Revival Gold intersects 2.29 g/t gold over 45.7 meters including 4.58 g/t gold over 10.1 meters at Beartrack-Arnett

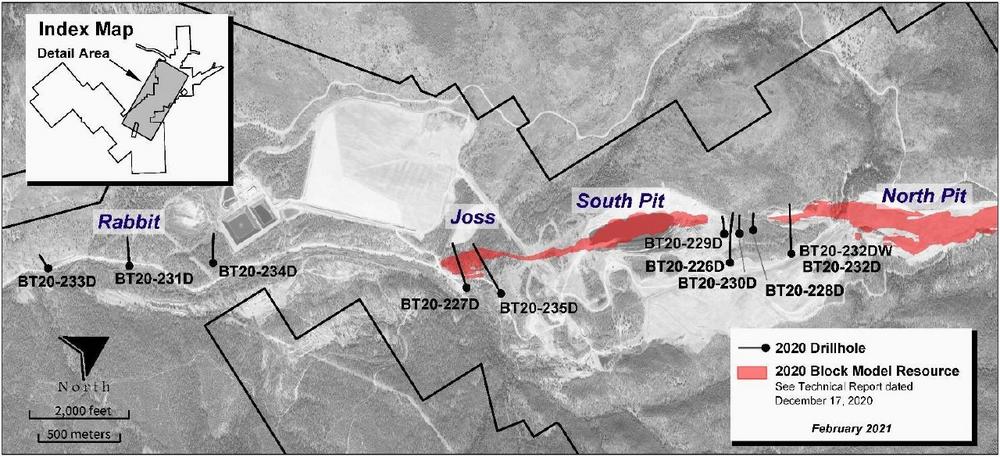

Highlights from today’s drill results include two core holes drilled in the Joss target area at the southern end of Beartrack. The holes were drilled to test for high-grade sulphide mineralization and to validate a conceptual underground mining target hosted within the main shear zone as well as in cross structures. Summary results below:

- 29 g/t gold over 45.7 meters1 including 4.58 g/t gold over 10.1 meters in BT20-235D

- 41 g/t gold over 43.9 meters1 including 6.84 g/t gold over 3.9 meters in BT20-227D

1 Drilled width; true width is unknown at this time.

An additional five core holes were drilled between the North and South Pits in the central Beartrack area and successfully confirmed the continuity of mineralized structure over 400-600 meters of strike in this previously untested area. Mineralization in this location remains open at depth.

Finally, three core holes were drilled in the greenfield exploration target at Rabbit, approximately two to three kilometers south of the footprint of the existing Beartrack mineral resource. Difficult drilling conditions limited the 2020 program at Rabbit however, one hole, BT20-234D, intersected fracture-controlled sericite alteration with associated anomalous trace elements, including anomalous gold, that mirror the signature of mineralization at Beartrack. The results are encouraging and warrant follow-up drilling.

“Today’s drill results from Joss have transformed our understanding of the potential for high-grade underground gold mineralization at Beartrack-Arnett. We now have fourteen drill holes over approximately one kilometer of strike in the vicinity of Joss being assessed for the presence of a continuous high-grade core of mineralization. Results of the assessment are expected shortly. The Joss zone remains open to the south towards the anomalous gold intercept encountered at Rabbit, some two kilometers further south. These results, together with those between the North and South Pits, extend the potential for economic gold mineralization at Beartrack-Arnett to fully seven to eight kilometers of prospective structure,” commented President and CEO Hugh Agro.

Revival Gold is currently planning its 2021 exploration and engineering field program with drilling expected to commence in May. Further details will be available in March.

Qualified Person

Steven T. Priesmeyer, C.P.G., Vice President Exploration, Revival Gold Inc., is the Company’s designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved its scientific and technical content.

About Revival Gold Inc.

Revival Gold Inc. is a growth-focused gold exploration and development company. The Company is advancing the Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing gold mine in Idaho. A Preliminary Economic Assessment has been completed for a first phase restart of heap leach operations to produce 72,000 ounces of gold per year over an initial seven-year mine life at an AISC of $1,057 per ounce of gold. Meanwhile, exploration continues, focused on expanding the current Indicated Mineral Resource of 36.6 million tonnes at 1.15 g/t gold containing 1.36 million ounces of gold and Inferred Mineral Resource of 47.1 million tonnes at 1.08 g/t gold containing 1.64 million ounces of gold. The mineralized trend at Beartrack extends for over five kilometers and is open on strike and at depth. Mineralization at Arnett is open in all directions.

For further details, including key assumptions, parameters and methods used to estimate the Mineral Resources, and data verification, please see the Company’s NI 43-101 compliant technical report titled, “Preliminary Economic Assessment of the Heap Leach Operation on the Beartrack Arnett Gold Project, Lemhi County, Idaho, USA – NI 43-101 Technical Report”, dated December 17th, 2020.

Revival Gold has approximately 71.2 million shares outstanding and had a cash balance of approximately C$9.1 million on December 31st, 2020. Additional disclosure including the Company’s financial statements, technical reports, news releases and other information can be obtained at www.revival-gold.com or on SEDAR at www.sedar.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. Technical information in this news release has been reviewed and approved by Steven T. Priesmeyer, C.P.G., Vice President Exploration, Revival Gold Inc., Qualified Person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

This News Release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company, or management, expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, the Company’s ability to predict or counteract the potential impact of COVID-19 coronavirus on factors relevant to the Company’s business, failure to identify additional mineral resources, failure to convert estimated mineral resources to reserves with more advanced studies, the inability to eventually complete a feasibility study which could support a production decision, the preliminary nature of metallurgical test results may not be representative of the deposit as a whole, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()