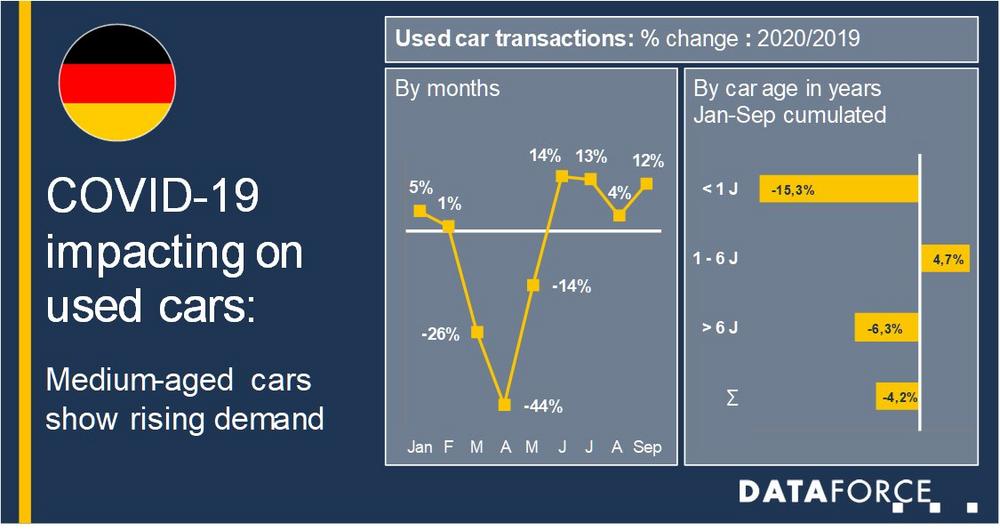

COVID-19 impacting on used cars: Medium-aged cars show rising demand

Lockdown gap is closing

The corona pandemic has again drawn car ownership into focus with it to ensure safe individual mobility. At the same time, car buyers have to thighten their belts due to economic uncertainty. Thus Covid-10 is bolstering demand for used cars, partly at the expense of the new car market.

As a result our data on the used market shows significant increases following the softening from the lockdown. At 4.2%, the year-to-date decline compared to 2019 is much more moderate than for new registrations (-25.5%).

Growing supply shortage for young used cars

The used data suggests there are still difficulties with young used cars, i.e. cars that were first registered less than 12 months ago. In this segment, demand shows a similar alignment to the new cars though the supply side is the real bottleneck. This comes as a result of dealerships and manufacturers cutting self-registrations due to multiple factors like production stoppages, falling demand as consumers weigh fiscal considerations and of course the closures of dealerships themselves but also from the contraction of short-term rental market. Buyers looking for a young used car are suffering the effects of this Corona pandemic and will continue to have difficulties finding the plethora of offers seen in 2019 and early 2020 until new cars picks-up once again.

Mid-market used car expansion!

Despite the problems on supply of nearly new, the transfer of ownership of 1-6 year old used cars has developed positively. Most former company cars fall into this group, as leasing contracts expire or long term rentals are moved on, but there are also many private owners who switch to a new car after this time. As a result, the used car data shows that 7 out of 10 transfers of ownership fall into this category.

During Covid, missing digitalisation becomes an impediment

Ownership transfers of more than six year old cars could not yet make up for the losses seen earlier in the year. We think this reluctance has been influenced by organisational difficulties in registration offices. As the pandemic took grip, there has been a scrambling to upgrade registrations processes, put in place safety protocols or even allow for most private car owners to transact with those authorities. Most would need to phyisically go there and many have reported to have waited several weeks or even months in order to get an appointment. With this in mind, the significant 9.8% growth in transactions of more than six year-old cars in September could well be the start of belated catch-up.

Outlook

In the coming months, the used car market should return to a form of normality. Catch-up effects from the lockdown are likely to dwindle as the backlog at registration offices is resolved but will the used car market or its feeder, the new car market, be forever slightly altered? We don’t believe the massive shortfall in spring will be fully made up in the 2020 annual balance sheet but the signs for 2021 do point to growth. What is for sure is that used cars and their registrations will remain a valuable insight into the recovery and consumer confidence that coronavirus has wrought on the car market.

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

![]()