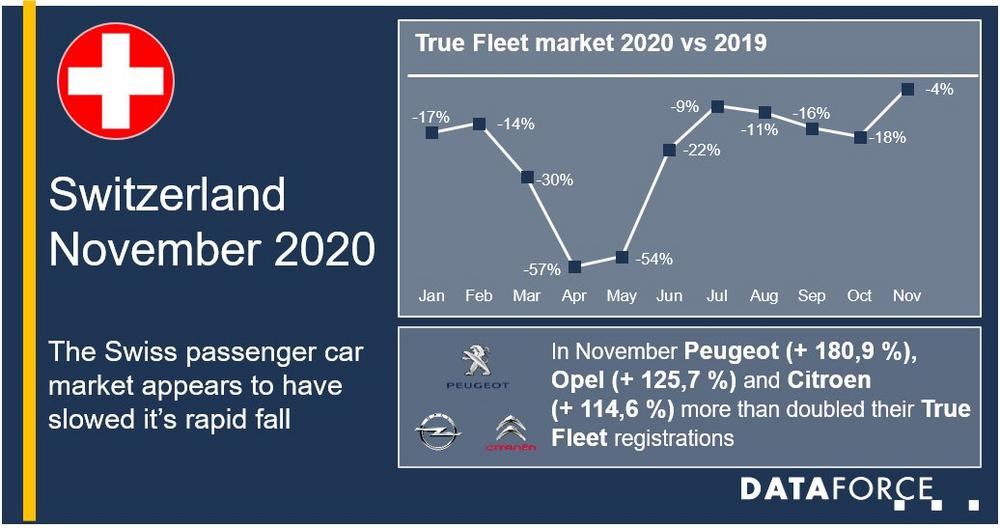

Swiss passenger car market continues to lose ground, but appears to be slowing its decent with some more stable figures

Swiss passenger car market in November 2020

For the first time this year, losses were only in the single-digit percentage range (- 9.0%). Registrations in the private market fell by 5.9%, while commercial registrations dropped by 12.6%.

Within the commercial detail channels, registrations losses for the True Fleet market were particularly small, ending up only 3.8% below the previous year’s level. The registrations of Dealer/Importer

(- 7.5%) were also able to visibly limit the sometime drastic losses seen in the previous months. The situation remains difficult for car rental companies, whose registrations in November were again 48.2% below those of the same month last year.

True Fleet market: Peugeot, Opel and Citroen grow by triple digits

The solid development of the True Fleet Market in November is also reflected at brand level. Within the top 20 importers, three brands stood out: Peugeot (+ 180.9%), Opel (+ 125.7%) and Citroen

(+ 114.6%), each of which more than doubled their fleet registrations compared to the same month last year. Peugeot strengthened its year-to-date performance and is the only one of the top 25 importer brands to increase its fleet registrations in the cumulative period between January and November compared to the same period last year (+ 2.5%).

An interesting development was also seen at the model level. The VW Passat and the BMW X1 relegated the Skoda Octavia, the most popular fleet model in Switzerland to date, to third place. Within the top 10 fleet models, the Toyota Yaris (+ 230.8%) and the Peugeot 308 (+ 123.5%) won over Swiss fleet managers showing an overall trend towards smaller fleet vehicles for November. This trend was evident in fleet registrations for PC Mini (+ 88.2 %) and PC Small (+ 60.9 %) segments, which increased at an above-average rate.

Market development of light commercial vehicles up to 3.5t

After nine months of decline, the Swiss market for light commercial vehicles managed to seemingly turn the corner. November saw an increased by 13.2% compared to the same month last year. In this process, the Private market continued its impressive streak and increased registrations for the sixth month in a row (+ 31.6%). Commercial registrations also grew by 10.3%, driven by a 15.6% growth in corporate registrations from the True Fleet market. However, the combined registrations of Dealer/Importer (- 13.0%) as well as the volume from Car Rental companies (- 38.1%) declined again.

With almost identical growth percentages Citroen (+ 58.6 %) and Peugeot (+ 58.5%) were two of the main winners in the True Fleet market. However, November was even more successful for Renault

(+ 98.3%), which, like Volkswagen, accounted for three of the 10 most-registered fleet models. In addition, Renault was the main contributor for the significant growth in light commercial vehicles with electric drive (+ 185.7%), especially with its Kangoo ZE model (+ 305.9%).

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Junior Marketing Manager

Telefon: +49 (69) 95930-353

Fax: +49 (69) 95930-333

E-Mail: claudia.articek@dataforce.de

Telefon: +49 (69) 95930-265

Fax: +49 (69) 95930-333

E-Mail: christian.spahn@dataforce.de

![]()