Karora Announces Consolidated 2022 Gold Production Guidance of 110,000 – 135,000 ounces at AISC of US$950 – US$1,050 per ounce sold and Inaugural Nickel Production Guidance at Beta Hunt

Paul Andre Huet, Chairman & CEO, commented: "Following our record full year 2021 gold production of 112,814 ounces, gold production for 2022 is projected be between 110,000 – 135,000 ounces. After careful review, we consider it prudent at this time to both widen and trim our 2022 production guidance range to factor in the ongoing challenges associated with COVID-19 restrictions that are impacting the entire mining sector in Western Australia.

We are also very pleased to announce our first nickel guidance of 450 – 550 tonnes from our Beta Hunt operation (since our 2020 re-naming), as nickel becomes an increasingly important part of the Karora story. Currently, we are mining nickel from remnant nickel Mineral Resource areas. However, the recent 50C and 30C nickel discoveries position us well to increase nickel production in the coming years beyond what we have forecast for 2022. Nickel production is reflected as a by-product credit in our 2022 AISC guidance at a conservative assumed nickel price of US$16,000 per tonne. With the current LME nickel spot price over US$23,000 per tonne, there is upside potential for achieving a significantly higher by-product credit to our AISC.

Like all our peers operating in Western Australia, we have been preparing for continued pressure associated with labour availability and supply chain constraints at our operations. Combining the sector-wide impacts on materials, labour supply, cost inflation and the lack of clarity as to when these constraints may ease, we consider it important to factor this into our production and cost guidance forecasts for 2022.

Should restrictions ease in the near term, we expect some lag before relief from these challenges can be realized across the mining sector. We note that we are not making any revision to our 2023 and 2024 numbers.

We have also adjusted AISC cost guidance slightly upwards due to the same constraints. The increase in AISC is primarily due to increased labour costs, fuel and consumables. We remain optimistic that the situation will improve later in the year with the anticipated easing of restrictions. However, we are forecasting higher AISC in the first half of 2022, with lower second half costs anticipated to bring our full year numbers within the guided range. Our 2022 capital guidance has been increased by approximately 12% (midpoint to midpoint) to account for increased labour, contractor and materials costs associated with our mill expansion work at Higginsville and the development of a second underground decline at Beta Hunt.

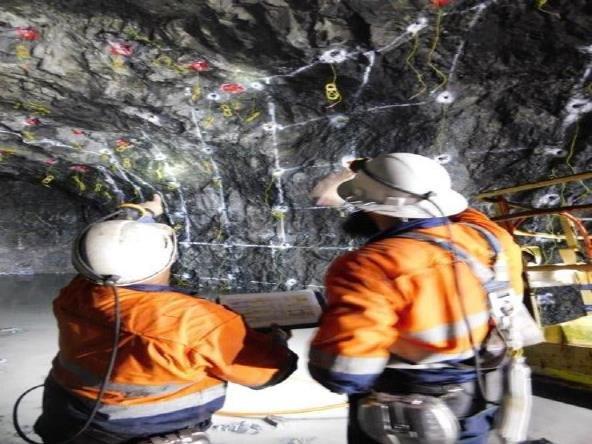

With respect to progress on our growth plan, I am pleased to announce that development of our second decline at Beta Hunt is underway and ahead of schedule. Karora crews have commenced work on the second decline from underground with the first cut taking place on the 506 level of the mine. We have also selected a contractor for construction of the portal and upper portion of the decline with mobilization scheduled for February 14, 2022.

We enjoyed strong exploration success in 2021 at Beta Hunt with both new discoveries and significant extensions of gold zones (Larkin, Fletcher and Gamma) and nickel zones (50C and 30C). In 2022, we will continue to push ahead on the exploration and resource development front with an aggressive drilling program planned across both operations with total expected expenditures of between A$21 – A$24 million.

Wrapping up, although challenges exist for our Western Australian operations in the presence of continued COVID restrictions, I have never been more confident in the abilities of our team to execute on our plans, as we have demonstrated during these past three years. Whether it was bush fires, floods or COVID restrictions, our Karora team has continuously risen to overcome these impacts to deliver on our strategy to expand the business and deliver shareholder value.”

2022 Exploration

Karora’s exploration will be underpinned by both surface and underground drilling at Beta Hunt and Higginsville with a total of 85,000 metres planned in 2022. Drill metres are divided into both Exploration drilling (42,000 metres) aimed at delivering additional resources from new discoveries and Resource Definition drilling (43,000 metres) directed at upgrading and extending existing Mineral Resources.

At Beta Hunt, the growth opportunity is significant. During 2022, Karora plans to drill 43,000 metres to test more of the eight kilometre strike of the gold and nickel mineralized system. Drilling will target extensions to the Western Flanks and A Zone Mineral Resources, Larkin, the new Fletcher Shear Zone and follow up on the significant gold intersections in the under-explored shear zones south of the Alpha Island and Gamma faults. Exploration drills will also be following up on the recent nickel discovery towards the southern end of the mine with drilling aimed at extending the 50C Nickel Trough in the Gamma Block as well as testing for new parallel nickel troughs in the Beta Block. Karora is committed to developing its nickel potential and has committed 16,000 metres to test and upgrade nickel targets in 2022. By the end of February Beta Hunt will have in place three underground diamond rigs (full-time) and a surface diamond rig (part-time).

At Higginsville, Karora’s exploration budget is focused on an extensive near-mine and greenfields drilling program to follow-up on priority targets including the Sleuth Trend as well as extensions to the Spargos Mineral Resource. Planned drilling totals 42,000 metres of which 13,000 metres is aimed at extending, upgrading and adding additional mineral resources at Spargos. On-site drill equipment currently comprises three rigs: two diamond rigs plus one RC rig. Dedicated salt lake drilling equipment comprising diamond, RC and aircore rigs will be used later in the year to undertake the drilling on Lake Cowan.

Notes to Table 1

(1) 2022 guidance, which was announced in June 2021 (see Karora news release dated June 29, 2021), is updated as detailed above in Table 1.

(2) The Corporation’s guidance assumes targeted mining rates and costs, availability of personnel, contractors, equipment and supplies, the receipt on a timely basis of required permits and licenses, cash availability for capital investments from cash balances, cash flow from operations, or from a third-party debt financing source on terms acceptable to the Corporation, no significant events which impact operations, such as COVID-19, nickel price of US$16,000 per tonne, as well as an A$ to US$ exchange rate of 0.74 and A$ to C$ exchange rate of 0.91. Assumptions used for the purposes of guidance may prove to be incorrect and actual results may differ from those anticipated. See below “Cautionary Statement Concerning Forward-Looking Statements”.

(3) Exploration expenditures include capital expenditures related to infill drilling for Mineral Resource conversion, capital expenditures for extension drilling outside of existing Mineral Resources and expensed exploration. Exploration expenditures also includes capital expenditures for the development of exploration drifts.

(4) Capital expenditures exclude capitalized depreciation.

(5) AISC guidance includes general and administrative costs and excludes share-based payment expense.

(6) See “Risk Factors” described on page 29 of the Corporation’s MD&A dated March 19, 2021.

About Karora Resources

Karora is focused on doubling gold production to 200,000 ounces by 2024 compared to 2020 and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,800 square kilometers. The Company also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the timing for the completion of technical studies, liquidity and capital resources of Karora, production guidance, cost guidance, the Corporation’s growth plan, the completion of the HGO mill expansion, the growth opportunities at Beta Hunt Mine and the potential of the Beta Hunt Mine, Higginsville Gold Operation and the Spargos Gold Mine and the timing for production at the Spargos Gold Mine.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()